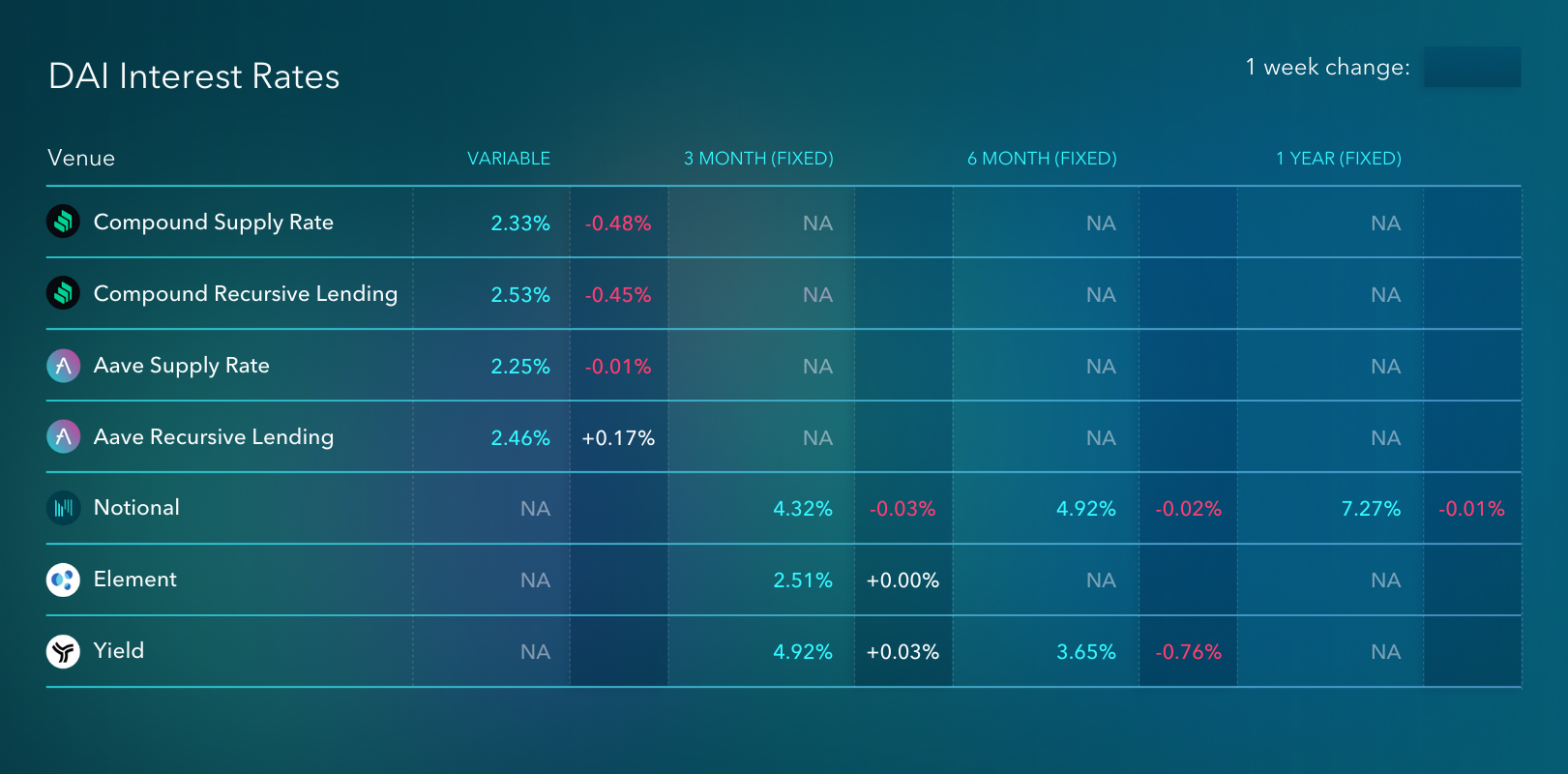

Weekly Interest Rate Roundup: Apr 26 - May 3

Not much movement in rates this week. DeFi rates are low and they look to be staying that way. True bear market vibes. If you can believe it, I think rates on Compound and Aave are more likely to go DOWN from here than up as the lending protocols withdraw their incentivization over the coming months.

The Compound community narrowly voted down a proposal to stop COMP incentives entirely, so for the moment their incentivize program continues unchanged. But by all indications, this is temporary. Their community seems to be set on removing incentives over time and this will only mean that rates will continue to go lower in the absence of renewed demand for leverage.

Lending protocols all across DeFi are running into the same problem - there just isn't a huge amount of demand to borrow against plain vanilla crypto-assets like ETH and wBTC. Maker is trying to solve this problem by onboarding real-world assets, but it isn't clear to me what Aave and Compound are trying to do to stimulate borrowing demand. Ultimately, if these protocols remove incentives and don't do anything new to serve borrowers, rates will continue to go down until the bull market comes back and users have more appetite to borrow and go levered long.

In the fixed rate space we've seen some convergence between the rates on Notional and Yield due to Yield's onboarding of Notional's fCash as a collateral asset. This happened quite quickly - in the space of just a few weeks, users made use of this new feature to lend on Notional, borrow on Yield against their fCash and re-lend on Notional. This moved Yield's rates from near 0 to almost parity with Notional's.

This strategy makes sense - Notional is able to cater to a unique category of borrowers who want fixed rates and need substantial liquidity to execute large-size loans. Taking fCash as collateral means that Yield is able to benefit to some extent by proxy. Compound and Aave should take note. Maybe they should add fCash as collateral too :)

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.