Introducing the NOTE

Earlier this month we introduced the core features of Notional V2. Today, we are excited to announce the NOTE token and Notional’s plans for decentralization and community ownership. In order to achieve long-term success and growth of the Notional protocol, it’s essential that we put control of the protocol into the hands of the people who use it. Community ownership is fair, and it’s the best way for the Notional protocol to grow and serve more users. The stunning growth of some crypto-networks demonstrates the power that comes from an engaged community that shares ownership of the network. Notional V2 will distribute the NOTE token to the community via a retrospective airdrop, liquidity mining, and a community grants program.

Our Vision for Notional

Notional V2 is critical, base-layer infrastructure that will support the most efficient, secure, and liquid fixed-rate lending markets on Ethereum. Fixed-rate lending is an enormous market opportunity in its nascent stages in DeFi. As of Q4 2020, crypto OTC fixed-rate lending markets totaled $13.3 billion and traditional fixed-rate lending markets totaled over $100 trillion in size. Prioritizing efficiency, security, and liquidity will position Notional V2 to bring these markets to DeFi and make fCash a financial primitive that will underpin the next generation of financial innovation on Ethereum.

- Efficiency: Notional V2 creates fixed rate lending markets without the intermediaries that take a significant cut of user returns. On Notional V2, all users will be able to borrow and lend at the true, fair market price and get the maximum value out of their assets.

- Security: A user who puts capital into Notional V2 can be certain that they will get what they are owed. Notional V2 will ensure systemic integrity via protocol reserves and rigorous risk-management by protocol governors. Notional V2 will be the safest place to earn fixed returns in DeFi.

- Liquidity: Users will be able to borrow and lend in significant size and experience minimal slippage in the interest rate on their loan. An integration with Compound coupled with capital efficient design ensures that liquidity providers earn attractive returns, resulting in liquidity pools deep enough to facilitate the loans of even the largest users and institutions.

Notional Governance

NOTE token holders will have full control over the on-chain treasury, the protocol’s risk and collateralization parameters, and any smart contract upgrades. The Notional team will temporarily retain the ability to pause the system in the event of emergency, but will have no other special permissions.

Here are examples of some of the decisions that NOTE token holders will need to make as the protocol grows:

- Setting collateral haircuts

- Onboarding new collateral types

- Activating new maturities for lending and borrowing different assets

- Determining liquidity incentive emission rates

- Proposing and evaluating upgrades to the protocol

These decisions are complex and will require balancing different priorities. In order to assist the community in this process at inception, the Notional team will produce research and analysis related to governance decisions and risk-management. We will open source the simulation code that supports our analysis and actively encourage community participation as we build out our risk management and simulation framework.

