Introducing Notional V3

We are extremely excited to announce the details of the next step forward in DeFi lending - Notional V3.

Notional V3 is the most powerful lending protocol that DeFi has ever seen. Notional V3 introduces the prime money market - Notional’s new, native variable-rate lending and borrowing market that will make the protocol more powerful and accessible to all DeFi users while strengthening Notional's core value prop as a fixed rate lending protocol.

The prime money market integrates directly with Notional's fixed rate markets to improve yields and UX for fixed rate users and LPs while introducing new variable-rate functionality at the same time.

Here’s how the prime money market will impact Notional users:

- High yields for variable-rate lenders and LPs: The prime money market will offer market-leading returns through a groundbreaking mechanism whereby supply funds that are not utilized by borrowers on Notional are lent out to earn yield on external money markets.

- Better UX for fixed rate borrowers: On Notional V3, fixed rate debts automatically convert into variable rate debts at maturity via the prime money market. They are no longer forcibly rolled forward to the next fixed rate maturity at a penalty.

- Leveraged interest rate trading: The prime money market allows Notional users to arbitrage variable interest rates against fixed interest rates by borrowing variable and lending fixed with high leverage.

- Open term leveraged vaults: Users will be able to enter into a leveraged vault on a variable-rate, open term basis by borrowing from the prime money market.

The prime money market is a huge step forward for Notional that will drive the protocol’s growth, improve utility and UX for all Notional users, and allow the protocol to sustainably decrease NOTE incentive emissions by increasing organic returns for LPs.

But there’s more! Notional V3 also introduces the following new features and improvements:

- Multi-currency leveraged vaults: Notional V3 enables the launch of leveraged vaults that borrow in two or more currencies at once. This kind of leveraged vault will allow users to borrow both sides of a liquidity pool and earn the yield from that pool while minimizing price risk.

- Upgraded AMM: A new liquidity curve for Notional’s fixed rate pools increases LP efficiency by ~3x and decreases slippage for fixed rate lenders and borrowers.

- Increased integration flexibility: Notional V2 is integrated directly with Compound V2. On Notional V3, governance will have the flexibility to allocate underlying tokens to other money markets without interrupting protocol operations.

