Smart Liquidations: Liquidating Illiquid Collateral

Smart withdrawal unlocks an entirely new class of leveraged yield strategies by making it possible to liquidate illiquid, redemption-delayed collateral assets using flash loans.

We call this smart liquidation.

This post will dive deep into the novel methodology of smart liquidation from a practical perspective. We’ll examine how it works, the risk factors that can affect asset recovery, and how to set risk parameters in this new liquidation model.

DeFi liquidations today

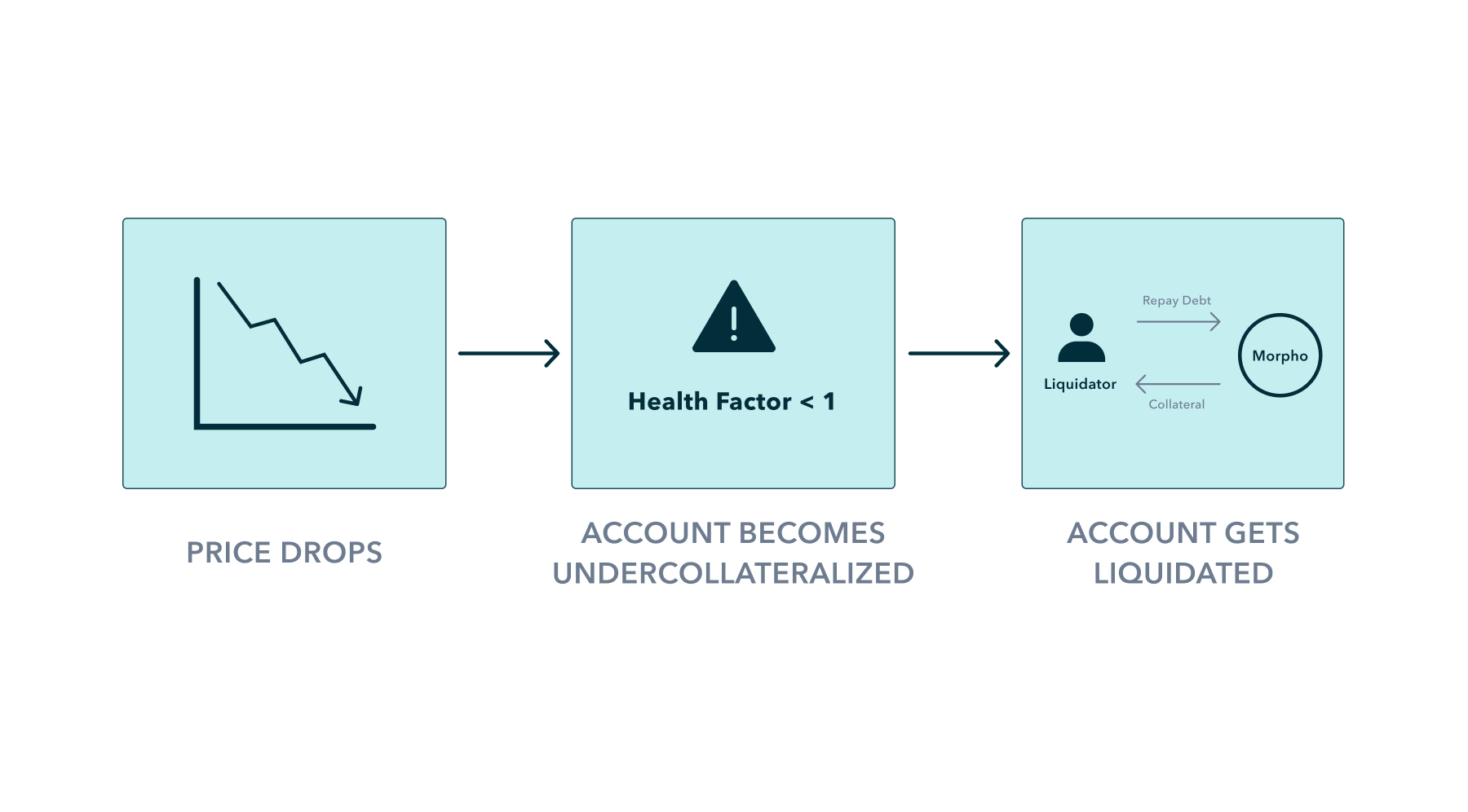

Let’s quickly recap how DeFi liquidations work today: a borrower has some collateral, the price of their collateral drops, they become undercollateralized, and they get liquidated:

