Weekly Interest Rate Roundup: Feb 23 - Mar 1

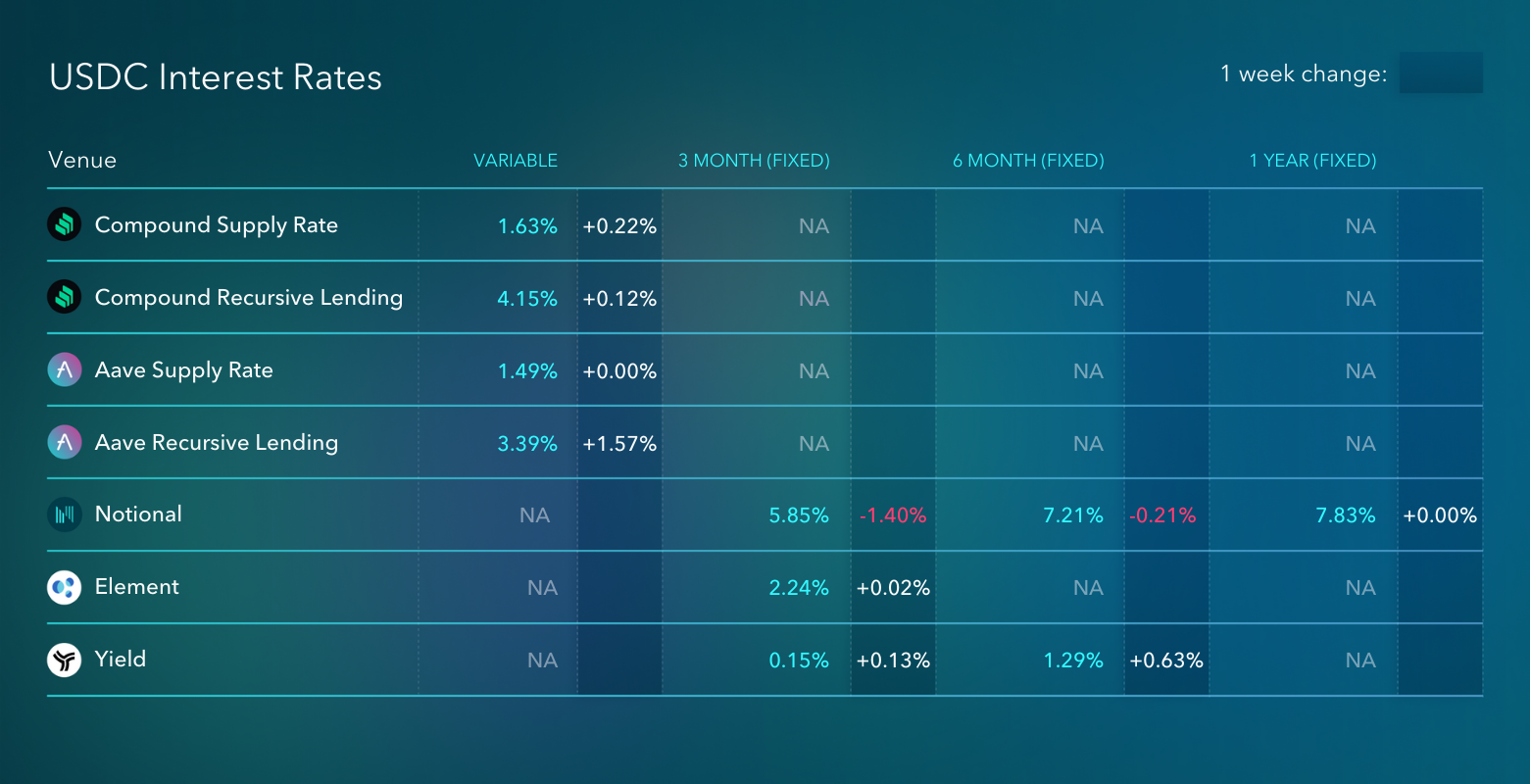

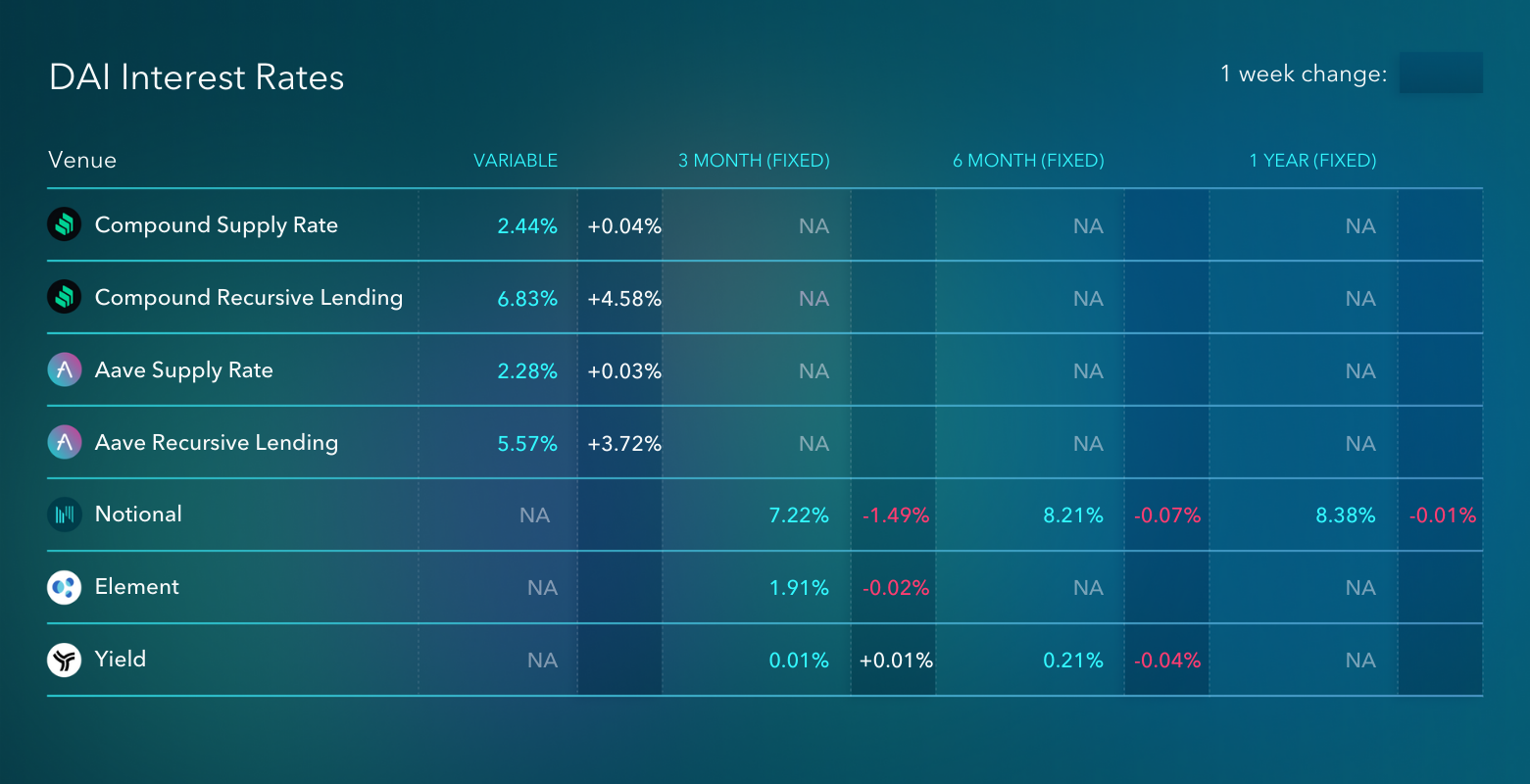

The Compound and Aave supply rates were mostly unchanged this week, but the recursive lending rates saw big gains.

The Compound and Aave supply rates were mostly unchanged this week, but the recursive lending rates saw big gains. This move is likely due to a recovery in the COMP and AAVE token prices as well as a reduction in the amount of recursive lending rate positions over the past week.

Interestingly, the USDC recursive lending rate on Compound barely changed over the week in contrast to the DAI recursive lending rate and the rates on Aave. It's not totally clear why this happened. Given that the baseline supply rates have only marginally changed, it's likely that the discrepancy is due to a relative unwind in DAI recursive lending vs USDC recursive lending positions on Compound. This would suggest that the USDC recursive lending positions on Compound are stickier than Compound's DAI recursive lending positions for some reason.

Notional had a big week that pushed interest rates substantially closer to the baseline Compound and Aave supply rates. The influx of capital into Notional continued as an integration with Yearn this past week generated ~$20M in lending alone.

Fixed rate lenders continue to prefer the three-month maturity on Notional which has led to yield curves that are now strongly upwards sloping. I think what we can infer from the shape of the curve is that lenders in DeFi place a high value on the optionality of their capital.

Elsewhere in the fixed rate space, activity on Element and Yield continues to be light, although Yield's rates bounced off of zero today and moved up to 1.29% on the 6 month maturity.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.