Weekly Interest Rate Roundup: May 3 - May 10

Good God, what a week. Crypto prices took an absolute beating over the last couple days. Even stablecoins got rekt. For the most part, the net result of this for interest rates is that they moved lower, although that isn't completely true. USDC rates hit new lows of less than 2%.

Good God, what a week. Crypto prices took an absolute beating over the last couple days. Even stablecoins got rekt. For the most part, the net result of this for interest rates is that they moved lower, although that isn't completely true. USDC rates hit new lows of less than 2%. At this rate, yields on Compound will be lower than the Fed Funds rate in a matter of months!

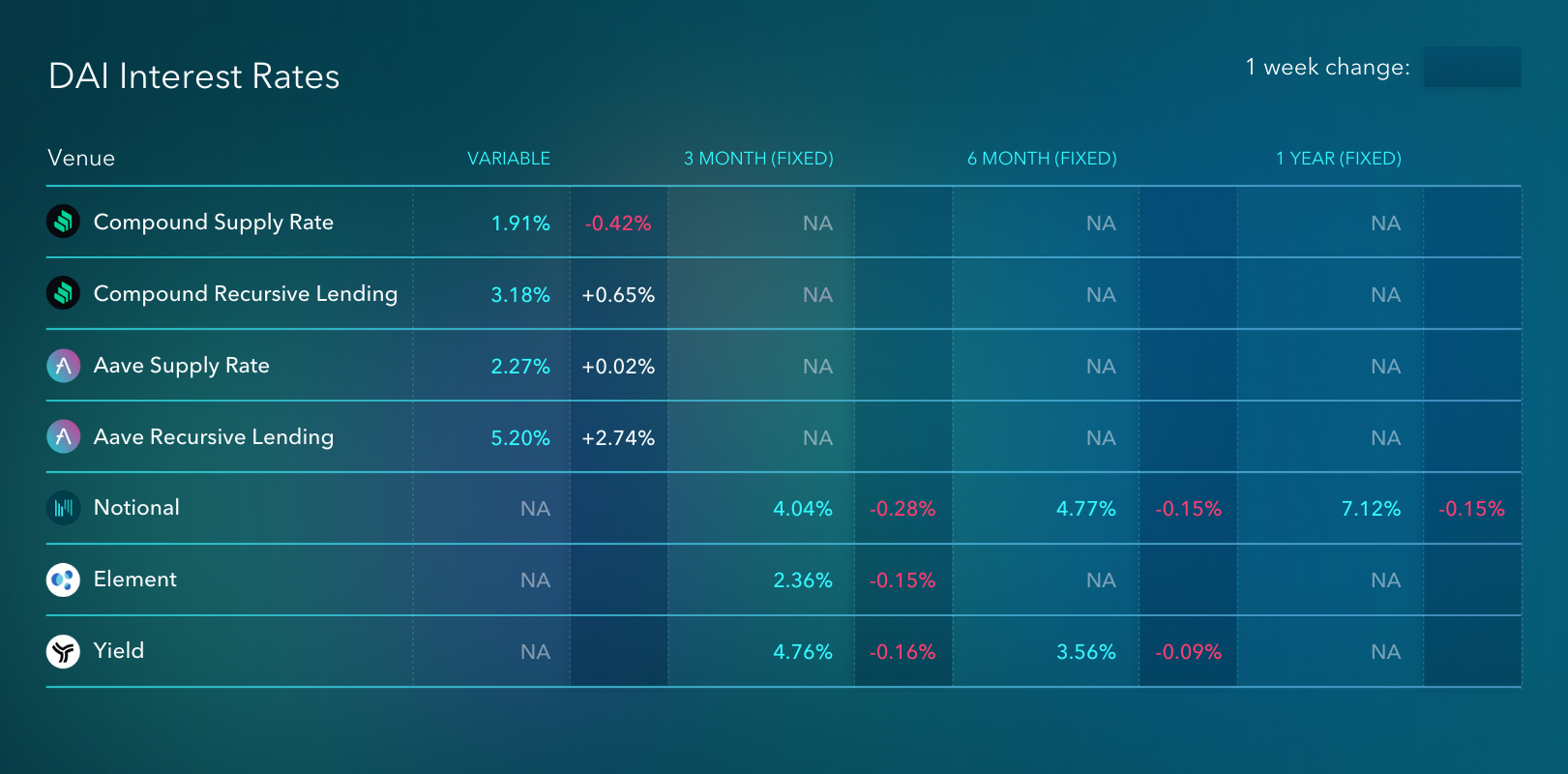

Interestingly though, DAI rates were generally higher - including a sharp rise in Aave's DAI recursive lending rate. This might seem surprising given that the price of $AAVE fell ~25% over the last week. But I think what we're seeing is the effect of a massive contraction in the total supply of DAI as falling ETH prices force people to close out their DAI vaults. Over the last week, the total DAI supply has fallen from ~8.7 Billion DAI to ~7.4 Billion DAI - a contraction of 17.5%! It looks like the events of the past week caused a substantial unwind of DAI recursive lending positions on Aave.

This anomaly aside, yields are down all over DeFi and we should probably expect them to stay that way for a while. Token incentive prices have been taken to the woodshed. Without incentives, all that remains is organic user activity... which has also fallen off a cliff (excepting days with massive price crashes of course). The casino doesn't do so hot when all the players cash in their chips.

I think the DeFi rate environment is set to go from bad to worse over the next few months. There's too much capital chasing too little organic yield. Particularly if the Fed follows through on its stated goal of getting the funds rate up to ~2.5% by year's end, why take DeFi risk for no better return than you can get from the US government? I think we'll probably end up seeing a substantial contraction in outstanding stablecoin supplies this year. Crypto twitter won't like that. My guess is that contracting USDC supply FUD will mark the bottom for DeFi tokens. Either that or a DOJ indictment for somebody following this UST fiasco.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.