Improved Risk Metrics for Borrowers

Our goal with Notional Finance is to build the most capital efficient lending and borrowing platform, period. Capital efficiency, however, often comes hand in hand with more sophisticated collateral calculations. The latest update to the Notional UI includes a batch of updates to help borrowers better understand their liquidation risk. Lenders and nToken holders who are not borrowing are never at risk of liquidation.

In short we have:

- 💯 Switched from collateral ratio (collateral / debts) to loan to value (debts / collateral).

- 💱 Display liquidation prices if an account has exchange rate risk.

- 🏦 Display liquidation interest rates if an account has interest rate risk.

- 🧮 Funded a simulation tool via our bounty program that allows anyone to visualize how risk affects the system.

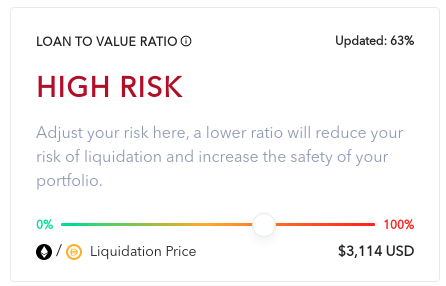

💯 Loan to Value Ratio

We've switched the Notional UI to display the loan to value ratio instead of the collateral ratio. A loan to value ratio is more commonly used in other borrowing protocols like Aave and Compound and we wanted to align what our users were seeing with other similar products.

A loan to value ratio (LTV) is bounded between 0% (no debt) and 100% (debts equal collateral). We hope this change makes it easier for users to compare their borrow capacity with other protocols.

💱 Liquidation Prices

If an account may be liquidated due to changes in token prices (we call this cross currency exchange rate risk 🤓), we will show a liquidation price. If an account is holding multiple tokens as collateral we will show the liquidation price for the two largest collateral balances and the largest debt.

If an account has debt in one currency and holds collateral in one token (i.e. borrowing DAI against ETH collateral), you can rely on this liquidation price to monitor your liquidation risk. If you are doing something more complex where you have multiple collateral or debt currencies then be aware that these liquidation prices can change (they are calculated holding everything else constant).

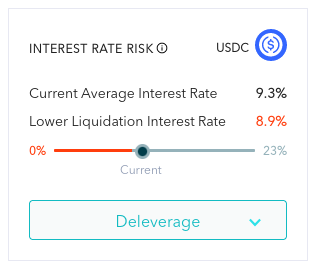

🏦 Interest Rate Risk

If an account may be liquidated due to changes in interest rates (we call this interest rate risk), we will show an approximate upper and lower liquidation interest rate. Interest rate risk may be present if an account is borrowing against nTokens or fCash.

Interest rate risk is a product of greater capital efficiency allowed by Notional's collateralization framework. Borrowers can get a lot of leverage against nTokens to increase their yield (i.e. mint nDAI and then borrow DAI against it to mint more nDAI 🤯) but this strategy is not risk free. Traders can also speculate on the yield curve by borrowing from one maturity and lending to another (again, not risk free).

The present value of nTokens and fCash fluctuate with changes in market interest rates. Although these changes are small relative to changes in token prices (exchange rates), a fully levered account can still be liquidated.

🧮 The Risk Simulator

To help users better understand account risk (as well as system wide risk), we've leveraged our growing community to build an slick simulation tool so users can see the effect of different changes on an account or Notional as a whole!

We're really proud of the ShippooorDAO team for all the work they've put into info.notional.finance. It's been an invaluable tool for us to understand the system and we hope you like it too! It's been really exciting for me to see such sophisticated technical contributions to Notional Finance.

If you're looking to contribute (and get paid!) to Notional check out our open bounties at community.notional.finance. If you're a developer looking to #BUIDL check out our SDK!

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $500M in TVL.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.