DeFi Has a Yield Problem

DeFi has a yield problem. DeFi lending protocols can’t offer sustainable yields that are high enough to attract external capital and grow the space beyond its current niche. That’s because today’s major lending protocols provide limited utility for borrowers which results in low interest rates for lenders.

In order to provide high enough yields to attract outside capital, DeFi lending protocols should embrace sophistication by catering to a more specialized set of borrowers and lending against yield strategies. Leveraged yield strategy products built for sophisticated borrowers will enable DeFi lending protocols to offer lending rates that approach the returns that only professionals are currently able to achieve.

By transforming the rate of return earned by professionals into a passive lending yield, DeFi lending protocols will be able to offer a product that is both simple and high yielding. This lending yield can be an entrypoint that directly funnels external capital into DeFi. This capital can then be utilized by sophisticated borrowers to increase the liquidity for DeFi assets and contribute to a more robust and efficient financial system.

Potential options to increase DeFi lending yields

I think there are only three ways to proactively increase lending yields on DeFi protocols:

- Onboard lower quality crypto assets as collateral.

- Onboard RWAs.

- Lend against sophisticated yield strategies.

Onboarding low quality crypto asset collateral has a terrible track record. The countless oracle hacks and the losses incurred by lenders to protocols with liberal collateral standards like Cream demonstrate that this is not a feasible path to growth for DeFi.

Onboarding RWAs has potential, but it can’t deliver high yields without taking significant amounts of credit risk (more on this later).

I believe that there is only one viable way to deliver high lending rates without compromising on collateral quality or credit risk - lending against DeFi yield strategies. Yield strategies like providing liquidity on a DEX can produce high returns using only high-quality collateral assets and they can also be precisely codified to remove credit risk.

In this post I will explore the example of providing leverage to an ETH/USDC liquidity provider as a prime opportunity for lending protocols to create value for borrowers by embracing sophistication. I will show that as lending protocols meet the needs of increasingly sophisticated LPs, they will be able to offer higher lending rates without taking credit risk or holding low quality assets.

But first, let’s start with some quick comments on RWAs.

The limits of RWAs

RWAs are a growing category, but they are not an immediate solution to DeFi’s low-rate problem. Transforming RWA yield into permissionless lending yield requires multiple rent-extracting intermediaries which results in lending yields that are significantly lower than the actual yield on the RWA.

Add in the lending protocol’s smart contract risk and you get a proposition for lenders that is not an easy sell to someone who isn’t already in DeFi and has access to the RWA yield through traditional means.

How RWA yield is transformed into permissionless lending yield

So far, the only way to offer permissionless yield to users via RWAs is to onboard them onto money markets as collateral and let users borrow against them to increase the yield on the other platform assets like USDC or DAI.

The problem is that this creates a large spread between the yield on the RWA and the yield available for lenders. First, the RWA administrator(s) take a cut of the RWA yield. Then the borrower has to borrow at a lower rate than the post-fee RWA yield in order to make money. This delivers a lending rate which is less than the borrowing rate, which is less than the post-fee RWA yield, which is less than the actual RWA yield.

This means that RWA-driven growth is limited by the number of lenders who are willing to lend at significantly less than the RWA’s actual yield - borrowing against T-Bills is great, but only if you’re borrowing at a lower rate than you get on the T-Bill.

I don’t think protocols will have an easy time attracting outside capital to lend at lower rates than the RWA yield. Why take the smart contract risk of lending on a DeFi protocol when you can earn more yield from the same asset with no smart contract risk through your Schwab account?

So in summary, I think that onboarding RWAs into DeFi lending protocols may reshuffle capital that’s already in DeFi between protocols, but I don’t think RWAs alone will be able to unlock yields that are high enough to attract outside capital and drive the growth of DeFi overall.

Providing leverage to DeFi liquidity providers

To understand how and why providing leverage to liquidity providers can unlock value and increase yields, we first need to understand a bit about how providing liquidity in DeFi works.

