Notional Exponent: Doubling Down on Leveraged Yield

Notional recently announced our newest product - Notional Exponent. If you missed it, check out our announcement blog post with all the details.

This post isn’t about what Notional Exponent is or how it works - it’s about why we decided to build a leveraged yield protocol and STOP building a fixed rate lending protocol.

In many ways, Notional Exponent is what we’ve been building towards for years - a protocol that helps users maximize their returns using the best leveraged strategies in DeFi.

But Notional Exponent is also a recognition that our fixed rate lending protocol wasn’t growing like we wanted it to. Notional V3 TVL topped out in March 2024 and has trended down since. Our strategy to drive protocol adoption didn’t work.

This is the story of what went wrong, what lessons we learned, and how it led us to make a change and build something better with Notional Exponent.

The strategy

The Notional V3 business strategy was pretty straightforward:

- Use leveraged vaults to boost our lending APYs above our competition.

- Use higher APYs to drive TVL growth.

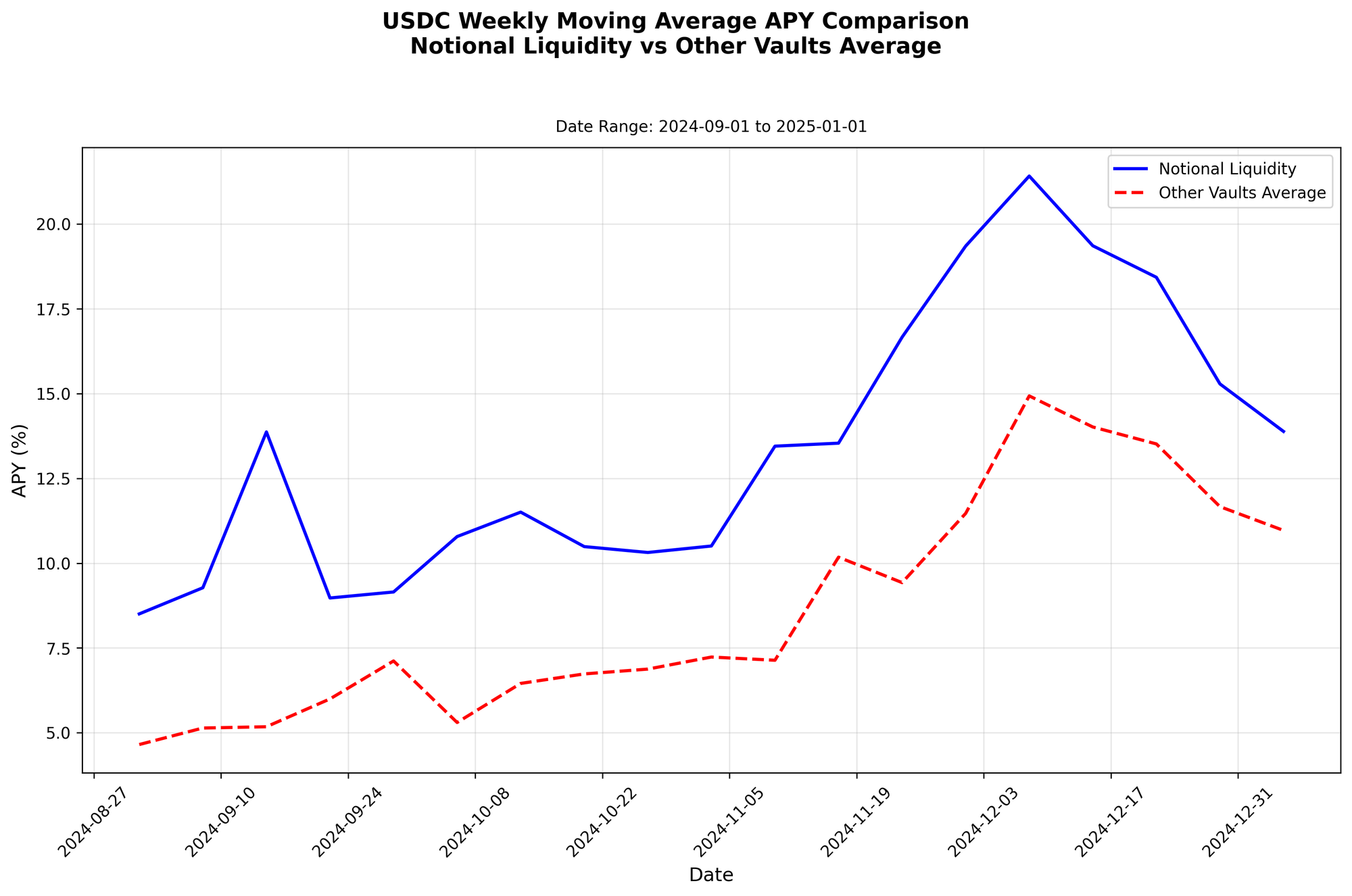

It took most of 2024 to get the leveraged vault UX where it needed to be for this strategy to work, but eventually we got it there. By the end of 2024, our APYs consistently sat at the top of the pack relative to an average of other DeFi lending protocols:

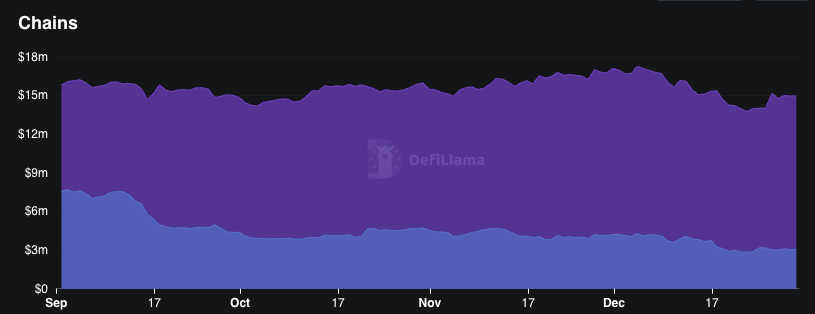

But attractive APYs didn’t result in the TVL growth that we had hoped for. In fact, our TVL actually went down over this period:

Our APYs may have been good relative to the major lending protocols, but that wasn’t enough to attract lenders.

