Weekly Interest Rate Roundup: Dec 27 - Jan 3

Happy new year! For those hoping that the industry could turn a page and leave the wreckage that was 2022 behind, it looks like it isn't going to happen. The Gemini Earn v Genesis/DCG saga has spilled over to the new year and is turning increasingly ugly. So the reality is that we'll probably be dealing with last year's contagion for months to come.

But let's ignore that here and focus on an early 2023 theme for DeFi rates - the Ethereum Shanghai upgrade. I haven't been super focused on the updates from the Ethereum core devs, but my understanding is that this upgrade is currently scheduled for March and that it will enable withdrawals of staked ETH. I don't have much specific insight as to whether this will actually happen, but if we assume it does happen, what impact will it have on ETH interest rates?

Let's start with the obvious - LSD/ETH price convergence. Once LSDs are actually redeemable for ETH, their ETH exchange rates should converge to 1 due to newly possible arbitrage opportunities. If 1 stETH trades at 0.98 ETH, I can buy a bunch of stETH on the market at 0.98 ETH, redeem them for 1 ETH and then pocket the 0.02 ETH profit on each stETH I bought.

Conversely, if 1 stETH trades at 1.02 ETH, I can mint 1 stETH with 1 ETH and then sell my stETH for 1.02 ETH and pocket the 0.02 ETH profit. This should push exchange rates to very tight bands around par. Yes there are wrinkles due to things like the withdrawal queue (you can't instantly redeem stETH for ETH), but in general you would still expect to see this convergence.

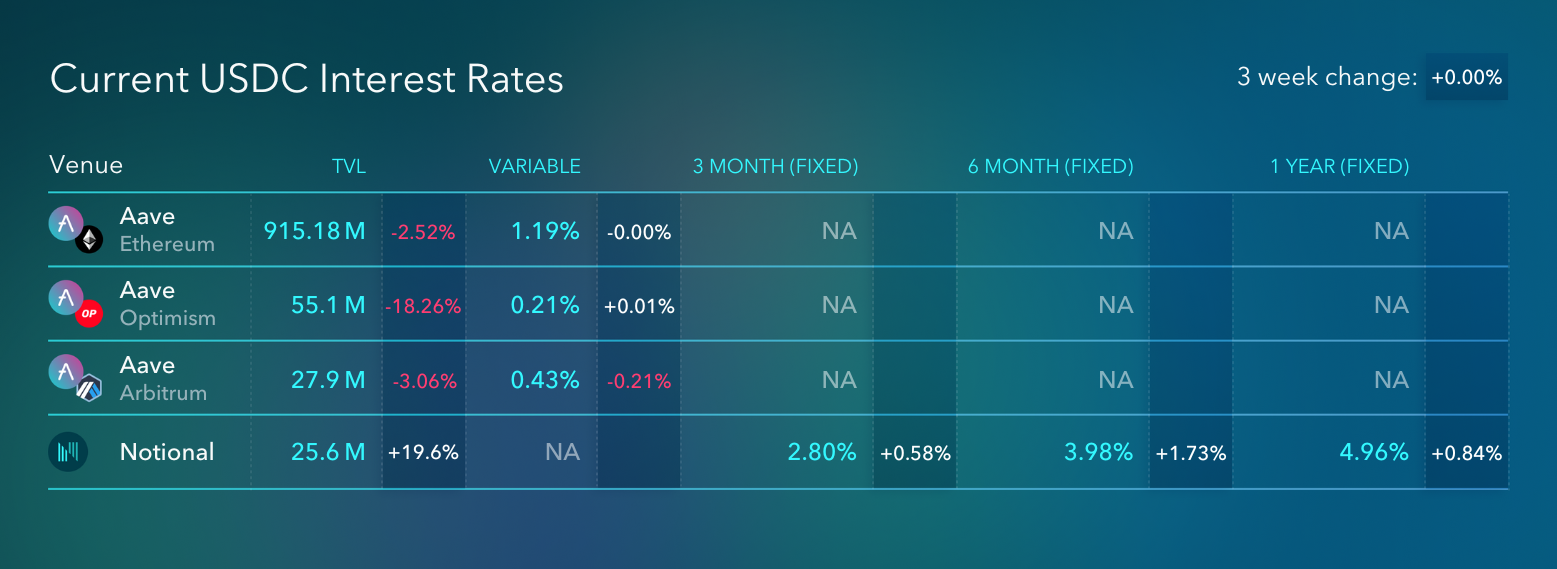

What's less clear is what happens to ETH interest rates. On the one hand, you'd expect them to increase because the risk barrier to staking decreases and so the overall unstaked ETH supply decreases. But I think that in practice, a lot of the re-rating of ETH yields already happened post-merge. Yes there are a few places where the ETH yield is below the staking rate like on Compound and Aave, but pretty much everywhere else ETH yields are at least in line with staking returns.

Here's my contrarian take - enabling withdraws will push ETH yields DOWN, not up. When withdraws are enabled I think we will see a significant increase in ETH staked from today's relatively small level (only ~14% of ETH is currently staked). This increase in stake size will decrease network rewards and will decrease the staking yield by 1%-2%. This will then lower the total staking yield from today's 4.2% down to maybe 3%, and it will actually push DOWN rates of return for ETH in DeFi, not up. Sorry guys.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.