Notional Finance Quarterly Report: Q1 2023

Q1 has been a challenging quarter for crypto, with USDC de-pegging in early March and multiple protocols directly or indirectly suffering from smart contract hacks. Notional managed to navigate this environment unscathed and continues to lead the space as the top DeFi fixed rate protocol.

You can download the full Notional quarterly report here:

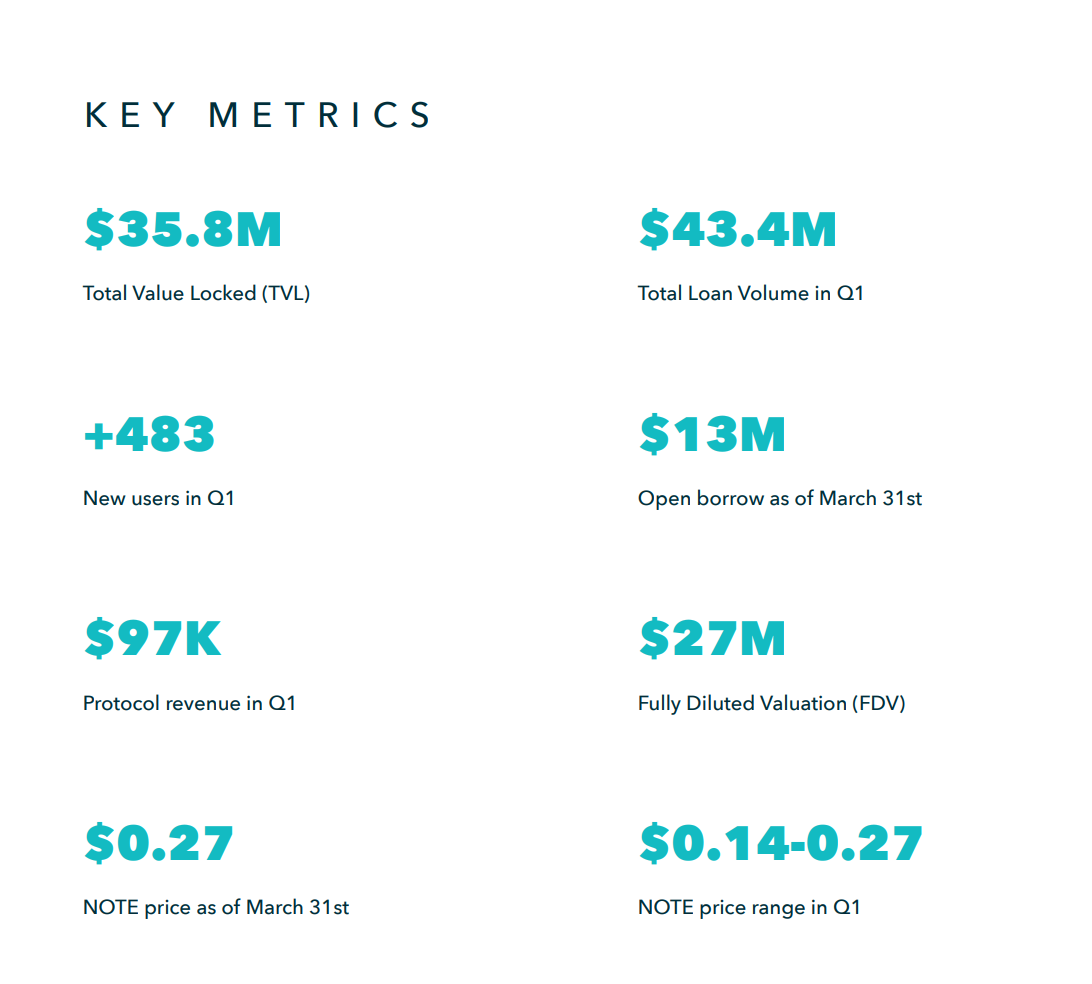

During the quarter, Notional saw its TVL decrease from $55M to $36M. Nevertheless, the protocol still processed $43M in transaction volume and generated $97K in revenue.

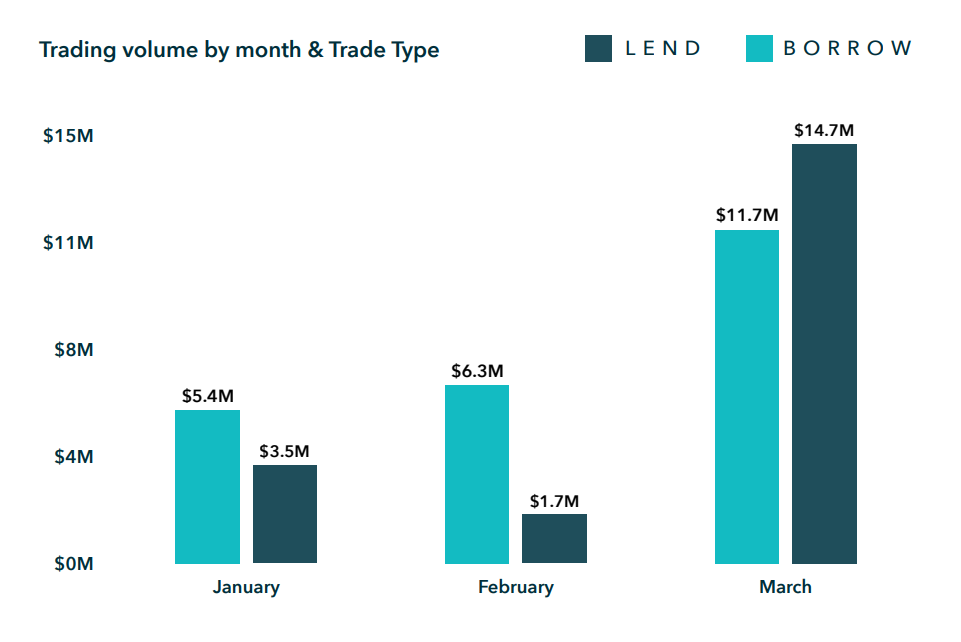

Notional facilitated $9M of volume in January, $8M in February, and $26M in March. Borrowers drove 54% of the overall trading activity, while lenders drove the remaining 46%.

