Weekly Interest Rate Roundup: Nov 22 - Nov 29

I have two things to talk about this week - the CeFi lending apocalypse and surging ETH rates on Notional. We'll start with CeFi.

The death of the CeFi lender

A few weeks ago around the time of the FTX revelations I said in this newsletter that there was a significant probability that we had reached the end of the line for CeFi lending. Looks like that was about right. Genesis trading, the central nexus of the CeFi lending market has halted withdrawals and may soon enter bankruptcy proceedings.

This is a big deal. Genesis was counterparty to pretty much every lender and borrower in CeFi. We don't know the details yet, but this is going to have broad ramifications. I don't think the CeFi lending market will die completely. There will always be people/funds that know each other and are willing to lend to each other.

But I do think that businesses which take retail deposits and lend them out in CeFi with zero transparency are 100% done. The ones that are still operating are most likely insolvent. If users pull their funds I would expect to see more withdrawal freezes.

Notional ETH rates to the moon

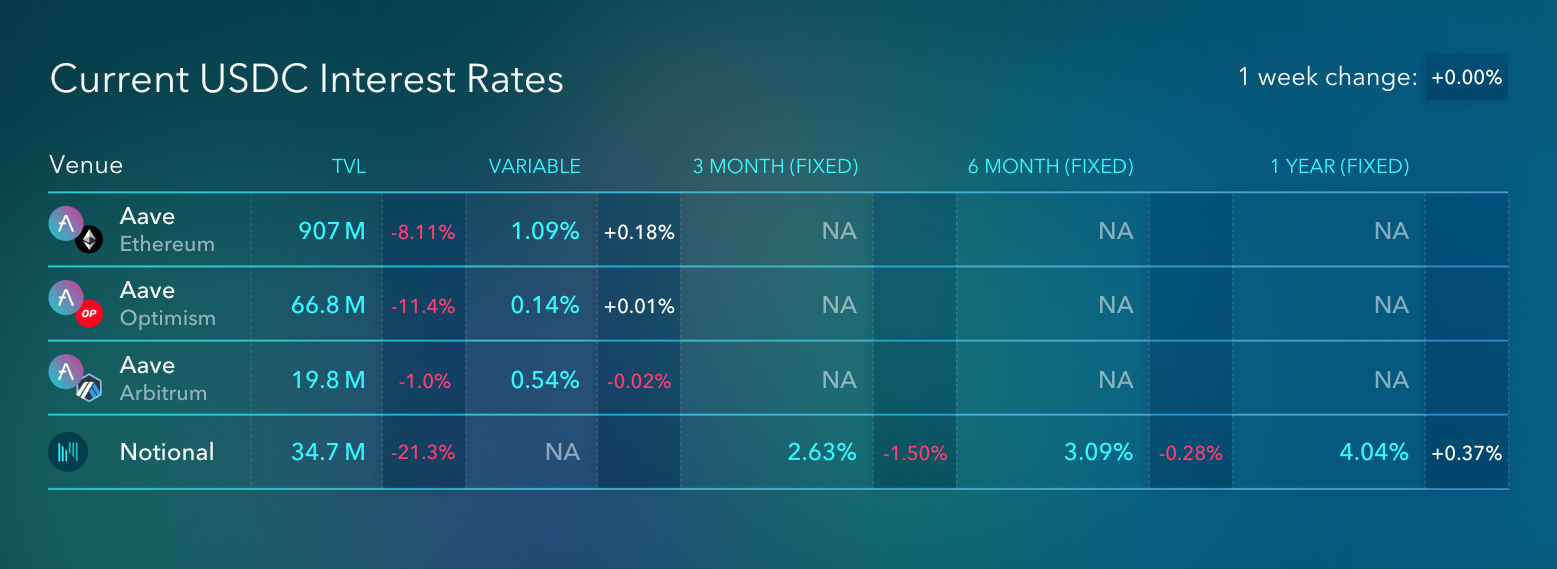

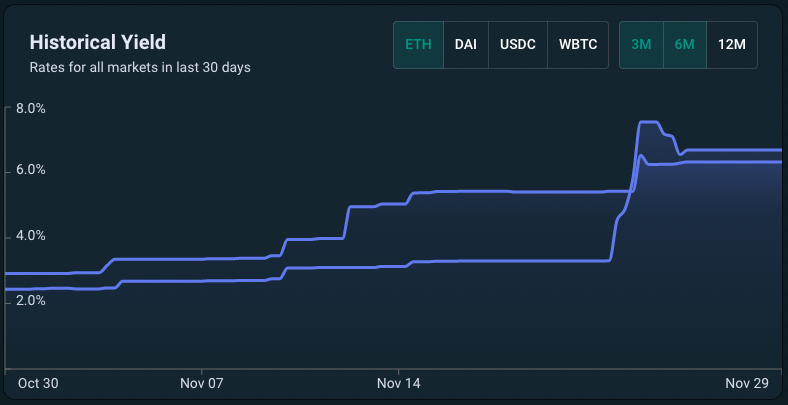

Meanwhile, in DeFi, there's been a little action on Notional. Dec 22 and Mar 23 ETH rates are up substantially - from ~2.5% to ~6.5% in the last few weeks:

This coincides with the launch of a new product called leveraged vaults. With this product, users can borrow from Notional and put the capital directly into whitelisted vaults that execute DeFi yield strategies. This has led to a lot of borrowing on Notional and a big increase in rates.

Users have been borrowing to fund the Balancer/Aura wstETH/ETH vault. This vault takes ETH, LPs it into the wstETH/ETH pool on Balancer, stakes the LP tokens on Aura, and then periodically harvests and reinvests the incentives. So far, users have done pretty well - they've been earning high ongoing yields + they've made money on the inherent levered long price exposure to stETH/ETH.

I think, on balance, this continues to be a good trade because you can sit there and earn above market yield while you wait for stETH/ETH to return to peg and make money on that price move. Granted, stETH/ETH has already retraced a fair bit from its latest wobble, but at 0.99 there's still enough room to make a decent return there + you get paid 18% APY while you wait.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.