Notional Finance Quarterly Review: Q1 2022

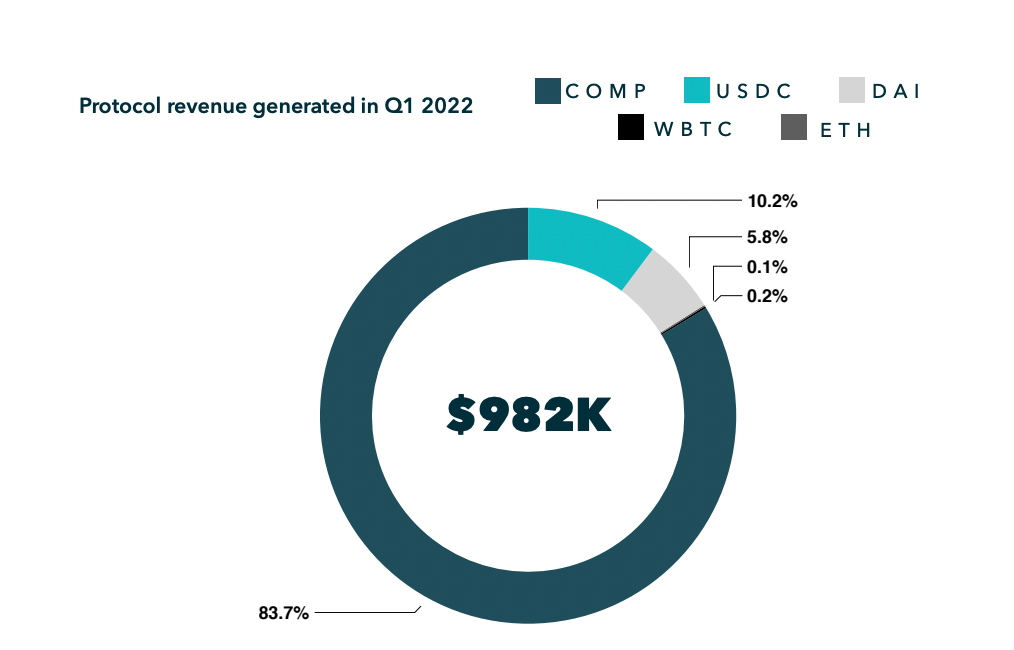

Notional accomplished a lot in Q1 2022. The protocol won the majority share of the fixed rate lending market, laid the foundations for continued success through protocol integrations, and increased the utility of the NOTE token with the NOTE staking module.

Notional accomplished a lot in Q1 2022. The protocol won the majority share of the fixed rate lending market, laid the foundations for continued success through protocol integrations, and increased the utility of the NOTE token with the NOTE staking module. Notional’s loan volumes were orders of magnitude larger than our competitors and established our position as the leading fixed rate protocol in DeFi.

The success of the business in this quarter also helped us establish integrations with some of the leading protocols in DeFi like Yearn and Index Coop. These integrations, among others, provide access to scalable and sticky demand for fixed rate lending on Notional. With these integrations in place, Notional will be able to smoothly scale up as quickly as we can grow the borrowing side of the business. Driving borrowing demand will be a key focus area for Q2 as Notional begins to onboard new collateral types and stablecoins.

In addition to capturing the majority of DeFi’s fixed rate lending market, Q1 saw Notional launch the NOTE staking module. This module allows NOTE holders to earn rewards tied to the performance of the protocol while simultaneously contributing to NOTE liquidity and to the security of users’ funds on the protocol.

The NOTE staking module is a major step toward delivering value to NOTE holders, increasing the utility of NOTE within the Notional ecosystem, and providing insurance to user funds on the platform. We look forward to building on our success in Q1 and delivering more strong quarters to come.

Download the full report below, or continue reading for more selected highlights.

Total Value Locked (TVL)