The prime money market, explained

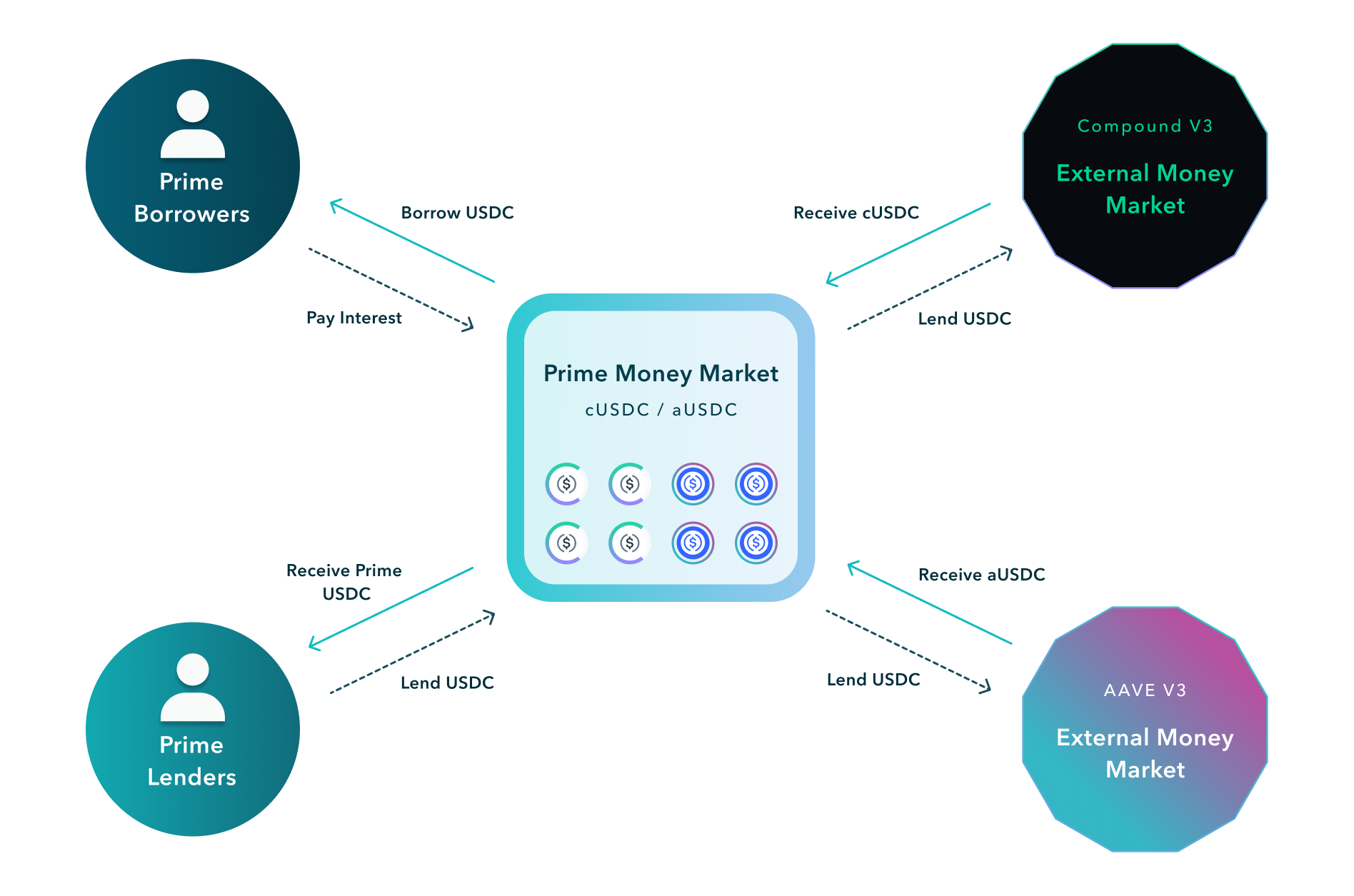

The prime money market works like other money markets, but with one big difference. In the prime money market, unutilized supply funds (funds that aren't currently being borrowed) don’t have to just sit idle on the contract - they can be lent out to other money markets.

If there aren’t enough borrowers on Notional, excess supply funds can be lent out on other money markets to earn yield instead of sitting idle on Notional. This means that variable-rate lenders on Notional (prime lenders) can know that their capital will be utilized no matter what the borrowing demand is on Notional.

The prime money market accomplishes this without compromising the experience for variable-rate borrowers on Notional (prime borrowers). If additional prime borrowers come to Notional, supply funds will be automatically redeemed from external money markets and made available for borrowing on Notional.

