Understanding Notional v2 Liquidations

In this post, we’ll cover how settlements and liquidations work in Notional v2, and how liquidators can profit from the various opportunities offered by the protocol. Settlements refer to a third party rolling an account’s unpaid debt forward upon maturity while liquidations refer to a third party buying an under-collateralized account’s collateral at a discount in order to recapitalize it.

Settling accounts with unpaid debts

Purpose & mechanics of settlements

To ensure that borrowers repay their debts when they are due, Notional allows third parties to settle accounts that have not done so. When a liquidator settles an account’s debt, he effectively lends to the settled account at the 3 month interest rate plus the settlement penalty rate. For example, if the rate on fUSDC 3 month was 10%, the liquidator would effectively be able to lend at a 12.5% rate. The liquidator could then immediately close out its position by borrowing in the fUSDC 3 month market and pocket the spread.

This mechanism ensures that debts are properly repaid and penalizes delinquent borrowers who have not repaid their borrow in a timely fashion. For example, if a user borrows USDC for 6 months and does not repay its balance upon maturity, a third party could roll his outstanding fUSDC debt forward every quarter until the borrower either repays its debt or gets liquidated.

Liquidators can settle accounts either with their own capital or use flash loans to do so with no capital required. As a side note, settling accounts can not be done through the UI, it can currently only be done by calling the Notional Proxy directly.

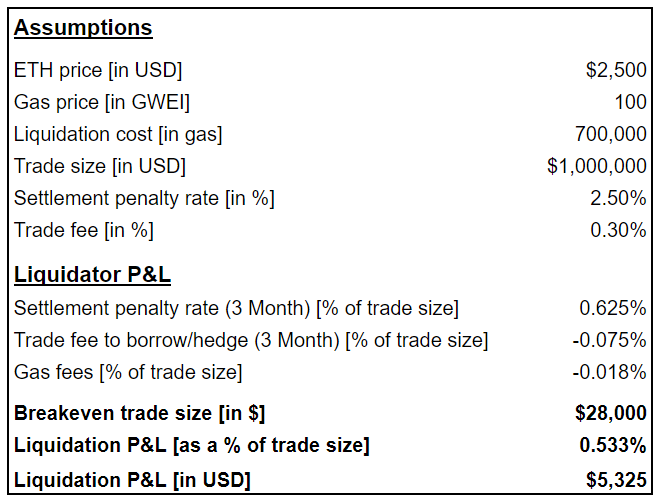

Example

Taking into account the current governance parameters, a liquidator would make roughly 250 BPS (settlement penalty rate) - 30 BPS (trading fee on the borrow trade) or 220 BPS on the annualized interest rate when settling an account. Since settled accounts are rolled forward in the 3 month markets a liquidator’s P&L would be roughly 55 BPS x trade size - gas fees - flash loan fees. Here’s an approximation of a liquidator’s P&L executing a $1M settlement:

Case study

During Notional v2's first quarterly roll last December, a liquidator made more than $20k in profit settling roughly $4.33M of debts.

Liquidating accounts with negative free collateral

To ensure the solvency of the system, borrowers using Notional V2 need to overcollateralize their borrowing positions against one or a combination of the following collateral asset types:

- Cash (ex: cTokens)

- Positive fCash

- nTokens

To evaluate an account's collateral position and validate that its debts are sufficiently overcollateralized, Notional uses the concept of Free collateral.

Free collateral represents the amount of collateral denominated in ETH, that an account holds beyond what it needs to meet its minimum collateral requirements. If an account’s free collateral figure is positive, the account is adequately collateralized. If the account's free collateral figure is negative, it is under-collateralized and eligible for liquidation. Learn more about free collateral here.

When an account is eligible for liquidation, every collateral asset type in that account can be liquidated to re-collateralize the account. Liquidations are critical to ensure that the protocol is properly capitalized.

Once liquidators find an undercollateralized account in the system they can call one of Notional’s four possible liquidation actions:

- liquidateLocalCurrency;

- liquidateCollateralCurrency;

- liquidatefCashLocal;

- liquidatefCashCrossCurrency.

The preferable liquidation action to call will depend on the undercollateralized account’s holdings and the most profitable liquidation route. It is possible for an account to be liquidated using different liquidation actions. For example, an account holding nETH, nUSDC, and a USDC debt can be liquidated using either the local currency liquidation or the collateral currency liquidation actions. In other words, the liquidator could purchase either the nUSDC or the nETH in exchange for cUSDC. For a more technical explanation of different liquidation types read our technical blog post on liquidations.

Liquidators can purchase collateral assets (Cash, fCash or nTokens) in a currency where the account has a collateral surplus in exchange for Cash (ex: cTokens) in a currency where the account has a collateral requirement. Liquidators can purchase up to 40% of an account's collateral value or what we call the “default liquidation portion”. This ensures that liquidations can return an account to a position where it is more than minimally collateralized. It also gives the liquidator more profitability to cover gas fees and other trading costs. If the account requires more collateral to be liquidated to reach minimal collateralization then the liquidation will go past 40%.

When liquidators call these liquidation actions they can either manually liquidate accounts by buying their collateral assets at a discount and then sell them at their full price in the open market or use flash loans to liquidate accounts without the need of using their own capital. Notional’s v2 flash liquidation contract is public and accessible here.

Example

Let’s take a look at the following example of a cross-currency liquidation:

Initial position

cETH collateral: $100

USDC debt: $50

ETH/USD price: $100

Free collateral: ($100/$100) x 0.7 - ($50/$100) x 1.3 = 0.05 ETH

Position after ETH drops in price

cETH collateral: $90

USDC debt: $50

ETH/USD price: $90

Free collateral: ($90/$90) x 0.7 - ($50/$90) x 1.3 = -0.0222 ETH

Liquidation

The liquidator buys 40% of collateral assets (0.4 x $90 = $36 of cETH) at an 8% discount to the chainlink oracle price. In our example the liquidator would buy $36 worth of cETH for ~$33 of cUSDC.

cETH collateral: $90 - $36 = $54

USDC debt: $50

cUSDC = $33

Net USDC debt = $17

Free collateral: ($54/$90) x 0.7 - ($17/$90) x 1.3 = 0.1744 ETH

Estimated liquidation profit

Expected liquidation profit: $90 x 40% x 8% = $2.88

Free collateral benefit for the liquidated account

The liquidated account’s free collateral position benefited from the liquidation:

Free collateral pre-liquidation: -0.0222 ETH

Free collateral post-liquidation: 0.1744 ETH

Case study

This liquidator made $22K in profit executing a flash local currency liquidation on Notional. Users can also look at the list of historical liquidations on Notional’s analytics dashboard.

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $500M in total value locked.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.