Weekly Interest Rate Roundup: Aug 2 - Aug 9

Drama has returned to DeFi. Yesterday, the US Treasury sanctioned Tornado Cash and Circle (the issuer behind USDC) added the sanctioned assets to its blacklist and froze their assets. The Treasury's actions set an alarming and dangerous precedent, and I fully expect them to be challenged in court. But for now, their sanctions stand and they have been successful in compelling centralized asset issuers like Circle to comply. This has enormous potential implications for DeFi and crypto more broadly, but I'm going to stay focused on rates markets - what does this all mean for stablecoin interest rates in DeFi?

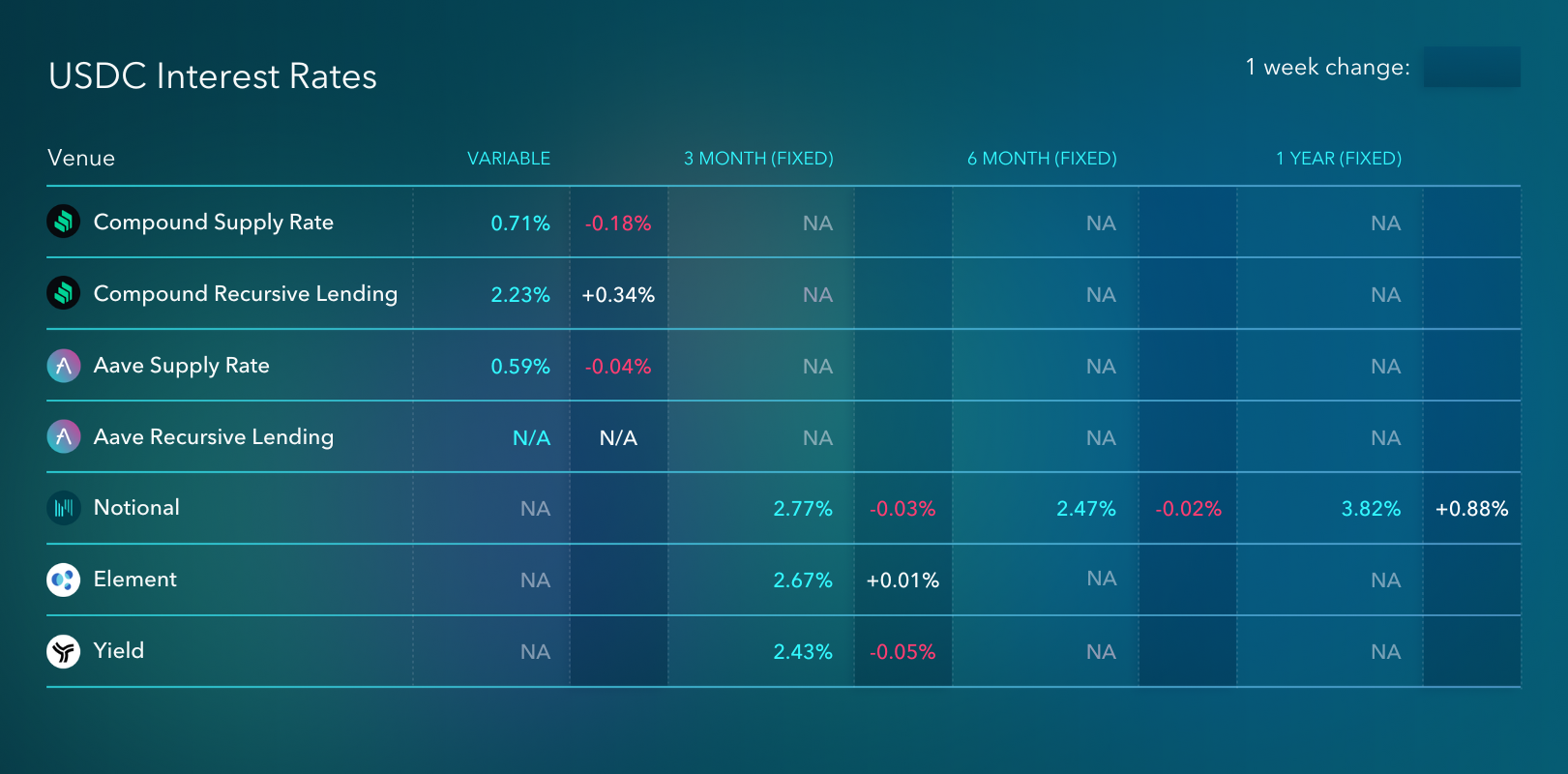

So far, not a whole lot. And to be honest, I don't expect this to have much of an effect in the near to medium term either. While this event does appear to be precipitating a re-evaluation of the centralization risk of different stablecoins, large scale shifts in demand for one stablecoin vs another seem unlikely to me. Any USD stablecoin that is actually decentralized and censorship-resistant tends to be impractical, unscalable, and unable to meet increased demand while maintaining its peg (see LUSD trading at ~$1.05 in the wake of the sanction news).

Somewhat counter-intuitively, I think that perhaps the most likely outcome is that this event actually benefits USDC to the detriment of DAI and FRAX. Because though DAI and FRAX have not blacklisted the sanctioned addresses like Circle has, they both have crucial dependencies on USDC. Maker has even decided to put cash BACK INTO the traditional banking system through its RWA initiatives. All this to say that if the US government wants Maker or Frax to play ball, it can compel them to do so. If that's where we're headed, and it looks like it might be, what's the advantage of either of these stablecoins over the one true USDC?

If people really want to get out from under the yoke of the US government, they'll have to ditch the US dollar altogether. Some have touted RAI as a possible winner here as the "crypto-native stablecoin". I doubt it, honestly. I think the only real candidate for a crypto-native currency that can operate as a store of value and means of payment beyond the reach of the US government is ETH. It has utility, a native interest rate in POS, and it already denominates trade in the crypto-native economy in the form of NFTs. But hey, who knows, maybe I'm just an ETH maxi.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.