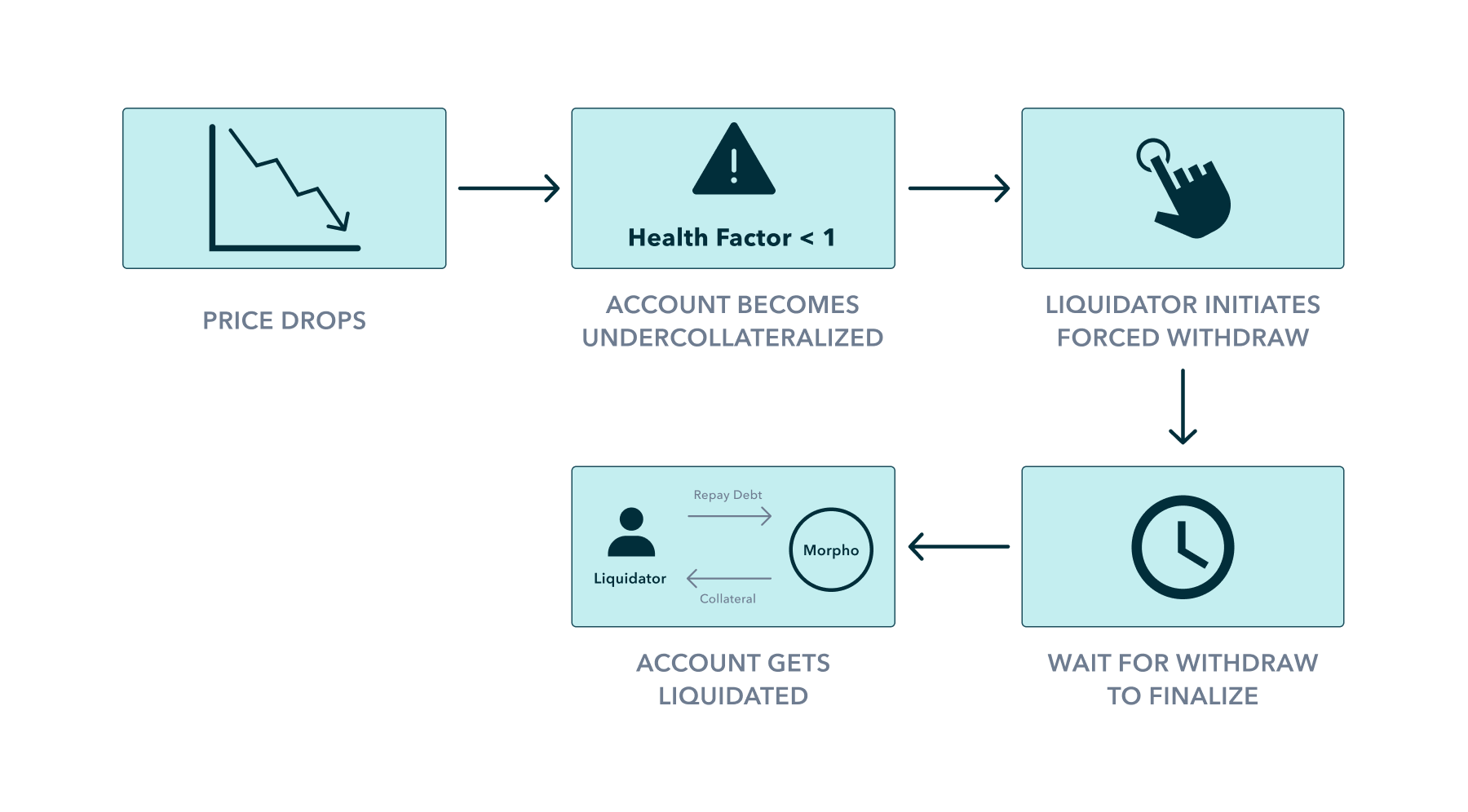

Smart liquidations aren’t that different. First, the price of the collateral drops and the account becomes undercollateralized.

The account can be liquidated at this time, but if the yield tokens held by the vault are illiquid and redemption-delayed, it probably won’t be.

Instead, smart liquidations start with forced withdrawal. When an account becomes undercollateralized, anyone can force that account to begin the smart withdrawal process.