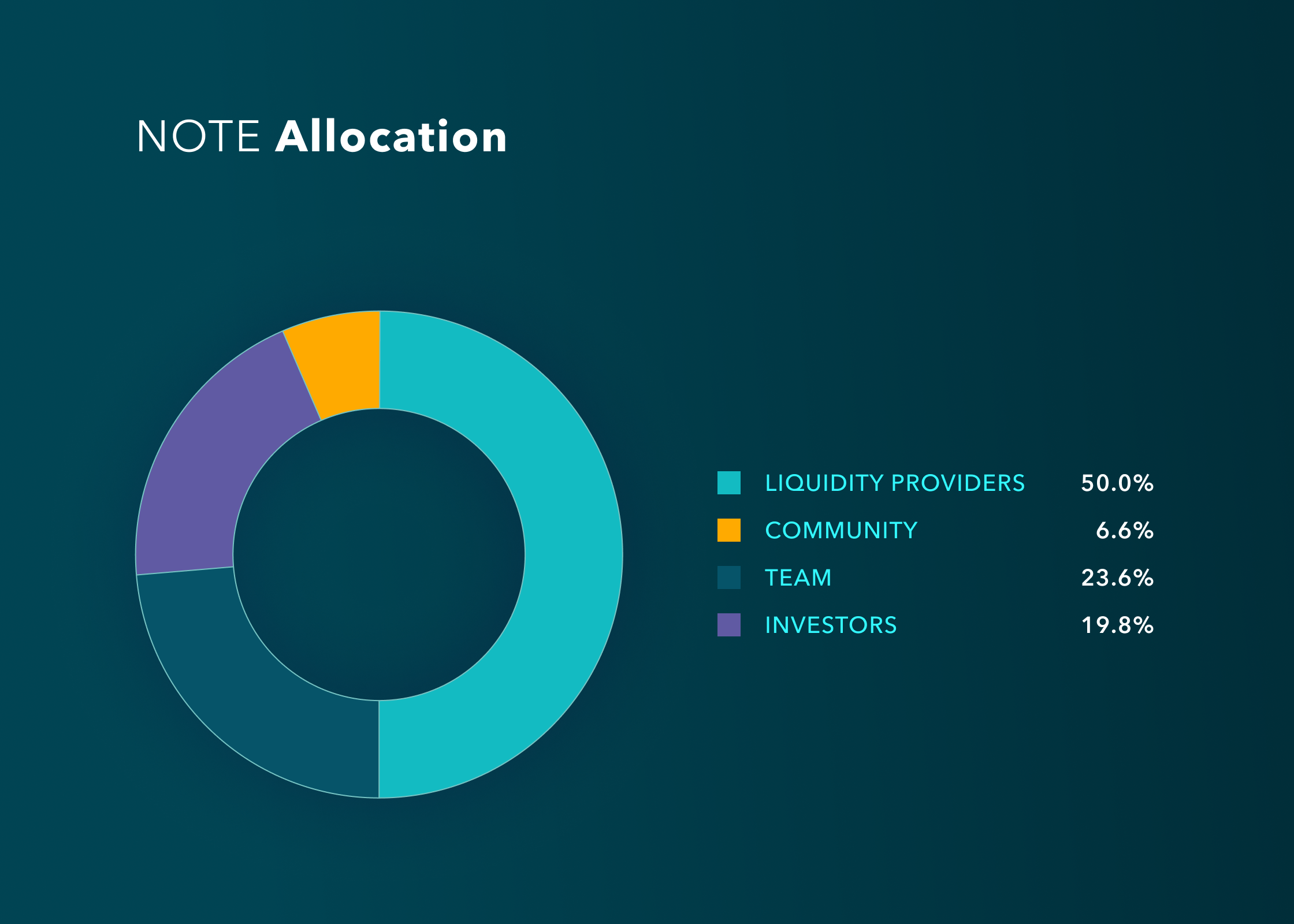

NOTE Allocation

We will allocate 56.62% of the token supply to the community. 50% of the supply goes to liquidity incentives with an additional 6.62% earmarked to support the growth of the Notional ecosystem and fund developers who want to build products on top of Notional.

The total supply of NOTE is 100,000,000, with the following allocation:

- 50,000,000 (50%) to liquidity incentives

- 6,620,000 (6.62%) to development grants and community building

- 23,600,000 (23.6%) to the team and future team members unlocked over three years

- 19,780,000 (19.78%) to early investors unlocked over three years

Retrospective Airdrop

Notional could not have gotten to where it is today without the engagement of our early community. Notional’s early users took a chance on our product and they deserve to share in the success of the protocol because of it. All users who have borrowed, lent, or provided liquidity in an amount greater than or equal to 50 DAI/USDC as of July 4th 2021 00:00 GMT will be eligible to receive between ~600 NOTE and 1800 NOTE. This airdrop will represent 0.75% of the total NOTE supply and will come from the allocation devoted to community building. The structure of our airdrop will reflect two principles:

- The earlier a user interacted with Notional, the more they contributed to the project’s success, and the more they should be rewarded. We determine users’ airdrop allocations as a function of the first time that they used the protocol. Someone who first used the protocol in October 2020 will receive roughly three times as many NOTE as someone who first used the protocol in July 2021.

- Smaller users should not be penalized for their relative lack of resources. Notional was built to help democratize access to financial services, and this airdrop will be egalitarian. Users who want to earn NOTE in a way that scales with the amount of capital they commit will have the opportunity to do so via our liquidity mining program.

741 addresses will be eligible for this airdrop - click here to see specific allocations.

Liquidity Mining

Liquidity providers are the lynchpin of the Notional system, and they will receive the largest allocation of any stakeholder. Allocating 50% of the total NOTE supply to liquidity providers ensures that the Notional protocol will be sufficiently capitalized to meet the needs of any end user, no matter their size.

