How to Add 4% to Your Compound Recursive Lending Return

Recursive lending is a very popular strategy in DeFi. It involves lending and borrowing on Compound / AAVE in order to harvest the maximum reward possible. This strategy was very profitable at the beginning of 2021. However, returns have dropped considerably as more money flew into the strategy and the value of the Compound token fell from $800 in May '21 to $125 at the end of January '22.

In this blog post, we show that given current market conditions, there are simpler, and more rewarding alternatives for DeFi users that are uncorrelated to token prices. One of these alternatives is fixed rate lending on Notional Finance. The latter is even more compelling in the DAI pool, as Compound returns have been historically lower versus USDC. Lending on Notional Finance increases on average your lending returns by 4 to 5% based on current prices.

Recursive lending in a nutshell

Recursive lending is a strategy on Compound (or Aave) that takes advantage of the fact that the net borrowing rate (after rewards) is lower than the net lending rate. COMP incentives make the borrowing rate lower than the lending rate. For example, as of Feb 2nd, the supply rate is 2.25% and the borrow rate 3.77% p.a for the USDC pool. On top of these yields, lenders will receive 0.93% p.a in COMP tokens and borrowers 1.38% p.a. Including those incentives, one can borrow USDC at 2.39% and supply it at 3.18% p.a on Compound.

In that configuration, one should deposit stable coins and borrow as much as possible in the same token. Borrowing on Compound needs to be over collateralized so you cannot leverage indefinitely. The platform has a collateral factor (cf) of 80% meaning that if you deposit $100 of collateral, you can only borrow $80 worth of tokens. With a $100 initial lending deposit, one will borrow $80 against it in the same currency. Those $80 will then be re-deposited on Compound and used to borrow $64 (80% of $80) and so on ….

As the collateral ratio is 80%, we can therefore lend $5 with $1 of capital and borrow $4. This enables us to get ~10x more COMP reward if we had loaned only $1.

The total return of the strategy equals therefore Lending Rate + 4*(Lending- Borrow Rate) with the lending Rate and borrow rate being net of COMP rewards.

People do not borrow 4x times their initial stake as after a certain amount the gas fees become too high versus the interest they expect. Also, they might want to have some margin of safety on their collateral to avoid liquidations. Instadapp and Yearn are using a 4 to 4.6x leverage (i.e. borrow 3x to 3.6x their initial stake instead of 4x).

Historical returns for DAI and USDC

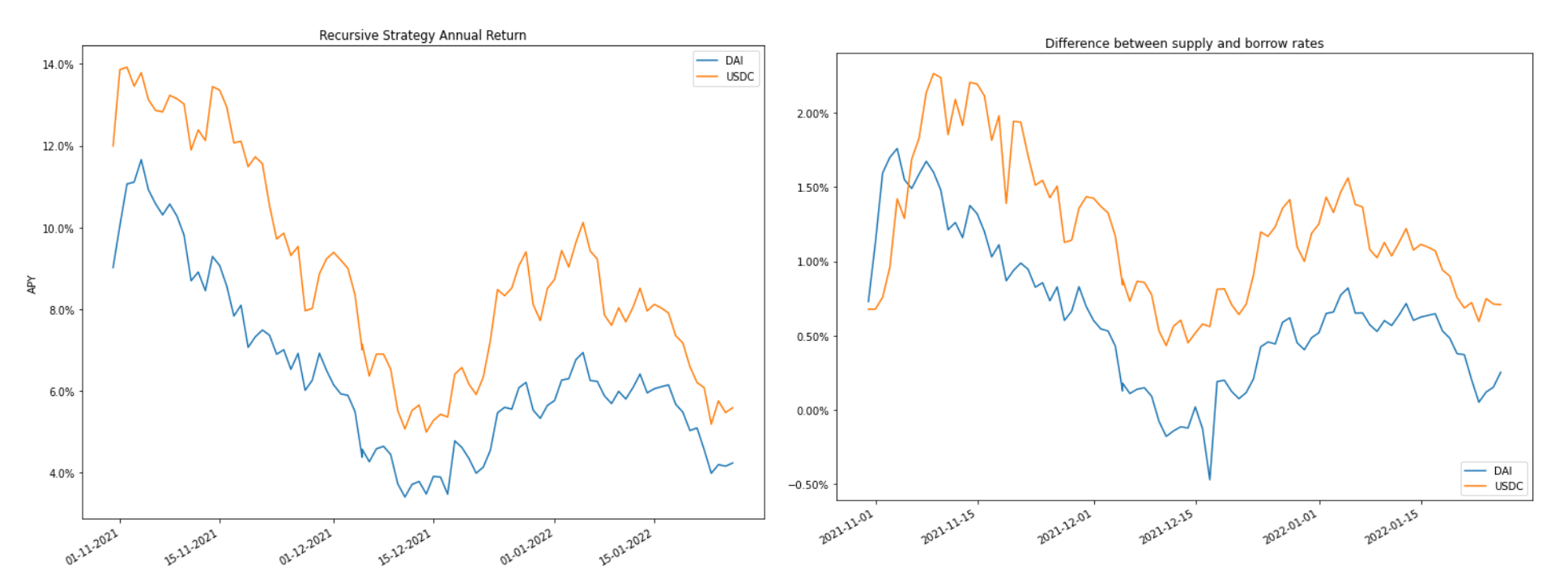

We look at the historical daily APY of the recursive lending strategy since November 1st 2021, which is the launch date of Notional V2. We have assumed a 4.6x leverage in our calculations. The strategy APY has been quite volatile in the last three months and returns have been consistently higher for the USDC pool versus DAI. Since Nov 1st, the annualized return was 6.34% for DAI and 8.88% for USDC.

