Weekly Interest Rate Roundup: July 5 - July 12

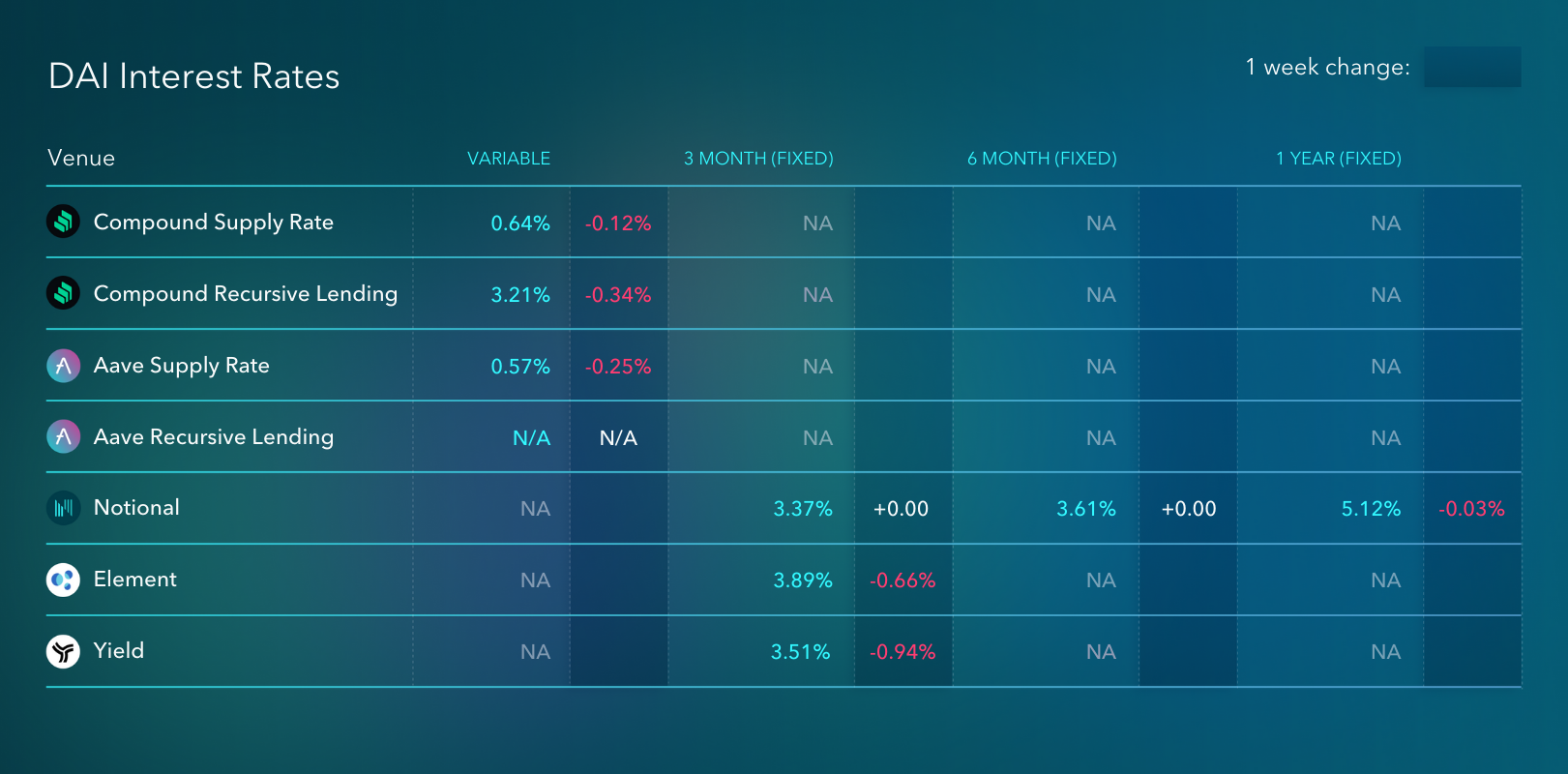

Times are tough out there for DeFi lenders. Over the past week or so, Celsius has repaid stablecoin debts totaling $300M - $500M in value across Maker, Compound, and Aave. This unwinding has caused stablecoin interest rates to drop even further - less than 0.5% for USDC and less than 0.65% for DAI.

The last few months has laid bare the extent to which DeFi TVL has been dominated by a few big companies, notably Celsius and Nexo. This "whale dominance" is even more pronounced when you look at DeFi borrowers. Just Celsius and Nexo together held somewhere in the area of 1B in stablecoin debts between them across the major lending protocols. That debt has now been almost entirely unwound and interest rates have absolutely cratered because of it.

And yet the total outstanding supply of USDC still does not contract. On the contrary, USDC outstanding continues to grow! The USDC supply is up 2.3% on the month and is only slightly down from all time highs. A migration of cash from DeFi to Tradfi in search of higher yields has yet to materialize. Converting between crypto to fiat in size is not easy, so we shouldn't expect it to go back and forth as quickly as liquidity moves between DeFi protocols for example.

So what have we got here? A lot of apparently sticky capital sitting around and waiting to be put to use and earn some return. The opportunity is there, DeFi protocols just need to figure out how to put that capital to productive use.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.