Weekly Interest Rate Roundup: Apr 12 - Apr 19

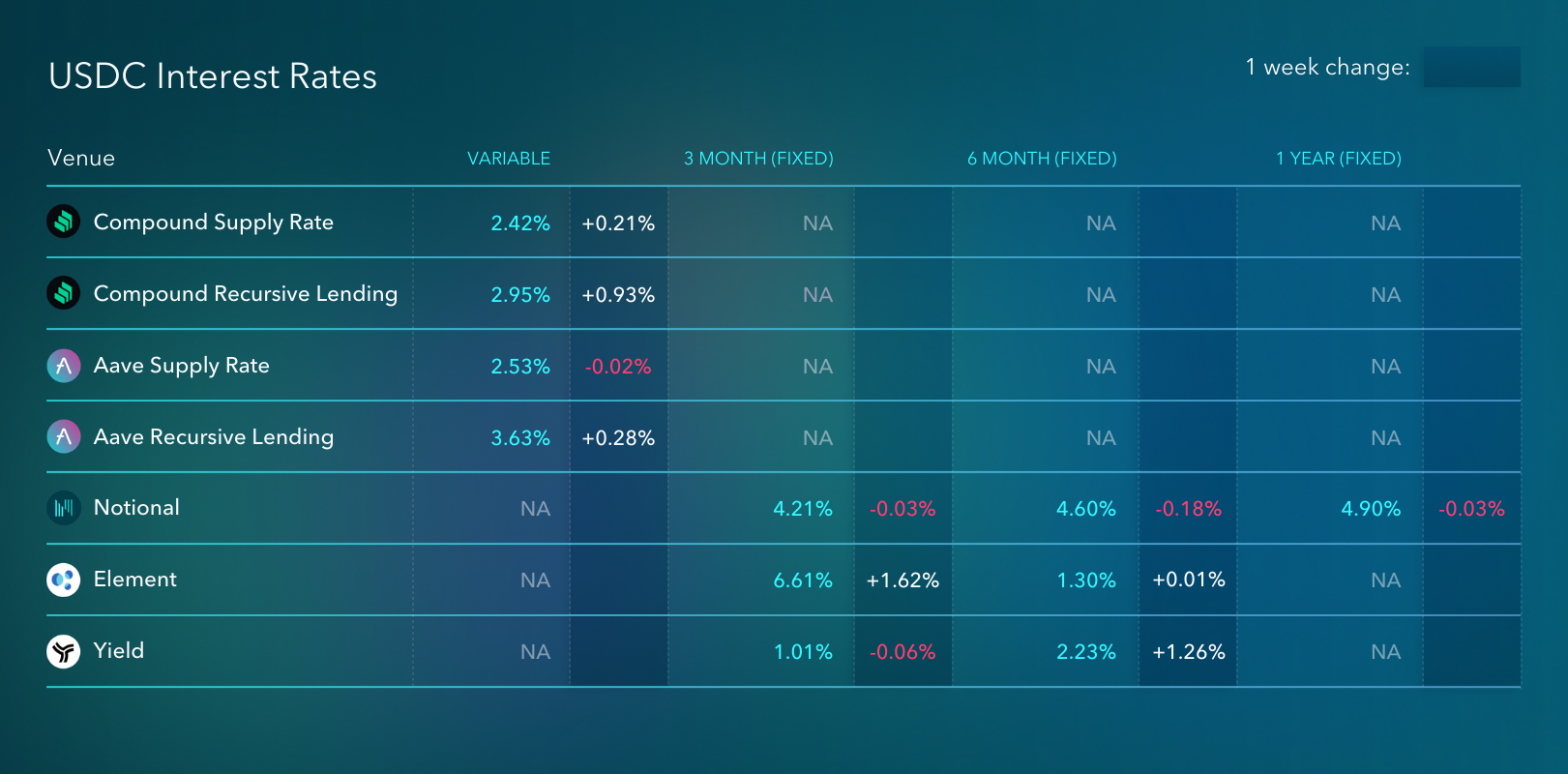

Rates around DeFi are mostly unchanged this week. The rates on Compound and Aave remain stuck in the 2% - 3% range. Recursive lending rates ticked up slightly due to slightly higher token prices. But they're still low and don't show much sign of increasing.

The big story is Compound proposal 100 - the proposal to slash COMP incentives down to 0, effective immediately. Voting on the proposal is currently live until roughly 8 PM Eastern Time on April 20th. Right now the ays have it - if a large holder doesn't come in to vote no in the ~30 hours, COMP liquidity mining will be officially a thing of the past.

As I've spoken of previously on this newsletter, passing this proposal would have enormous implications for the DeFi rates landscape. According to analysis done by the Maker DAO risk team, the unwind of recursive lending positions due to this incentive cut would decrease the borrowing demand on Compound by >50%. This would in turn decrease the supply rates on USDC to 1.55% on USDC and just 0.72% on DAI. I've seen better rates from my bank.

Could this move mark the end of an era? Members of the Compound community assert that Aave will quickly follow suit in slashing their incentive scheme. I haven't been able to independently verify that information, but it is possible. If they do, we'll be looking at some dark days ahead, anon. With Compound and Aave out of the incentive game, the only major money-giver left will be Curve. At least their incentives are hard-coded into the protocol.

If rates in DeFi really are down-only, Notional is looking pretty good. DAI lending rates at 7.4%? What a steal! Better lock that in now before you start having to count your returns in decimals of a percentage point. But who knows? Maybe the next leg of the bull market is just around the corner and the demand for leverage on crypto is about to skyrocket! Otherwise, we've got work to do. DeFi protocols will need to figure out a way to create value that doesn't involve token incentives.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.