Weekly Interest Rate Roundup: Apr 5 - Apr 12

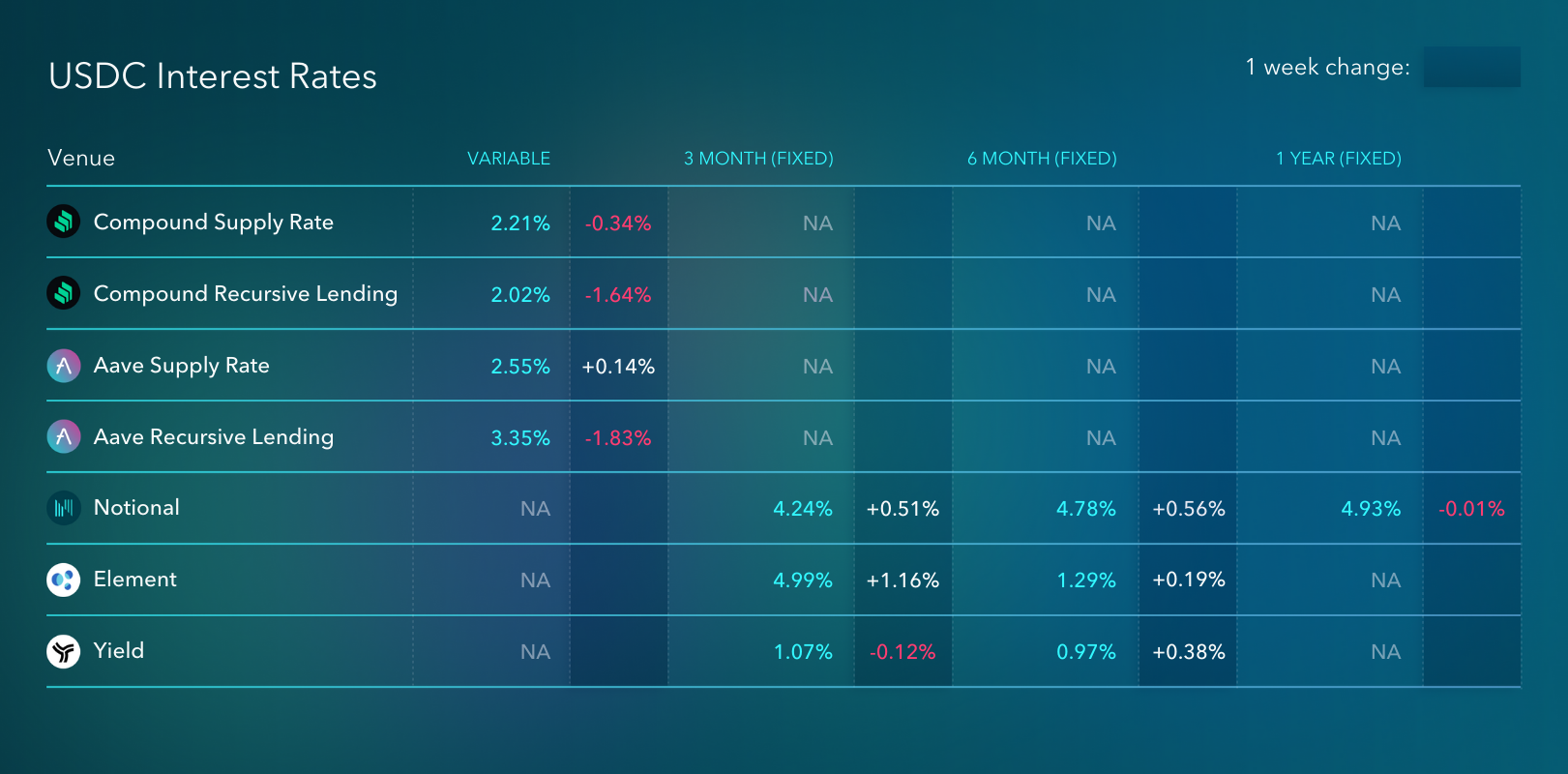

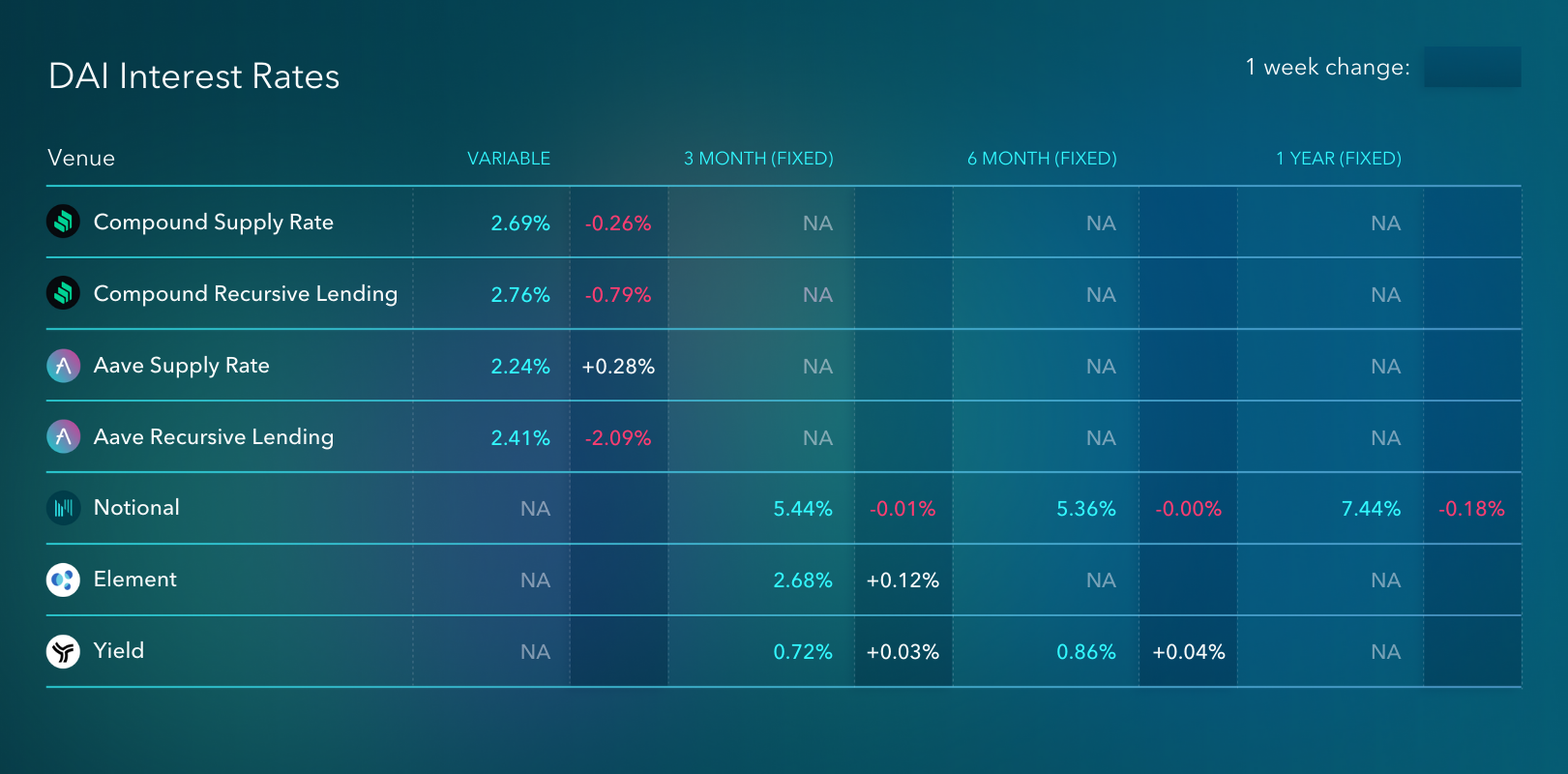

Markets are back in bear mode, and once again, DeFi stablecoin returns are looking rough. Recursive lending rates on Compound and Aave are down below 3% for the most part.

Aave returns have had an especially large downward adjustment. A week ago, the token was trading high on Aave V3 launch euphoria - it has since lost about a third of its value and absolutely crushed the recursive lending returns. It looks like Aave probably lost a bit of the mercenary farming capital that was doing this trade due to the fact that the supply rate moved marginally higher over the same period of time that the recursive lending rate dropped.

To me, Balancer looks like the best source of risk-adjusted yield on Ethereum right now. They are incentivizing heavily and paying very high returns on Curve-like pools of blue-chip stablecoins. For example, you can LP into Balancer's USDT/DAI/USDC pool and earn 11%+ on your investment. This is great value - Balancer is an old and battle-tested protocol so the smart contract risk is quite low. They're only offering these yields now because they just recently launched a new incentivization structure and the market hasn't yet caught up. Get your yields now before they're gone!

In fixed rate news, Notional's rates seem to have found the right level. For the first time in many weeks, we're seeing Notional's USDC rates go up instead of down as borrowers outweigh lenders. Notional's rates are still attractive relative to Compound or Aave, but they also should be a bit higher given the opportunity cost of capital in DeFi. Maybe a ~2% spread over the variable rate is about right for now. I think it will come down over time, but it's not a crazy spread.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.