Newcomer Starter Boost - Incentives for New Lenders

Are you ready to unlock higher yields on your lending? If you're an active DeFi lender on platforms like Aave, Compound, Morpho, or Fluid, it’s time to explore Notional Finance.

With our Newcomer Starter Boost, we’re offering a 5% APY bonus for your first week as a Notional lender. Read on to see how you can benefit from this limited-time offer and why it’s worth making the switch.

What is the Newcomer Starter Boost?

The Newcomer Starter Boost is designed for active DeFi lenders who haven’t yet experienced Notional. Eligible users who deposit at least 5,000 USDC or 2 ETH between Nov 26 and Dec 10 will receive a 5% APY boost on their deposits for the first week.

Here’s how it works:

- Deposit into Notional's lending, fixed-rate lending or liquidity provision products on Ethereum Mainnet or Arbitrum.

- Maintain your deposit for at least 30 days to qualify.

- Your APY boost will be transferred to you in the token you deposited on January 15.

Limits apply:

- Maximum individual deposit eligibility: 500,000 USDC and 200 ETH.

- Campaign-wide cap: 5M USDC and 2,000 ETH.

Act fast—only the first deposits will qualify!

Who’s Eligible?

Eligibility is simple:

✅ You’re currently an active lender on Aave V3, Compound V3, Morpho, or Fluid but you haven't used Notional before.

OR

✅ You've used Notional before, but you don't have an active position now.

Confirm your eligibility by connecting your wallet to the Notional UI and then navigate to the portfolio page. If you see this banner on the top of the page, you're eligible!

Why Try Notional?

Notional isn’t just another DeFi lending protocol. Here’s why you should add us to your portfolio:

1. Superior APYs

Notional consistently outperforms other protocols in both USDC lending and liquidity APYs and ETH liquidity APYs.

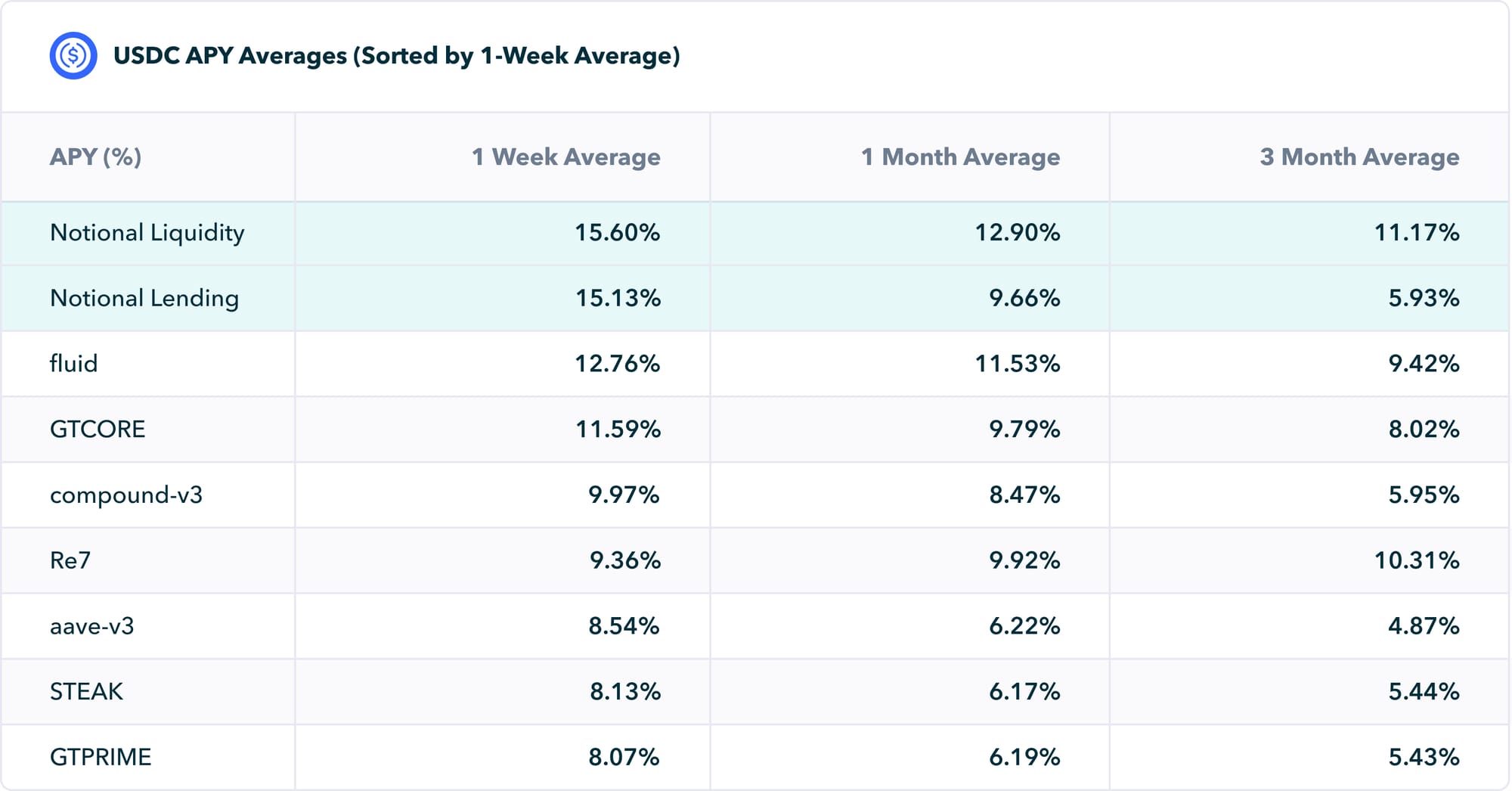

USDC Lending and Liquidity APYs: Higher returns compared to Aave, Compound, Morpho, and Fluid across multiple timeframes:

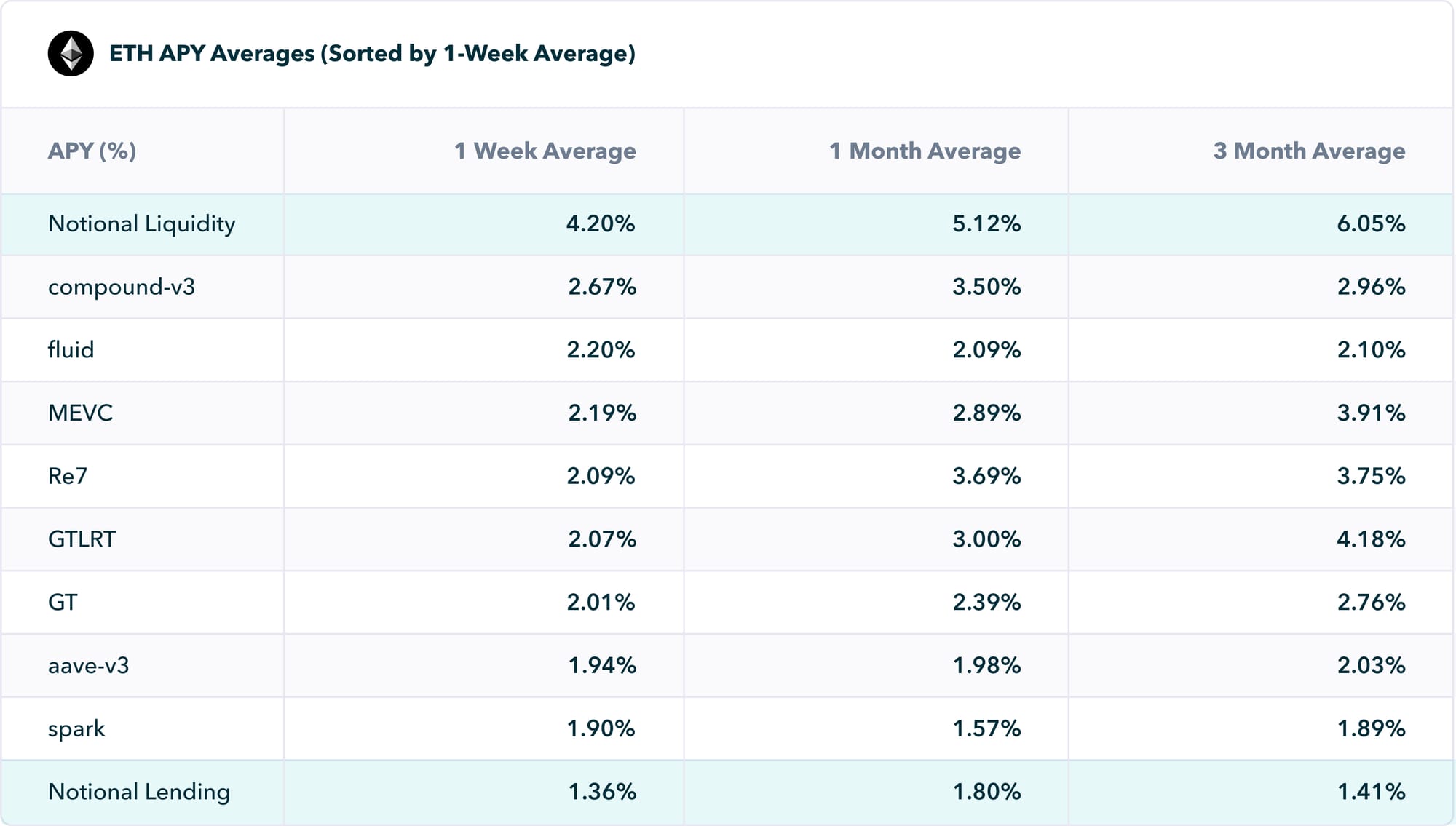

ETH Liquidity APYs: Consistently better rates on Notional than competing platforms:

2. Smart Portfolio Diversification

The #1 risk in DeFi is smart contract risk. Diversifying your funds across multiple battle-tested, well-audited protocols helps reduce the risk of catastrophic loss in your portfolio.

Why trust Notional?

- Live on Ethereum Mainnet since 2021.

- 17 audits from top firms including Sherlock, Consensys, Open Zeppelin, and Code Arena.

Adding Notional to your lending mix strengthens your portfolio while optimizing yield.

How to Get Started

- Check Your Eligibility:

- If you’re an active lender on Aave V3, Compound V3, Morpho, or Fluid but you haven't used Notional, you’re likely eligible.

- If you've used Notional before but don't have a position now, you're likely eligible.

- Deposit Funds: Choose Notional’s lending, fixed-rate lending, or liquidity provision products.

- Get Boosted: Maintain your deposit for at least 30 days and receive your boosted APY rewards on January 15.

Don’t Miss Out!

With a cap of 5M USDC and 2,000 ETH for rewards, the Newcomer Starter Boost is first-come, first-served. Don’t wait—get started today to maximize your returns.

Start earning smarter: Notional Finance

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.