Notional Launches Out of Beta

We’re thrilled to announce that Notional is launching out of beta. We’ve refined our UI, attracted over $3M of initial liquidity, and received a full audit report from Open Zeppelin. Check it out at notional.finance.

We learned a lot from all of you who tested our product over the last few months and we’re ready to take the next step forward. Thanks to your participation and liquidity, on Notional today you can borrow 250K USDC at less than 5% APR. That means that anyone can use our product to fix their interest rates and achieve predictable returns — from the minnow to the whale. If you’d like to learn more about Notional’s design and how we can get such high efficiency from LP capital, check out our docs.

Fixing interest rate volatility

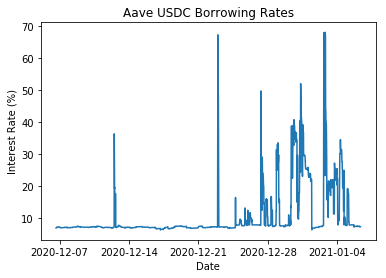

DeFi interest rates have been exceptionally volatile in recent weeks, and Notional can protect borrowers from the negative impact of volatility with fixed interest rates. Here are USDC borrowing rates on Aave from December ’20 to Jan ‘21:

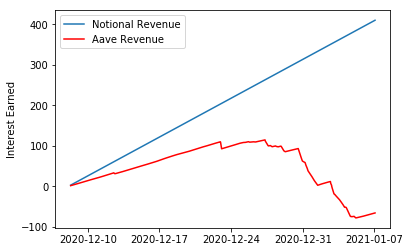

Interest rates spiked to almost 70% multiple times! Rates were so volatile that you would have lost money if you were borrowing USDC on Aave to deposit into a pool at 10% APY. Here is what your revenues would have looked like if you had borrowed variable on Aave vs fixed at 5% on Notional:

On Notional you would have made strong and consistent returns. On Aave you would have lost out on your yield. We’re in a bull market — if you want to lever up on your wBTC or ETH and farm yield, save yourself the headache and fix your borrowing rate on Notional today.

The opportunity we’re going after is significant — fixed rate lending is a multi-trillion dollar market. We have a long way to go, but we’ve come a long way already. If you want to contribute and be a part of this journey, we would love to have you along for the ride. If you want to use the product, try it out on our site notional.finance or if you want to ask us any questions, just hop in our Discord. Whether you’re interested in providing liquidity, running a liquidator, or just using the protocol and giving feedback, together we will build the future of fixed rate finance on Ethereum.

Thanks,

Teddy and Jeff

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.