So far, net supply rates have been above borrow rates for both lending pools, apart from a brief period in December for DAI. The returns have also been declining since November and the current APY for DAI and USDC (as of Feb 1st) are respectively 5.58% and 4.22%. Those rates are much lower than the current rates one can lock until the end of March on Notional. Notional offers lenders a net return of 9.34% for USDC and 9.25% for DAI. These are 5% superior to the expected returns of a recursive strategy on DAI and ~3.8% higher for USDC.

Main drivers of the recursive strategy

As we have seen previously the returns of a recursive strategy are quite volatile through time. They will depend on 1) the value of COMP token, 2) the utilization rate of the pool, 3)how much AUM in the pool is sharing those rewards 4) ethereum prices.

COMP token price

A recursive lending strategy is subsidized by the COMP rewards a user will receive for borrowing and lending. With supply rates before rewards being close to 2%, COMP rewards represent between 50% and ⅔ of the total returns. Most of the volatility of the strategy comes from the COMP token volatility.

As you can see below, the strategy APYs are extremely correlated to the COMP token price.

As a result, market neutral users will try to lock in returns by hedging in advance the amount of COMP token they expect to receive using futures on platforms like Binance or Perpetual Protocols. With hindsight, it would have been the best strategy to adopt early November 2021 when the COMP token was close to $400. However, hedging at current rates will guarantee you suboptimal returns between 4 and 5% annualized. Using Notional fixed rates looks like a much more attractive alternative.

If the rewards are left unhedged, your returns can be wiped out by a sharp decline in COMP prices, like the one we have experienced in the last three months.

We have plotted below the return achieved by the strategies for various COMP price scenarios.

To achieve Notional’s 9.3% annualized return, the recursive strategy needs COMP token to be worth $170 for USDC and $185 for DAI vs a current price as of time of writing of $125. But COMP prices cut both ways, if they were to fall to $50, returns would fall to 0.

If you want to keep some exposure to COMP, one interesting strategy for lenders would be to lend on Notional and buy some COMP tokens upfront for the amount of interest you will receive. This way you will be guaranteed to outperform a recursive strategy whatever the future COMP price.

In the example below, we have lent our USDC for a 9.3% net yield, we then buy 9.3% of COMP Tokens. If the COMP token price doubles you will have made a profit of 18.6% over one year but your profit goes to 0 if COMP drops to 0. This strategy always outperforms a recursive strategy even if COMP goes to $500!!

Utilization Rates

Interest rates on Compound are variable and they are a function of the utilization rate of the pool. If you want to go into the nitty gritty of the interest rate model, I highly recommend Ian Macalinao’s article.

The short version is that rates increase slowly with utilization until we reach a pool optimal utilization rate (80% for USDC and DAI). They accelerate when we go past 80% to urge borrowers to supply money on the platform and lenders to reduce borrowing.

The interest rate before COMP rewards takes the following shape: (source Compound website)

If we factor the COMP rewards into our equation, as utilization rates drop (i.e less people borrowing with a constant amount of lending), COMP rewards for borrowers are fixed (440.19 COMP token every day) shared by a smaller amount of borrowers hence they increase as a % of funds. This makes the recursive lending strategy even more profitable and offsets the reduction in lending rate.

