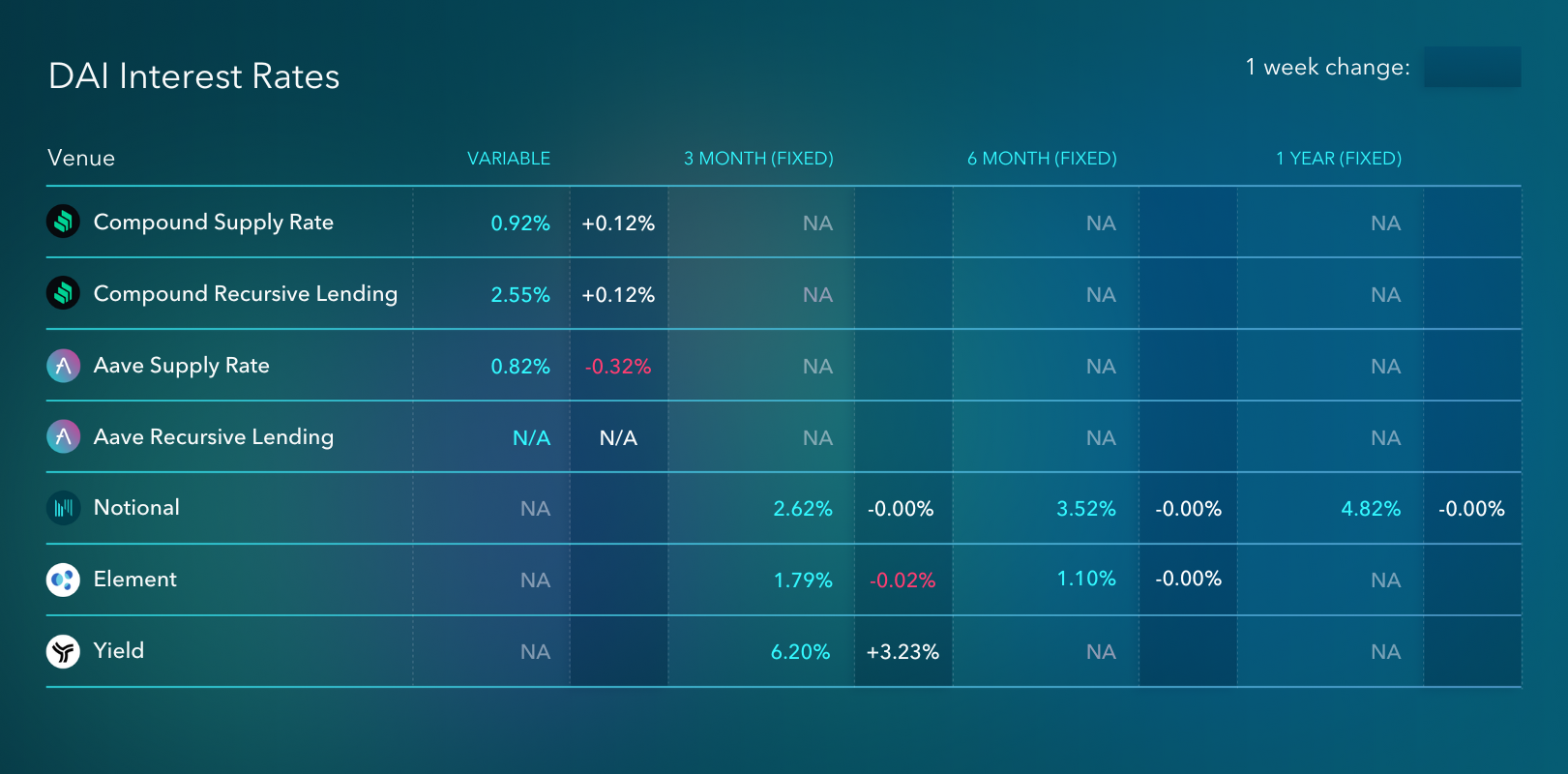

Weekly Interest Rate Roundup: Aug 30 - Sep 6

The Bellatrix fork is behind us and we’re now less than 10 days away from the merge. It’s all anyone is talking about in crypto circles these days - in particular, how to make money off it.

The consensus opinion is that the merge is a free money event, and you want to maximize the amount of ETH you’re holding when it happens. The obvious play is to borrow it. It makes sense - if you borrow the ETH for a very short period of time you pay a small amount in interest but you get the entire ETH POW airdrop.

But this creates systemic risks for DeFi. Crypto lenders, Notional included, anticipate full utilization of their ETH markets over the merge. The trouble is, this was never supposed to happen. If ETH lending markets are fully utilized, then they aren’t redeemable for ETH, and they can’t reliably be liquidated even though borrowers are still able to use loaned ETH as collateral.

Normally, high utilization results in high interest rates, which drives lenders to deposit capital and make nETH, cETH, and aETH redeemable again. But this mechanism may break down over the merge because the potential return to holding ETH in your wallet over that period of time is so high due to the ETH POW airdrop. The fear is that lending protocols will seize up for a certain period of time and be unable to liquidate potentially undercollateralized borrowers.

Personally, I think this fear is overblown. For all the people out there who think there’s value in an ETH POW airdrop, there are just as many people who think that it’s a scam and that airdrop hunters are going to wind up being able to sell the ETH POW for a lot less than they hoped for.

The people in the first camp will be willing to pay exorbitantly high ETH borrow rates, which would be a problem if there was no one in the second camp willing to forego the ETH POW airdrop and capture the lending interest instead. But there are people in the second camp. I am one such person for example.

Compound is voting through a temporary change to their ETH interest rate model that would jack up the max interest rate to 1,000%! I think that’s a good way of handling this and they should find a clearing rate somewhere below that max.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.