How do Notional's nTokens Earn Returns? (Part 1 of 4)

nTokens are an innovative mechanism for providing liquidity on Notional. Although they can appear quite complex at first glance, nTokens offer an overlooked source of profits with limited risk.

nTokens are an innovative mechanism for providing liquidity on Notional. Although they can appear quite complex at first glance, nTokens offer an overlooked source of profits with limited risk. This is the first post of a 4-post series, aimed at demystifying how nTokens work, their key risk drivers and how to incorporate them into investment strategies.

In this first installment, we breakdown the primary drivers of returns for nTokens.

nTokens in a Nutshell

Users provide liquidity to Notional by minting nTokens. nTokens enable users to passively earn returns from providing liquidity to Notional across all active maturities in a simple way. To mint nTokens, users deposit any of the four accepted assets (ETH, DAI, USDT, WBTC) into Notional. The protocol will then automatically wrap the tokens supplied into the corresponding cTokens (users can also directly provide cTokens). It will then split the cTokens between the active liquidity pools (40% for the 3-month contract, 40% for 6-months and 20% for the 1-year contract).

Return Drivers for nTokens

We can decompose returns into four parts: 1) Variable APY 2) NOTE Incentives Yield 3) Trading fees 4) Impermanent Loss.

Variable APY

As lending and borrowing take place on Notional, users will exchange fCash and cTokens with the liquidity pool. For example, users will deposit cTokens and receive fCash when they lend on the platform. Inversely, borrowers will receive cTokens and give in exchange fCash to the liquidity pool.

Liquidity pools will then be composed of cTokens and fCash. nTokens are ERC20 assets that are redeemable for a share of Notional’s total liquidity. As a result, nToken holders generate interest from:

- The cTokens in the liquidity pools (3 maturities). They receive the variable Compound rate without incentives, and

- The net fCash position of the liquidity pool. fCash APY is the current Notional rate for each maturity. If there has been more borrowing than lending on the platform, nToken holders will have a net positive fCash position. Having a net positive fCash position means that the nToken is a net lender of fCash. Conversely, if there has been more lending than borrowing, nToken holders will have a net negative fCash position and will be net borrowers of fCash.

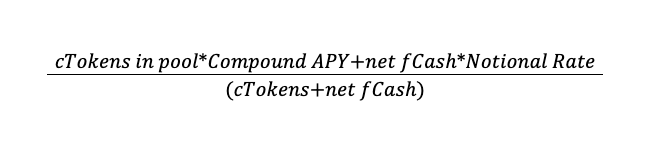

For a given maturity, the variable yield is calculated as a weighted average between Compound and Notional rates:

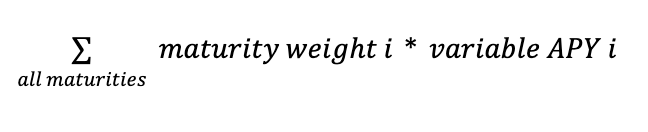

The total LP variable APY is the weighted average across the 3 maturities (3M, 6M,12M):

The variable and incentive APY for each pool is displayed on the Notional website so you don’t have to calculate it yourself.

NOTE incentives yield

The protocol distributes 9M NOTE tokens annually to the USDC and DAI liquidity pools. At a current NOTE price of c. $1, this is close to $9m distributed as incentives. This represents a yield of c. 8% p.a. at current prices. Like all token incentives, the yield depends on the NOTE price and on the size of the liquidity pools.

Trading fees

When someone lends or borrows on Notional, they pay an annualized trading fee on top of their fixed rate. The fees are then split between the protocol and nToken holders. The more volume on the platform, the higher the fees collected by nToken holders. In Q1 2022, USDC and DAI liquidity pools generated respectively a total of $368k and $194k in trading fees.

Impermanent Loss

Impermanent loss is probably the most difficult concept to comprehend on Notional. Just like providing liquidity on Uniswap, impermanent loss arises from a change in market prices. On Uniswap, impermanent loss is driven by changes in token prices. On Notional, impermanent loss is driven by changes in interest rates.

With expected use, trading fees should offset impermanent loss. When a user lends $1m on Notional at a fixed rate, nToken holders are on the other side of the trade. Therefore, nToken holders will pay the difference between the fixed rate locked and the variable Compound interest received during the duration of the loan.

At the beginning of 2022, lending rates on Notional were quite elevated creating a high risk of impermanent loss for nToken holders. However, providing liquidity currently looks attractive as the Notional rate premium vs. Compound has decreased to 2% on USDC and will disappear if/when an additional $10m is lent.

In part 2 of this series, we will dig further on how to estimate impermanent loss. We will also show that the risk of impermanent loss is relatively small and is offset by trading fees and NOTE incentives.

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $395M in total value locked and nearly $500M in lending volume.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.