Once the account’s withdrawal finalizes, their vault shares become instantly redeemable for the unstaked tokens. This makes it possible to liquidate them with a flash loan and complete the smart liquidation.

Here’s what a smart liquidation looks like:

The account’s vault shares can be liquidated at any point in this process - before withdrawal has been initiated, while withdrawal is in process, or after withdrawal finalizes. But it’s only after the withdrawal finalizes that it becomes possible to liquidate them with a flash loan.

Smart liquidation example

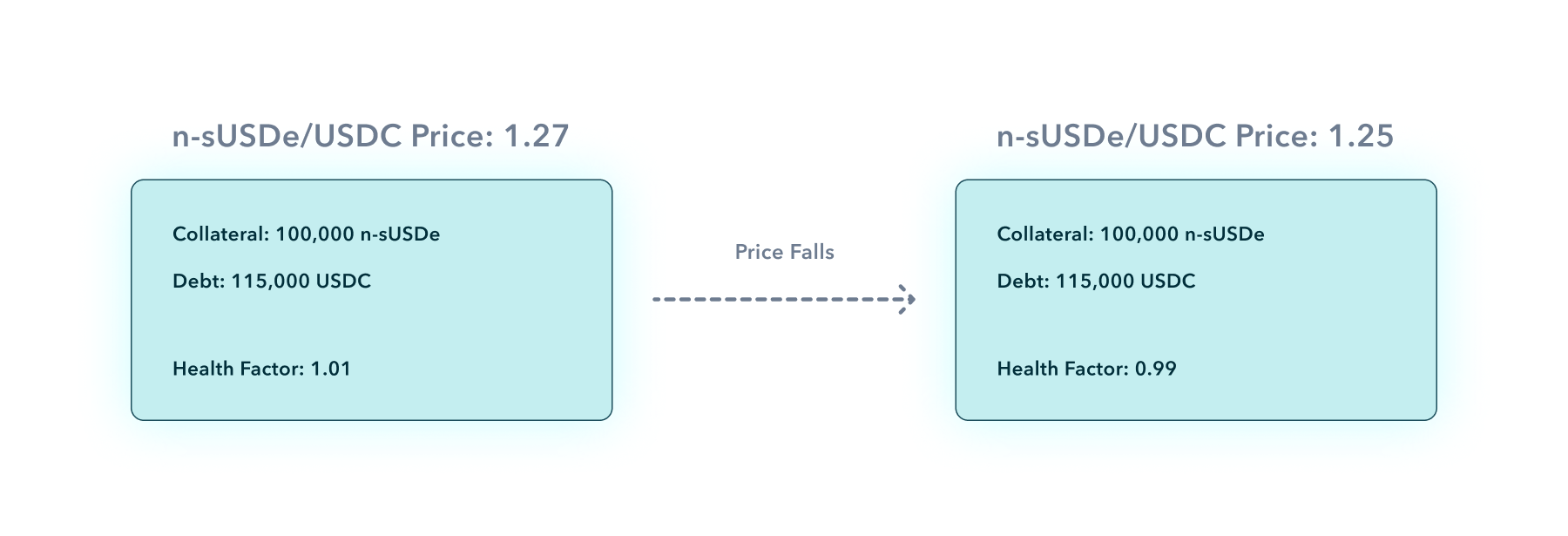

Let’s take a look at how this looks in practice using an n-sUSDe (Notional wrapped sUSDe) / USDC market on Morpho with a 91.5% LTV as an example.