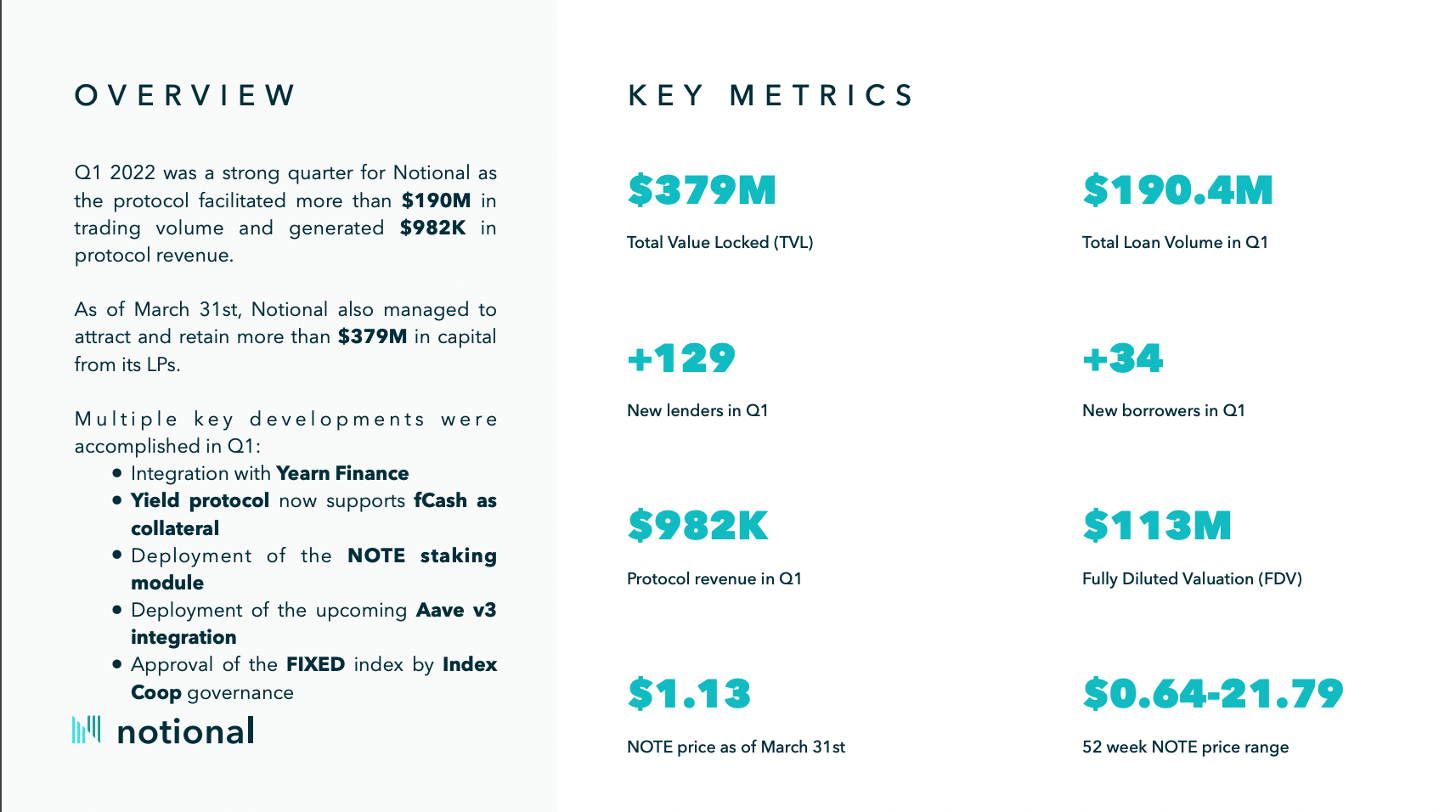

Notional’s TVL started the quarter at $526M and slowly decreased as crypto markets turned bearish and as the NOTE price decreased from $1.86 to $1.13.

As of March 31st, Notional’s TVL sits at roughly $380M allowing borrowers and lenders to trade large amounts of fCash (Notional’s zero coupon bond instrument) at low interest rate slippage.

Importantly, changes made to Notional AMM curves now allow borrowers and lenders to trade with 4X better slippage than with previous curves, thus requiring less liquidity from Notional LPs.