The prime lending premium

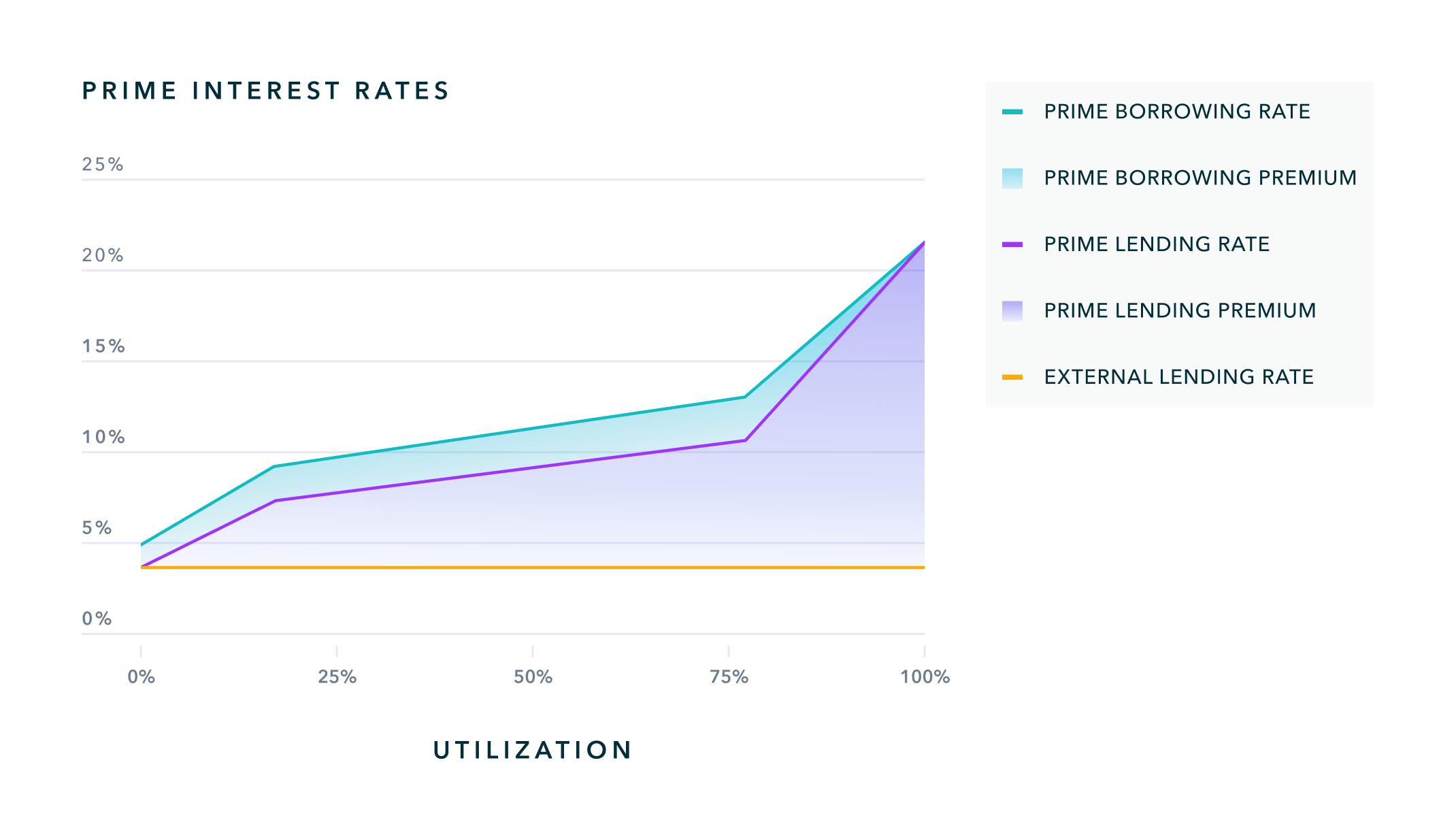

The prime money market also ensures that prime lenders will always get a higher return than the return paid by external money markets on unutilized supply. The prime lending rate is calculated as a premium (the prime lending premium) to the rate Notional's funds are earning on external money markets (the external lending rate).

The prime lending premium is based on the utilization of the prime money market - the more prime borrowers, the higher the premium. The fewer prime borrowers, the lower the premium.

The prime lending premium is always positive which makes the prime lending rate higher than the external lending rate at all times.

Improved borrower UX

The introduction of the prime money market significantly improves the experience for borrowers on Notional. In addition to the entirely new option of borrowing at a variable rate, fixed rate borrowing on Notional V3 is much smoother.

On Notional V2, borrowers were forced to deal with a rigid settlement process. If borrowers didn’t roll their loan forward to the next three month market prior to maturity, they would get rolled forward at a penalty rate. This made the prospect of borrowing on Notional complicated and hard to manage for larger accounts.

On Notional V3, a fixed rate borrowing position will auto-convert into a prime (variable-rate) borrowing position at maturity. This removes penalties and all forced rolling. With this upgrade, fixed rate borrowers can manage their loans with much greater flexibility. Both lenders and borrowers will be able to seamlessly switch between prime rates and fixed rates whenever they want.

Leveraged interest rate trading

The prime money market enables another key unlock on Notional. On Notional V3, users will be able to borrow at a variable rate from the prime money market and lend at a fixed rate by purchasing fCash. Because fCash is automatically collateral on Notional, users will be able to do this trade with leverage.