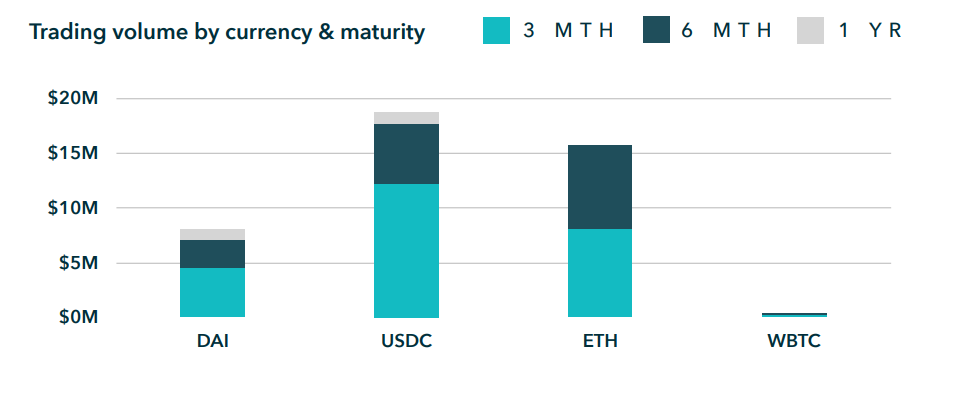

The proportion of ETH trading volume was up from 20% in Q4 2022 to 36% in Q1 due to the increase in activity from leveraged vault users. 61% ($9.6M) of the total fETH trading volume came directly from leveraged vaults.

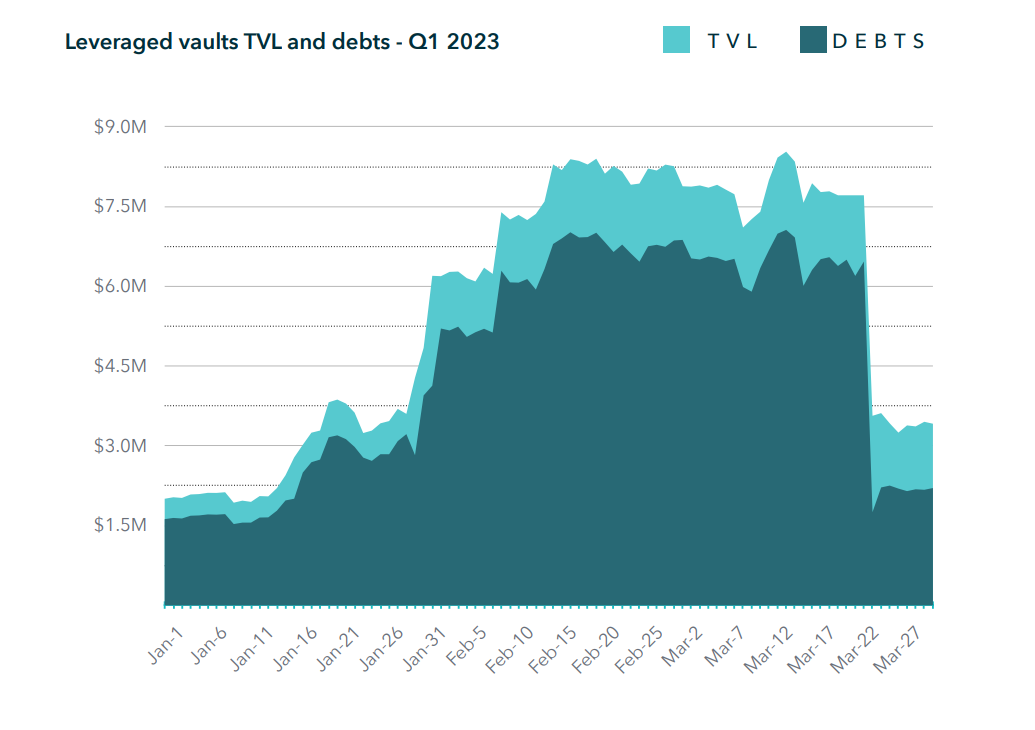

Strong demand for leveraged vaults even momentarily pushed the ETH 6 month fixed rate upwards of 8.7%. Leveraged vaults have proven that borrowers are willing to borrow at high rates to enter whitelisted yield strategies. This early success of leveraged vaults is extremely promising as we plan to launch additional vaults in the coming months.

In Q1 we also announced the details of Notional V3. This next version of Notional will introduce the prime money markets - Notional’s new, native variable-rate lending and borrowing markets. Prime money markets will greatly improve Notional’s UX making the protocol more accessible to DeFi users and more capital efficient.

As we complete audits for V3 the team is also actively redesigning the UI and planning the onboarding of new markets and leveraged vault strategies. We are excited to move forward with the launch of V3 and believe it will set a new standard for lending protocols in DeFi.

About Notional Finance📈

Notional is the #1 Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With more than $675M in total fixed rate lending volume, Notional is now a top 10 lending protocol providing core DeFi infrastructure.

Notional’s latest product launch, leveraged vaults, launched in beta in Q4 2022. A new DeFi primitive built on fixed rate borrowing, leveraged vaults execute specific yield strategies while collateralizing the vault assets, allowing users to maximize capital efficiency by taking up to 10x leverage.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched in November '21 with a host of new features as well as the $NOTE governance token.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.