Weekly Interest Rate Roundup: Nov 8 - Nov 15

It's been a rough week in crypto. Every time you thought the SBF/Alameda scandal was over, he found another way to shock and infuriate. But I already spent last week's newsletter talking about that, so this week let's focus on DeFi rates instead.

The most immediate impact of the chaos of the last week was a massive spike in ETH staking rates. Markets were panicked and gas was through the roof - both ingredients for a surge in MEV and staking rewards. The 7-day moving average yield on Lido's stETH is currently 8.4%. That's a full 3% higher than last week! And the moving average also obscures the extremity of this move. At times Lido's stETH yield was as high as 10%+.

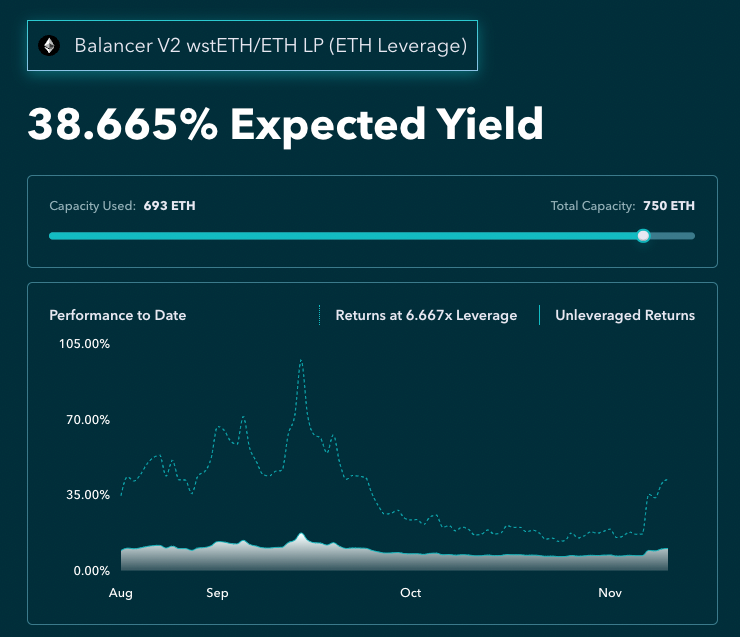

ETH staking rates this high should have a massive effect on DeFi. First of all, they dramatically increase the returns to leveraged staking strategies like Notional's leveraged vaults (coming out of private beta next week) or Instadapp Lite's vaults:

These monster yields aren't likely to last though - ETH gas fees are back down to 13 gwei so stETH yields will probably revert to the mean. But even so, you would think that such a large change in the risk-free rate for DeFi's base asset would cause large-scale rebalancing.

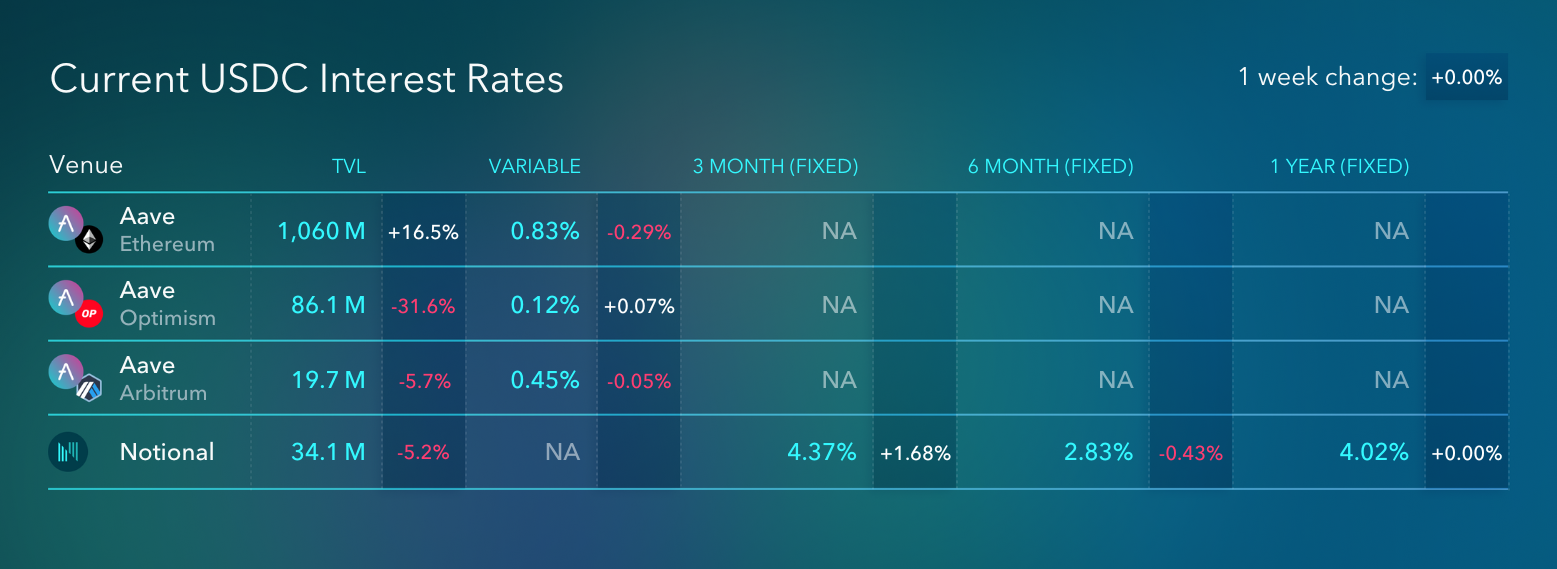

But in fact, it doesn't look like that's really happened in a large way. Lido's stETH supply increased by less than 1% week-over-week, and only a few percent of the ETH supply in Aave ventured out for higher yields.

The number that sticks out at me is Aave's growth in USDC deposits over the week. I think this could be a trend we see going forward - a flight to safety as users withdraw stablecoins out of centralized exchanges and put their capital into blue-chip DeFi protocols. It's hard for me to understand why else Aave would see such a sharp uptick in deposits when their supply rate is less than 1%.

A lot of people are making the point that the FTX controversy proves the value prop for DeFi yet again. I agree with this. The question is whether this is a big enough blow to user confidence in CEXes to make them cross the chasm from CeFi to DeFi. So far, it seems like DeFi really is making progress at gaining market share. We'll just have to see if that continues.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.