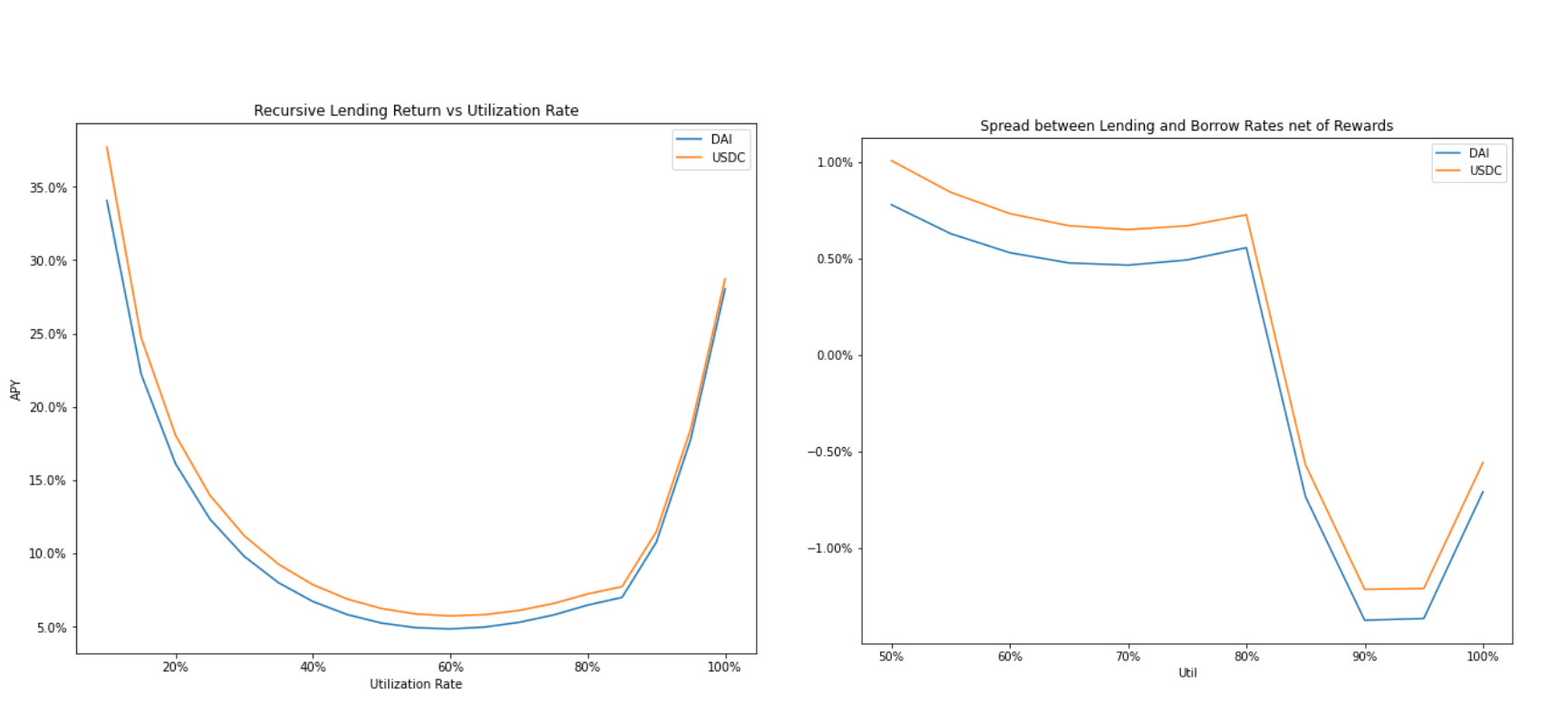

Given the current price of the COMP token, and all things staying equal, we can compute the return of the recursive lending strategy for DAI and USDC as a function of utilization rate.

The recursive strategy is very profitable when there is little borrowing on the platform (situation similar to Spring 2021) and returns are minimal around 60% utilization rate to go up slowly until 85% utilization. Above 80% utilization rate, the spread between lending and borrowing turns negative and the recursive strategy will underperform a standard unlevered lending strategy.

As we can see on these charts, for the recursive strategy to reach the level of yield offered by Notional (c10%), you either need the utilization rate to drop consistently below 30% or go consistently above 85%, both seem very unlikely in the short term.

AUM on the platform

As we mentioned before, the amount of COMP reward distributed is fixed (880.38 COMP tokens for each pool split evenly between borrowers and lenders). The TVL in the pool is unlikely to stay constant. As DeFi continues to attract capital, TVL in Compound is bound to rise and dilute the rewards investors will receive. A 10% increase in TVL has the same impact as a 10% drop in COMP price on the rewards distributed. This gives another strong case for fixing your lending interest rates.

Ethereum Prices

Ethereum prices have an indirect impact on interest rates. People usually borrow stable coins and use ETH as a collateral (when they are not doing recursive lending).

An increase in ETH prices leads to more borrowing on the platform and inversely. ETH prices have a counterbalancing effect on strategy returns: when they decrease, TVL drops, leading to higher rewards for users.

According to the below graph, the total DAI amount borrowed has been strongly correlated to Ethereum prices.

How likely are Notional returns to beat the returns of a recursive strategy?

We are ending this article by computing the probability that Notional’s fixed interest rate outperforms a recursive lending strategy over the next 2 months (expiry of the short term contract). We run price simulations on COMP token price, the pool utilization rate and the TVL of the pool. We have analyzed historic data on Compound to come up with our modeling assumptions.

COMP prices are modeled using a Student's t-distribution (5 degrees of freedom and an annualized volatility of 130% p.a.). We assume changes in the pool utilization rate follow a normal distribution with a standard deviation of 1.5% per day. We make the TVL on the lending pool dependent on the return produced by the strategy. This makes the simulation realistic by including a stabilization mechanism: high returns generate inflows on Compound and low returns outflows. As returns drop to 4%, we assume that users reduce their leverage and the expected return goes back up so there is intrinsically a floor to returns. Also historically, utilization rates have rarely gone above 90% as there are mechanisms in place in the protocol to rein back borrowing when we reach this level.

Based on current market conditions, a Notional Fixed rate is expected to outperform between 80% and 85% of the time. The actual number depends on the modeling assumptions used for COMP volatility and users’ behaviors.

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $450M in total value locked.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.