Trading Volume

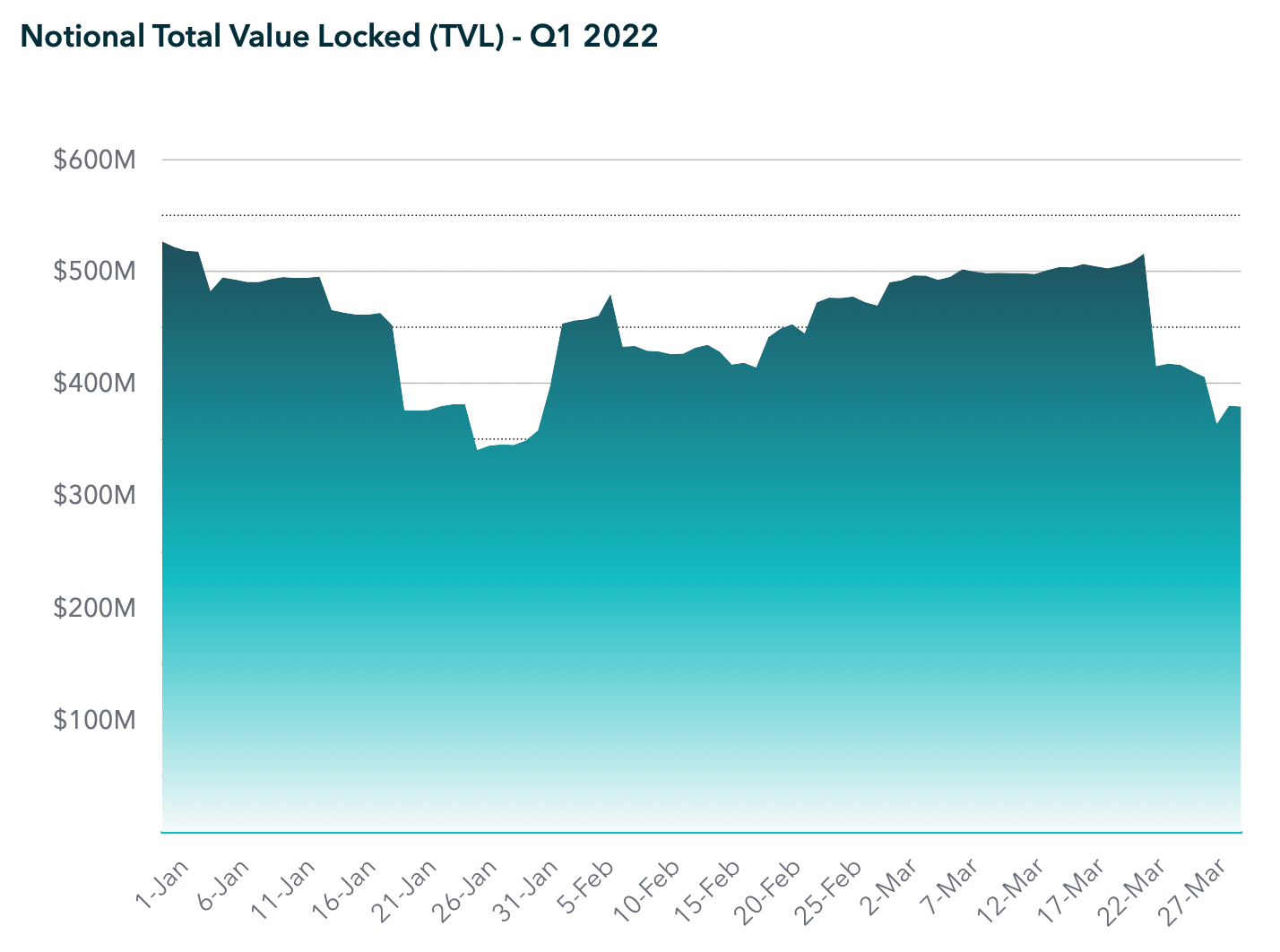

In Q1, Notional facilitated $190.4M in total trading volume. Trading volume increased each month with Notional facilitating $10M of volume in January, $67M in February, and $112M in March.

80% of the overall trading volume was driven by lenders while the remaining 20% was driven by borrowers. Lenders were more active in Q1 as Notional stablecoin rates offered users the opportunity to lock in 6% to 9% fixed yields for up to 1 year.

Of the $190.4M in trading volume:

-64.5% came from fUSDC trading

-33.9% from fDAI

-1.1% from fWBTC, and

-0.5% from fETH.

94% of the DAI volume and 74% of the USDC volume were lending trades. Interestingly, most of the ETH and WBTC volume was related to borrowing as many users rolled their ETH and WBTC borrow positions forward before the roll.

47% of the trading activity was executed in the 3 Month pools, 40% in the 6 Month pools and 13% in the 1 Year pools. Most the fUSDC volume (50%) came from the 3 Month pool while most of the fDAI volume (51%) came from the 6 Month pool. 1 Year fUSDC and fDAI pools respectively generated 15% and 10% of their respective currency’s total volume.

As for WBTC and ETH, 78% and 93% of the volume was executed in the 3 Month pools.