Problems getting lenders

Our focus on finding PMF with leveraged vaults pushed us to prioritize speed of iteration over stability. And constant iteration means increased risk - the opposite of what lenders want.

The decision to prioritize leveraged users sent negative signals to lenders across multiple aspects of the business, from the smart contracts, to the website, to the messaging:

- We were constantly adding new code because we were always shipping new leveraged yield strategies or updating old ones.

- We still didn’t have on-chain governance or timelocks on contract upgrades.

- The site became increasingly complex and difficult to navigate. We went from offering three products in 2021 to nine in 2024!

- Our social content consistently focused on our risky leveraged opportunities.

These signals turned off potential lenders and prevented us from converting our higher APYs into TVL growth.

Solutions

In theory, these problems were solvable without any major course correction. But solving these problems would take time. And even if we did solve them, it’s not clear that we would have enough edge to dislodge our much larger competitors’ network effects.

Furthermore, time spent focused on lending was time spent not focused on leveraged vaults. Even if we were able to reach parity with our competitors, the process would take months, if not years. That meant months or years specifically NOT devoted to our unique value proposition.

It wasn’t a great option, but we decided to do it anyway largely due to inertia. Notional was a lending protocol. What other choice did we have?

A chance conversation

At ETH Denver, I ran into a VC that I’ve known since the very beginning. I gave him my spiel of how we had these problems attracting lenders but we knew what to do to fix it and how we were planning to do it.

Unlike a lot of other people I had talked to about it though, he didn’t just nod and smile. To his credit, he called me out. Lending wasn’t working, but leveraged yield strategies were - maybe we should double down on that instead of trying to fight an increasingly lopsided battle against established incumbents.

We’d had the idea before, but had dismissed it. It had seemed like too big a change to even contemplate - how could we just abandon the lending protocol that we’d sunk millions of dollars and years of our lives into? But hearing it again from him forced us to reconsider.

The idea

The idea was simple. Instead of trying to solve all the barriers to growth of our own lending protocol, we could just use other lending protocols and let them worry about those problems.

This would allow us to focus exclusively on developing new leveraged yield strategies, improving our leveraged UX, and acquiring new leveraged yield users.

It would be a tradeoff - give up a small chance to own the entire lending/yield stack for a bigger chance to own a niche.

Creating a compelling and differentiated leveraged yield product is easier said than done however. There are already several leveraged yield products that provide a nice UX to manage looped positions on underlying lending protocols like Aave and Compound.

Offering a new version of this same product isn’t likely to be successful. Instead, Notional Exponent leverages our experience and expertise to unlock net new leveraged yield strategies that will offer high APYs and will only be accessible through our protocol.

Key innovation - smart withdrawal

The key technical innovation that enables Notional Exponent to offer new leveraged yield strategies is smart withdrawal. Smart withdrawal makes it possible to list tokens as collateral on lending protocols that don’t have liquidity and are not instantly redeemable.

An example of an illiquid yield token would be shares of the Upshift Finance High Growth ETH vault. This is a managed vault that takes rsETH deposits and deploys them into advanced strategies to earn 11%+ ETH APY. This yield token can’t be traded onchain and has a four day redemption delay.

Today, lending protocols will not accept this token as collateral because no liquidity + redemption delay makes it impossible to liquidate with flash loans. Notional Exponent changes that.

Smart withdrawal makes it possible to liquidate tokens like the Upshift Finance High Growth ETH vault share with flash loans (watch out for a full description of how this works in a future blog post!). This makes it possible to get the token listed as collateral and offer a leveraged yield strategy on it!

There are lots of tokens like this today, and we think there will be more in the future. More and more illiquid yield tokens have redemption delays either because they are taking capital offchain or because they are doing complex strategies that can’t instantly be unwound onchain.

The universe of instantly redeemable strategies to earn yield will ultimately be small compared to yield strategies that involve a lockup period. Notional Exponent will superpower this emerging class of yield strategies with leverage.

And we aren’t stopping there! Smart withdrawal is just the first example of how we will leverage our deep expertise in the leveraged yield space to build products that enable new strategies and make our users money.

What happens now

Initial development of Notional Exponent is already complete. Audits are locked in for the months of July and August. Following that, we aim to take the protocol live in the fall!

I believe that we can create the best leveraged yield protocol in DeFi. We know the space well and are power users ourselves. Notional Exponent is the product we want, and we’re putting everything into making it as good as it can be. I can’t wait to use it!

To all the Notional users and community who have been with us throughout our journey - thank you. You’re the reason we’re still here building products after over five years in DeFi.

And finally, if you’re a DeFi power user who loves to lever up their yield strategies, reach out - we’re building this for you.

Notional Exponent will disrupt the leveraged yield landscape in DeFi and it will happen sooner than you think. Stay tuned, anon!

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.