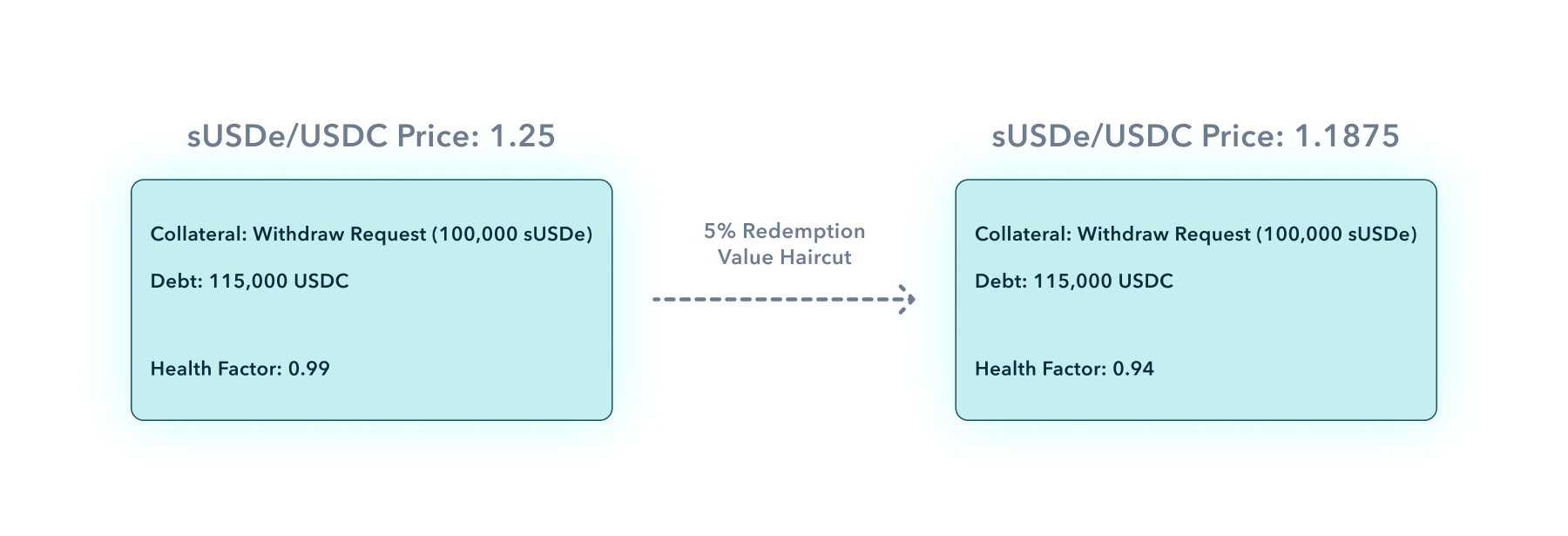

First, a decline in the sUSDe price makes an account unhealthy and eligible for forced withdrawal:

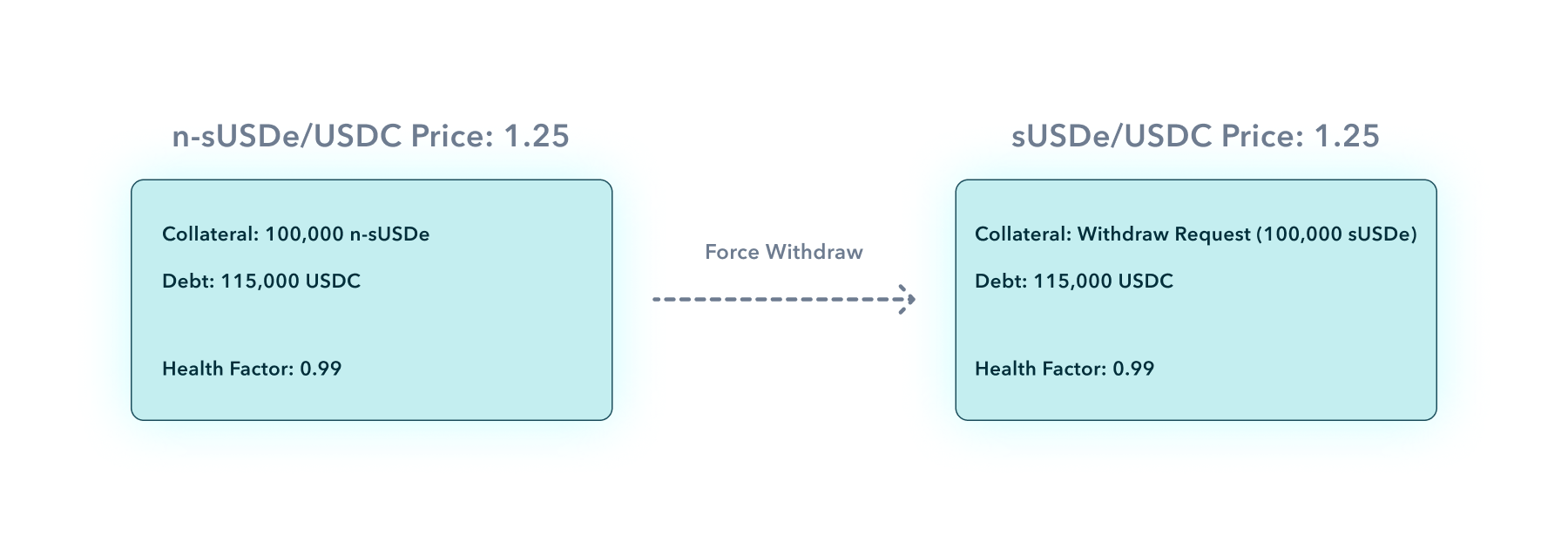

At this point, the account has a health factor below 1 and can either be liquidated or force withdrawn. Let’s assume that sUSDe is illiquid and a liquidator decides to force withdraw the account instead of liquidate it outright.

Forced withdrawal takes the borrower’s sUSDe out of the vault and initiates the withdrawal process on Ethena. The borrower’s collateral is no longer the 100,000 sUSDe itself, it is the withdrawal request for 100,000 sUSDe that Notional Exponent receives from Ethena.

The account can still be liquidated at this point - a liquidator could buy that withdrawal request at a discount and wait for it to finalize to earn a return.

But this would require the liquidator to take risk and commit capital. In a smart liquidation, the liquidator will wait until the withdrawal request finalizes and the borrower receives USDe before liquidating.

Upon receiving USDe the borrower’s account becomes flash loan liquidatable. This allows the smart liquidator to close the borrower’s position and lock in a risk-free profit within a single transaction.

Risks

There are two primary factors that can threaten asset recovery in smart liquidations.

- Redemption value haircuts. If the issuing protocol delivers fewer assets than expected when users withdraw, account values can be impacted.

- Borrow interest accrual. Once a borrower initiates smart withdrawal, their collateral (usually) stops earning yield while their debt continues to accrue interest. High interest rates and long withdrawal delays can lead to deteriorations in account value.

To illustrate these risks, let’s take a second look at the previous example and examine what might happen to the borrower’s position in an adverse scenario.

Smart liquidation negative scenario

Assume that a negative event significantly impacts Ethena’s operations - maybe an exchange blows up and Ethena loses a chunk of its capital.

This scenario may be unlikely, but if it did occur, this is what might happen:

- sUSDe value gets impaired by 5%. The expected redemption value of 100,000 sUSDe was 125,000 USDe. The actual redemption value is 118,750 USDe.

- Ethena increases the sUSDe redemption time from 7 days to 14 days in order to manage orderly withdrawals.

- Lenders pull funds from the n-sUSDe market and the USDC borrow rate rises to 15%.

In this scenario, the borrower’s withdraw request value gets haircut by 5% from 1.25 USDe per sUSDe to 1.1875 USDe per sUSDe.

This drops the account’s health factor to 0.94 and brings them close to insolvency.

