Notional Brings Fixed Rates to Ethereum

Backed by 1confirmation, IDEO, Parafi, Nascent, Coinbase, Polychain, and more, Notional launches Beta on Ethereum today

TLDR

We’re extremely proud to announce Notional, a protocol on Ethereum that lets you lend and borrow crypto at fixed rates. We believe that fixed rate debt markets are the natural evolution of decentralized lending and will bring a step-change in growth to the Ethereum ecosystem.

- Fixed rate lending is a massive market. Fixed rate lending represents the majority of the outstanding debt in U.S. corporate and consumer markets because it allows users to borrow and lend with certainty and confidence.

- Notional enables fixed rate debt on Ethereum using an entirely new on-chain AMM with dynamic curve sensitivity.

- DeFi traders can lock in their borrowing costs and take advantage of new arbitrage opportunities.

Notional Moves DeFi Forward

Fixed rate borrowing is a critical piece of financial infrastructure and an essential building block for DeFi to realize its potential. We believe that it won’t take long for fixed rate borrowing to eclipse variable rate borrowing in DeFi, the same way it does in traditional financial markets.

Today, DeFi is a jungle full of high net-worth speculators, self-identified degenerates and meme chasers — and interest rates are incredibly volatile as a result.

With Notional, you can take advantage of volatility instead of getting hurt by it. When you borrow or lend on Notional you get competitive market rates that won’t change once you trade. Notional is designed to maximize capital efficiency — that means you get the best prices and the most use out of your capital.

For DeFi traders:

- Lock in low borrowing rates on DAI to finance your yield farming for the next six months.

- Access fixed rates on levered long ETH trades for up to six months

For CeFi crypto traders and institutions:

- Lend and borrow crypto with no counterparty risk.

- Hedge overall portfolio risk and access working capital.

Things move fast in DeFi. Don’t miss your chance to capitalize on today’s opportunities. Try it now at notional.finance

How Notional Works

It starts with fCash.

An fCash token is defined by a currency and a maturity date — December 1st 2020 Dai, for example. fCash tokens are freely transferable — what makes them special is that a user can redeem an fCash token for one unit of its associated currency on or after its maturity date.

By trading cash for fCash, users can borrow and lend at fixed rates of interest.

Making a loan:

Redeeming at maturity:

Notional’s Dynamic AMM

On the surface, Notional is simple. But it has a lot going on under the hood. Notional has its own native liquidity pools to ensure that lenders and borrowers have somewhere to buy and sell fCash at a good price. Notional needs its own pools because fCash needs a new kind of AMM.

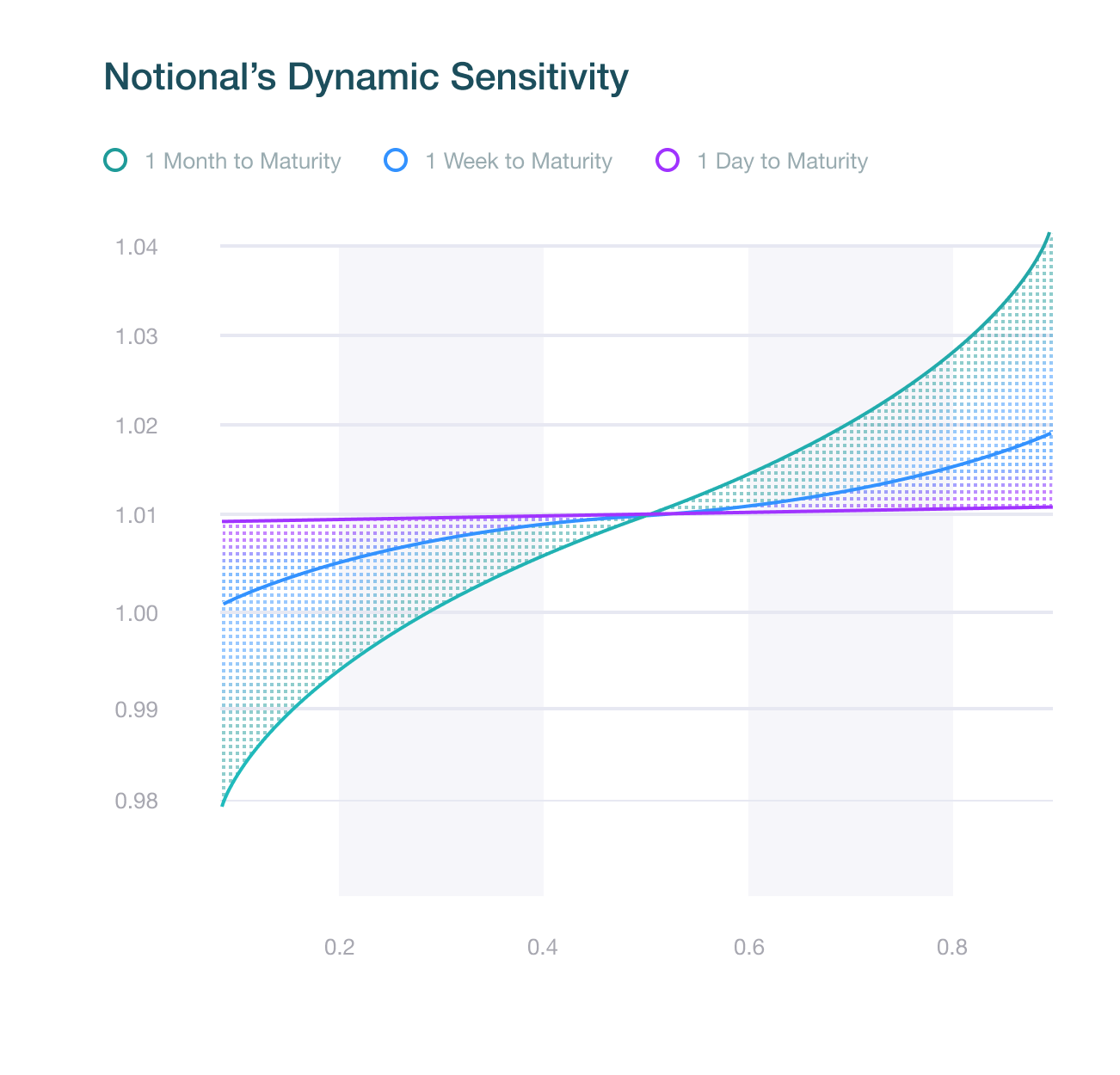

Users need an AMM with minimal slippage because small movements in the exchange rate between Dai and fDai produce big interest rate movements. As fDai approaches maturity, this effect intensifies — the same movement in the exchange rate produces an exponentially greater movement in the interest rate.

The solution is Notional’s dynamic curve sensitivity. Notional’s liquidity curve gets flatter as fCash approaches maturity.

This keeps slippage low no matter how far away maturity is. Our AMM explainer goes into more detail on how our dynamic sensitivity works. Check it out if you’re interested or message us in Discord!

Join Our Community

We are a small team with deep expertise in trading and technology. We’re lucky enough to work with some of the best in crypto from 1Confirmation, IDEO CoLab Ventures, Parafi, Nascent, Coinbase, and more. Together, we have brought Notional to where it is today.

But we can’t realize Notional’s full potential by ourselves. The ultimate success of Notional will depend on the strength of its community. That’s why we are committed to making Notional placing governance in the hands of Notional’s users, right where it belongs.

Thanks for taking the time to learn more about Notional. We’re excited to build the next generation of DeFi with you. Follow us on Twitter @NotionalFinance, join our Discord, or check out our website to learn more.

Teddy and Jeff, Co-Founders of Notional

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.