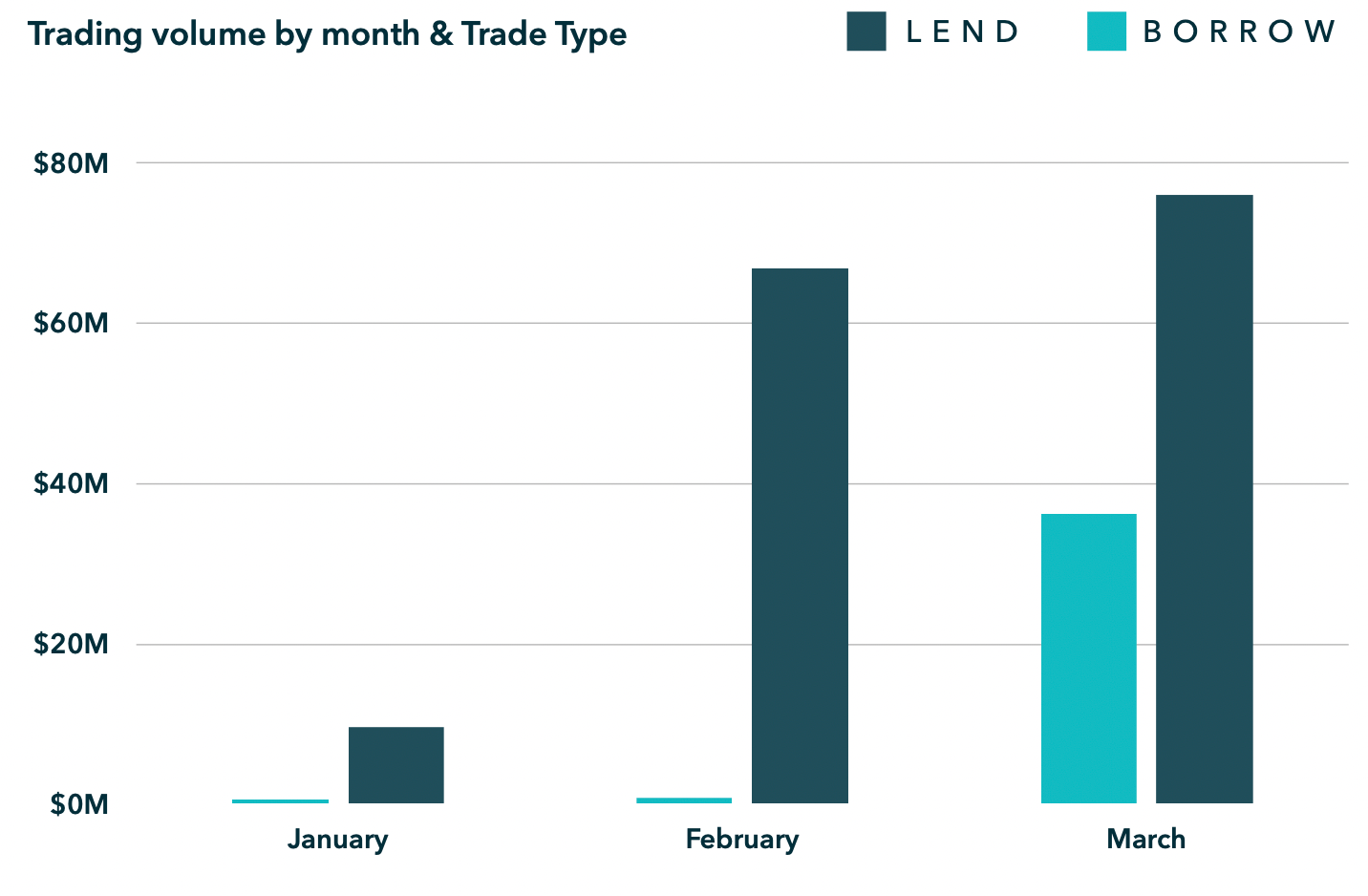

Protocol Revenue

In Q1, the protocol generated $100K in cUSDC, $57K in cDAI, $1.5K in cWBTC, and $1.1K in cETH from transaction fees. It also accrued ~5,750 COMP tokens or ~$822K as of March 31st 2022, for a grand total of $982K in protocol revenue during the quarter. As part of the launch of the staking module, part of the accrued COMP reserves will be sold to buy NOTE tokens to the benefit of sNOTE holders.

Upcoming Developments

The team is currently working on new developments and integrations:

• Launch of the staking module in early April (complete)

• Instadapp integration

• Launch of the FIXED Index in partnership with Index Coop.

• Onboarding of new collateral assets and new tradable currencies leveraging Notional’s Aave v3 integration.

Don't miss the full report - download the PDF below!

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $450M in total value locked.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.