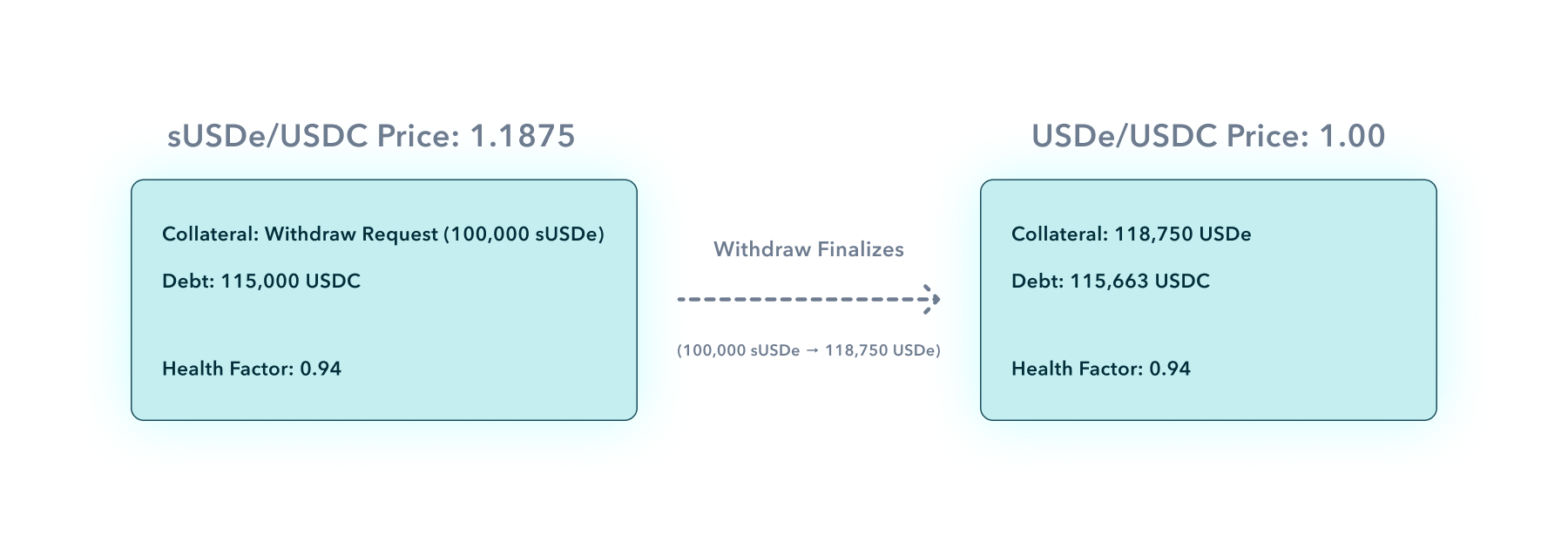

Borrow interest accrual makes the situation even worse. The borrower’s 115,000 USDC debt will accrue interest at 15% APY for two weeks while the sUSDe is stuck in the withdrawal queue.

When the withdrawal request finalizes, the borrower will have 118,750 USDe in collateral against 115,663 USDC debt:

Thankfully, this account’s position is still solvent and can now be instantly liquidated. Morpho’s 91.5% LTV markets use a liquidation incentive factor of 1.026, so the liquidator will purchase 118,670 USDe to fully repay the borrower’s debt.

Completing the smart liquidation leaves ~80 USDe in the borrower’s account and no bad debt. In this case, the lending market’s risk parameters were perfectly tuned to provide the maximum amount of leverage while creating zero bad debt in an adverse scenario.

Setting risk parameters

Setting risk parameters effectively requires estimating how badly an account’s value could deteriorate during the smart liquidation process.

Setting risk parameters is a four step process:

- Calculate the estimated loss in a negative scenario.

- Calculate the safety buffer.

- Check that the safety buffer is greater than the estimated loss.

- If the safety buffer is less than the estimated loss, try a lower LTV and go back to step 1.

Calculating estimated loss

The estimated loss primarily depends on the potential redemption value haircut, the redemption delay, and the borrow rate during withdrawal.

The estimated loss also depends on the LTV because the LTV determines how much debt a position will have when it becomes undercollateralized. The higher the LTV, the more debt there will be, and the more borrow interest accrual will occur.

Estimated Loss = redemption value haircut + LTV * (borrow rate * (redemption delay in days / 365))

In the previous example, sUSDe’s redemption value haircut was 5%, the borrow rate was 15%, the redemption delay was 14 days, and the LTV was 91.5%. This results in an estimated loss of 5.526%.

Estimated Loss = 5% + 0.915 * (15% * (14 / 365))

Estimated Loss = 5% + 0.526%

Estimated Loss = 5.526%

Calculating the safety buffer

The safety buffer measures how much an account’s collateral value can decline once they hit the LTV before liquidation would make them insolvent. As long as the safety buffer is greater than an account’s losses, there won’t be any bad debt.

The safety buffer calculation varies slightly from lending protocol to lending protocol but it is always a combination of the Max LTV and the Liquidation Discount / Incentive.

In Morpho’s collateral framework, the safety buffer can be calculated like this:

Safety Buffer = 1 - (LTV * LIF)

In the sUSDe example, the LTV was 91.5% and the LIF was 1.026. This creates a safety buffer of ~6.1% which is greater than the estimated loss of 5.526% This confirms our finding that the negative scenario we looked at would not create bad debt.

With careful estimations of loss and thoughtful parameter selection, risk managers can help ensure that smart liquidations proceed successfully even under adverse scenarios.

Applied effectively, smart liquidations will help open up vast new possibilities for DeFi and enable totally new categories of leveraged yield strategies for users. Make sure to follow Notional on Twitter to keep up to date on the launch of Notional Exponent this fall!

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.