The prime money market allows users to speculate on Notional’s fixed rates vs Notional’s prime rates with significant leverage. If the user thinks the fixed rate is too low, they can borrow fixed and lend prime. If the user thinks the fixed rate is too high, they can borrow prime and lend fixed. This isn’t a video game - this is actual solidity code that works.

Upgrades to leveraged vaults

The prime money market improves leveraged vault UX in the same way as it does for normal borrowers. In Notional V3, leveraged vault users will have the option to borrow at a variable rate to fund their leveraged vault in addition to the current fixed rate options.

This will enable users to take advantage of opportunities that might be more temporary or short-term and it will also improve the UX around settlement. In Notional V3, leveraged vaults no longer settle at maturity automatically - instead, fixed rate debt auto-converts to variable rate debt.

In addition to improved leveraged vault UX, Notional V3 also introduces the possibility of multi-currency leveraged vaults. In a multi-currency leveraged vault, the user can borrow multiple currencies at once to deploy in their DeFi yield strategy. This is particularly useful for leveraged vaults that deploy into volatile LP pools.

For example, the wstETH/bbaUSD pool on Balancer might be offering very high returns, but if you only have USDC you might not want to convert half of your capital into ETH to access those returns because you are unsure if ETH/USDC will go up or down. You might want to minimize your price risk. With a single-currency leveraged vault this would be impossible. The leveraged vault would have to sell half its USDC for ETH. But a multi-currency leveraged vault can borrow the ETH that it needs to deposit into the pool. This allows you to access the high yields on this volatile pool without taking a lot of price risk.

Increased LP returns and efficiency

A core goal of Notional V3 is to increase LP returns and increase the efficiency of LP capital in order to decrease the protocol’s reliance on liquidity incentives. The prime money market and an upgraded fixed rate AMM curve accomplish these objectives.

On Notional V2, LP returns are impaired by low utilization levels + low yields on unutilized capital. Today, most LP capital is earning the Compound V2 supply rate instead of the higher fixed interest rates on Notional. This drags down overall LP returns.

On Notional V3, unutilized LP capital will be earning the prime lending rate instead of the Compound V2 supply rate. Additionally, the upgraded AMM curve will make LP capital more efficient which means lower slippage for end users and less liquidity needs for the protocol overall. This will boost returns for LPs and allow the protocol to significantly scale back NOTE liquidity incentives without losing liquidity.

Increased integration flexibility

Today, Notional V2 is directly integrated with Compound V2. This tight integration makes Notional less resilient because a problem with Compound V2 can flow directly up to Notional. On Notional V2, we don’t have the capability to move the protocol’s funds off of Compound V2 or onto another money market. This exposes Notional to potential problems and it also closes off the ability for Notional to put its funds on to more robust or attractive money markets as conditions change and DeFi continues to innovate.

On Notional V3, we have removed the hard dependency on Compound V2. Notional V3 will have the ability to rebalance underlying holdings to other money markets made eligible by governance or to underlying balances on Notional itself. This both makes Notional V3 more resilient to issues in external protocols and future proofs the protocol. If opportunities or protocols arise that represent better places for Notional V3’s capital, we will have the flexibility to easily take advantage of those opportunities.

Tentative rollout plan

Notional V3 is code complete and went into audit with Sherlock on March 27th for 7 weeks. The audit will be led by Xiaoming90 and 0xleastwood, two leading security researchers with extensive experience and previous knowledge of Notional gained via participation in prior audits of the codebase. The Sherlock audit will also include a public contest.

We plan to deploy Notional V3 in a test capacity on Arbitrum in the next few months with a target for Mainnet deployment in early June at the conclusion of the Sherlock audit. Once all issues have been addressed and all the necessary testing has been completed, we plan to upgrade the Notional proxy to point to the new Notional V3 contracts. No liquidity migration or any other user action will be required to move from Notional V2 to Notional V3.

Notional V3 is the culmination of years of work and learnings. We believe that Notional V3 will set a new standard for lending protocols in DeFi and move the industry forward. We’re excited to share it with you.

The Notional Team

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.