Liquidity incentives will be allocated directly to nToken holders according to an incentive emission rate set per currency by Notional governance. Liquidity providers will be able to earn NOTE incentives by minting nTokens in the following currencies at launch: USDC, DAI, USDT, ETH and wBTC. Incentive emission rates for the above currencies will be announced prior to launch.

Liquidity incentive emission will be front-loaded to kickstart the network and in anticipation of an increasing NOTE value over time. Notional governance will revisit and potentially change incentive emission rates on a quarterly basis. The below schedule lays out a tentative vision for the distribution of liquidity incentives over time.

Year 1 Emission: 20,000,000 NOTE

Year 2 Emission: 15,000,000 NOTE

Year 3 Emission: 10,000,000 NOTE

Year 4 Emission: 5,000,000 NOTE

This schedule is only indicative and will ultimately be determined by Notional governance.

Developer Grants

Notional V2 will foster the next generation of financial innovation in DeFi by making it easy for developers to create fixed-income products. fCash is a groundbreaking financial primitive - it introduces the ability to define cash flows at specific future dates that can easily be converted into cash today via Notional’s liquidity pools. Notional V2 will enable developers to build financial products that incorporate fCash without having to worry about the underlying collateralization and trading infrastructure that makes fCash liquid and secure. Here are a few ideas:

- Fixed coupon bonds. Some lenders might find it helpful to receive a fixed amount of interest at a regular interval, instead of receiving all their interest at the end of their loan along with their principal. A fixed coupon bond is just a bundle of fCash tokens with different maturities. This structure would allow a user to lend out their principal for an amount of time (ex. one year) and receive fixed, regular (ex. quarterly) payments. Reliable fCash liquidity means that if the lender wanted their next interest payment a little early, they wouldn’t have to wait for it - they could sell the fCash token representing that payment for cash upfront on Notional.

- Fixed-rate yield farms with liquidity. Users could deposit capital into a yield farm and get a fixed rate payout denominated in fCash. This idea has already had some takeup by other teams in DeFi like Barnbridge and Element. Integrating fCash into the design would enable those projects to give their users instant liquidity on their fixed-rate yield. Instead of locking users into a yield farm until maturity, an fCash denominated payout would allow users to convert their returns to cash on Notional at any time. Users could even borrow against their returns if they wanted to!

- Future payments. fCash can allow a user to credibly commit to a future payment. Take the following example: you’ve hired someone to build you a house that they have promised to finish in one year for 100,000 USDC. They want to know that you’ll pay them for all the work that they’re going to do, but you don’t want to give them the 100,000 USDC today and lose out on the returns that capital would generate while you’re waiting for them to finish the house. Instead, you could purchase 100,000 fUSDC maturing on the date that they are scheduled to complete the job and give the contractor that. With interest rates at 5.26%, that 100,000 fUSDC would only cost 95,000 USDC today. You’d be saving 5,000 USDC! The contractor knows that he’ll get exactly what he is owed upon completion, and you don’t miss out on a year’s worth of returns on your capital. The contractor can even borrow against his future earnings for working capital today. This kind of financing is known as factoring, and it is a $3.1 trillion market.

These are just a few of the exciting prospects created by fCash and we’re certain there are more. Fixed-income products are the foundation of traditional financial markets and we’re thrilled to bring them to DeFi.

Community building

In order to fulfill the promise of an open, global financial network we need input from an engaged and diverse community. A portion of the community allocation will go toward supporting Notional community members that want to play an active role in the community’s growth in ways that don’t involve providing liquidity or building products on top of Notional V2. This will include moderation, content translation, and other activities that develop the Notional community. The NOTE allocation to community building ensures that anyone has the opportunity to be a contributing member of the community and earn NOTE rewards, not just developers and liquidity providers.

Distribution Details

The NOTE token will launch alongside Notional V2 in September 2021 pending an audit by ABDK, formal verification by Certora, and a second audit by Code Arena. In the coming weeks we will publish further details regarding airdrop logistics, liquidity incentive emission rates, and our community development program.

To stay on top of Notional’s progress towards launch, follow us on Twitter or hop in our Discord.

Thanks,

The Notional Team

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.