Weekly Interest Rate Roundup: Mar 22 - Mar 29

It was a huge week for DeFi. On March 26th, Compound executed a proposal that cut COMP incentives by 50%, effective immediately.

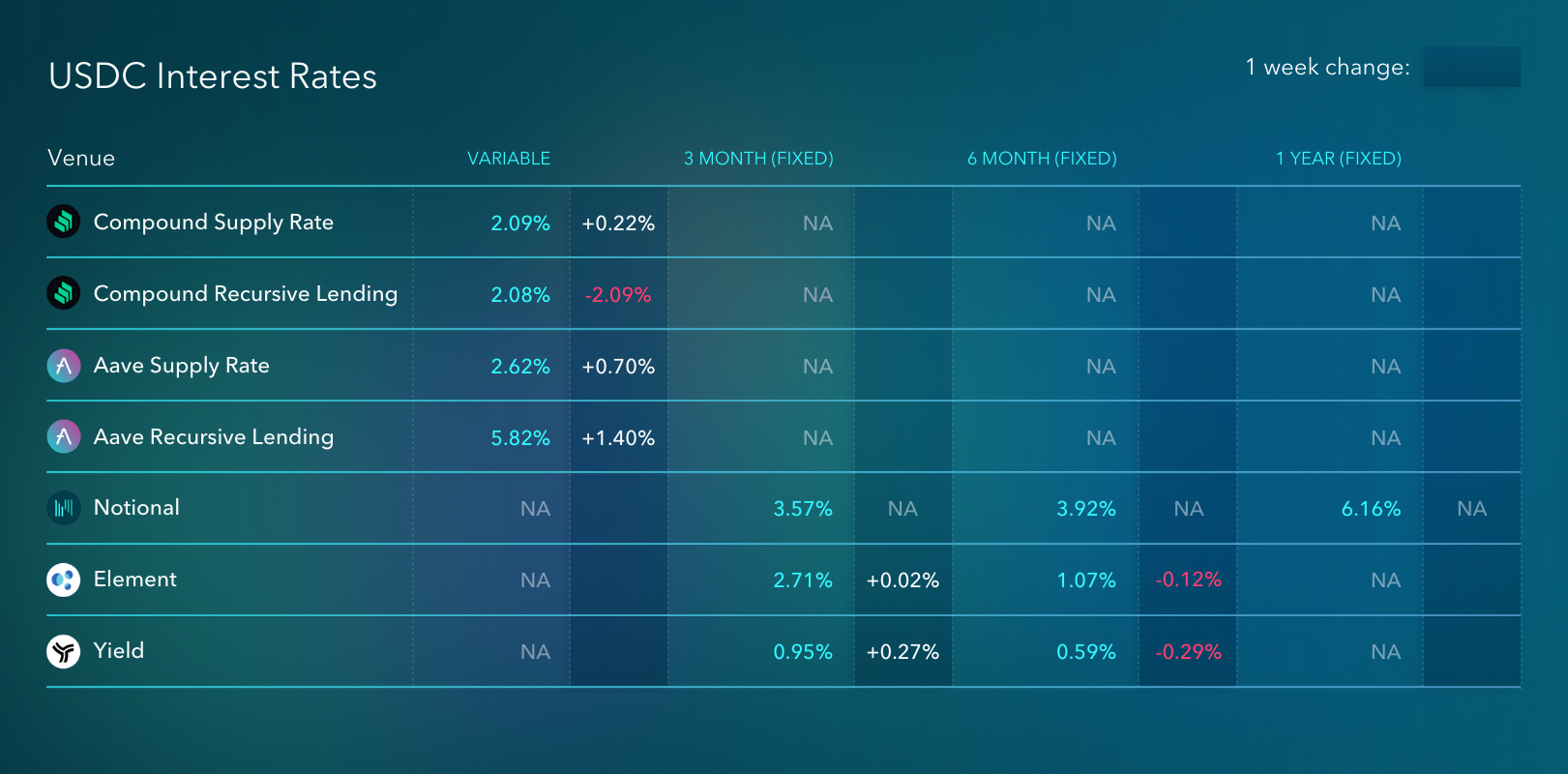

It was a huge week for DeFi. On March 26th, Compound executed a proposal that cut COMP incentives by 50%, effective immediately. They will issue another proposal in mid-April to cut their incentives down to zero. This is a really big move - it effectively kills the recursive lending strategy on Compound. The recursive lending strategy on Compound is now lower than the supply rate, and it doesn't look like it will come back.

But this is bigger than just the recursive lending rate on Compound. We've all known that heavy liquidity mining programs couldn't last forever, but is this the start of a trend? Will this move from Compound devastate its market share, or will it simply provide cover to Aave and others to drop their liquidity mining programs as well? I suppose we'll see, but we could be entering into a new era in DeFi. Less incentives mean lower yields. Without incentives, DeFi protocols will have to earn the yields that they offer to their users.

A lot depends on what Aave does in response to this move from Compound. If Aave drops their liquidity mining incentives as well, the last big DeFi honeypot where users can passively earn high yields on stablecoins will be Curve. If that were to happen, essentially the entire DeFi interest rate market would hinge on the price of CRV. Let's hope the ve-model is indeed all it's cracked up to be.

In the fixed rate space, Notional executed its second-ever quarterly roll. Notional now offers June, Sep, and March 2023 maturities on USDC and DAI. Over the past few months, Notional's yield curves have completely flipped from inverted to upward sloping. This shape makes a lot more sense to me - optionality is worth a lot in DeFi, and lenders generally require a significantly higher rate to lend their capital for a year rather than 3 or 6 months.

But who knows? If more projects follow Compound's lead and start to draw down their liquidity mining programs, maybe we'll start to see DeFi lenders re-appraise the opportunity cost of their capital and start lending longer term. We'll just have to see what happens.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.