Liquidity providers sit on a spectrum of sophistication. On one end is the retail hobbyist who is passively providing ETH and USDC to a Uniswap V2 pool. On the other end is the professional trading firm who is running a highly active, automated strategy, trading on multiple venues in DeFi and CeFi and maintaining delta-neutrality across their entire portfolio.

As liquidity providers get more sophisticated, they (theoretically, hopefully) get more profitable. The passive liquidity provider’s returns are meager compared to the professional’s returns.

Think of it like this:

Increased profitability means increased value of leverage

As the profitability of a liquidity strategy increases, so does the value of adding leverage to that strategy. If a hobbyist liquidity provider is only earning 5% APY, they might be interested in borrowing at 4% to add leverage to their strategy, but they might not.

The extra value they’re getting is marginal because the spread between their strategy return and borrow rate is only 1%, so 4% rate leverage is not hugely valuable to the hobbyist. And in practice, many hobbyist LPs aren’t optimizing for returns - some provide liquidity because they’re indifferent between holding the two tokens they’re providing as liquidity.

But if the liquidity provider is running an advanced, sophisticated strategy that earns 20% APY for example, the spread between their return and a 4% borrow rate is 16% - 16x more than the spread for the hobbyist LP.

So for the sophisticated LP, 4% rate leverage is much more valuable than it is for the retail LP, particularly because sophisticated LPs are reliably profit-optimizing. This example sophisticated LP is so profitable that they are probably willing to pay much higher than 4% for leverage given the strong returns to their strategies.

In other words, as the sophistication and profitability of an LP increases they are willing to pay higher borrowing rates because they can put the extra capital to work for higher returns.

I should make a note that fixed rate borrowing plays a key role here in reducing the risk of leverage for the borrowers. Given that their margins (the difference between their borrow rate and the return on their strategy) may be relatively small, the ability to fix their borrow rate greatly reduces their overall risk and makes it more likely that they will decide to take on leverage for their strategy.

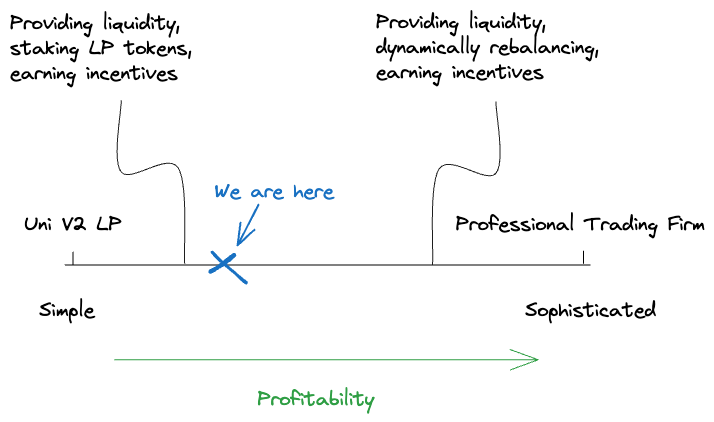

Where we are today

Lending protocols today are just starting to make significant progress towards unlocking value with sophisticated products tailored for more advanced DeFi users. Pioneering protocols like Notional, Sturdy, Gearbox, Sentiment, and Angle have been able to lend against relatively simple strategies and they are progressing forward quickly.

It’s still too early for the full impact of these products to be felt, but over time they will feed through to higher yields for lenders, a lower cost of capital for LPs, and greater liquidity for DeFi assets.

What leveraged yield strategies mean for DeFi

Providing leverage to yield strategies allows lending protocols to channel money from passive lenders to the sophisticated users who can put it to use most productively. Leveraged yield strategies will increase yields available to lenders and help us attract the external capital that the DeFi space needs to grow. Sophisticated borrowers can then route this capital to the most attractive opportunities and increase liquidity for DeFi assets.

Greater liquidity for DeFi assets leads to greater efficiency, lower transaction costs, and a better financial system.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.