Weekly Interest Rate Roundup: Aug 9 - Aug 16

The focus of activity in DeFi rates markets, and in crypto in general, over the past few weeks is the upcoming Ethereum merge. ETH bulls are parading around infographics showing how much money ETH stakers are going to earn, and that ETH will transition to becoming a deflationary asset once the transition to POS occurs. Relatively speaking, it's a good time to be an ETH maxi. So what does this mean for DeFi rates markets?

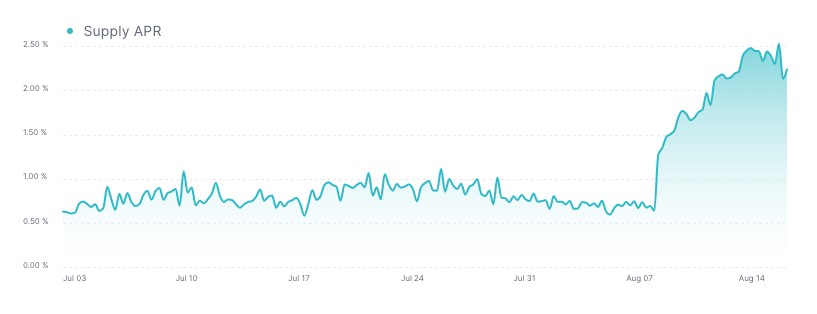

So far I haven't spent much time covering ETH rates in this newsletter because historically ETH rates have been basically zero. But that's changing, and in the past few weeks in particular ETH rates have been much more volatile than stablecoin rates. This is the ETH supply rate on Aave in the last ~6 weeks:

Since the successful completion of the Goerli testnet merge earlier this month, ETH rates have been way up. The mainnet merge date is set for next month, and people are getting in position to take advantage of the oldest money-maker in the crypto book: the contentious hard fork.

We've gotten some rumblings on twitter about various crypto people declaring their intention to keep a proof-of-work fork of Ethereum going after the merge to proof-of-stake. This is of course a shameless money-grab, but it's captured enough attention to raise the question of how valuable ETH on the proof-of-work fork (ETH POW) will be once the merge goes through. With some exchanges publicly committing to allowing users to trade the asset, it is possible that there will actually be ETH POW buyers to sell to.

This all means that there is extra value to holding ETH balances through the merge because your ETH balances will be copied over to the proof-of-work fork. You'll have all the ETH you have on proof of stake + your ETH POW on the proof-of-work fork.

Savvy market participants are borrowing ETH from DeFi lending protocols in order to inflate their balances through the merge and give themselves extra ETH POW that they can presumably then dump. From a purely economic perspective, this could make a lot of sense - if you can sell your ETH POW at even 5% of its ETH value, you don't mind paying interest to borrow ETH on the main chain because you'll only hold the position for a short period of time and receive all the ETH POW upside.

I expect pretty much every lending protocol to have all of its ETH borrowed in the days leading up to the merge. I'll write more on it in the coming weeks, but this whole thing could introduce some pretty interesting and unforeseen risk scenarios for DeFi.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.