Weekly Interest Rate Roundup: Mar 1 - Mar 8

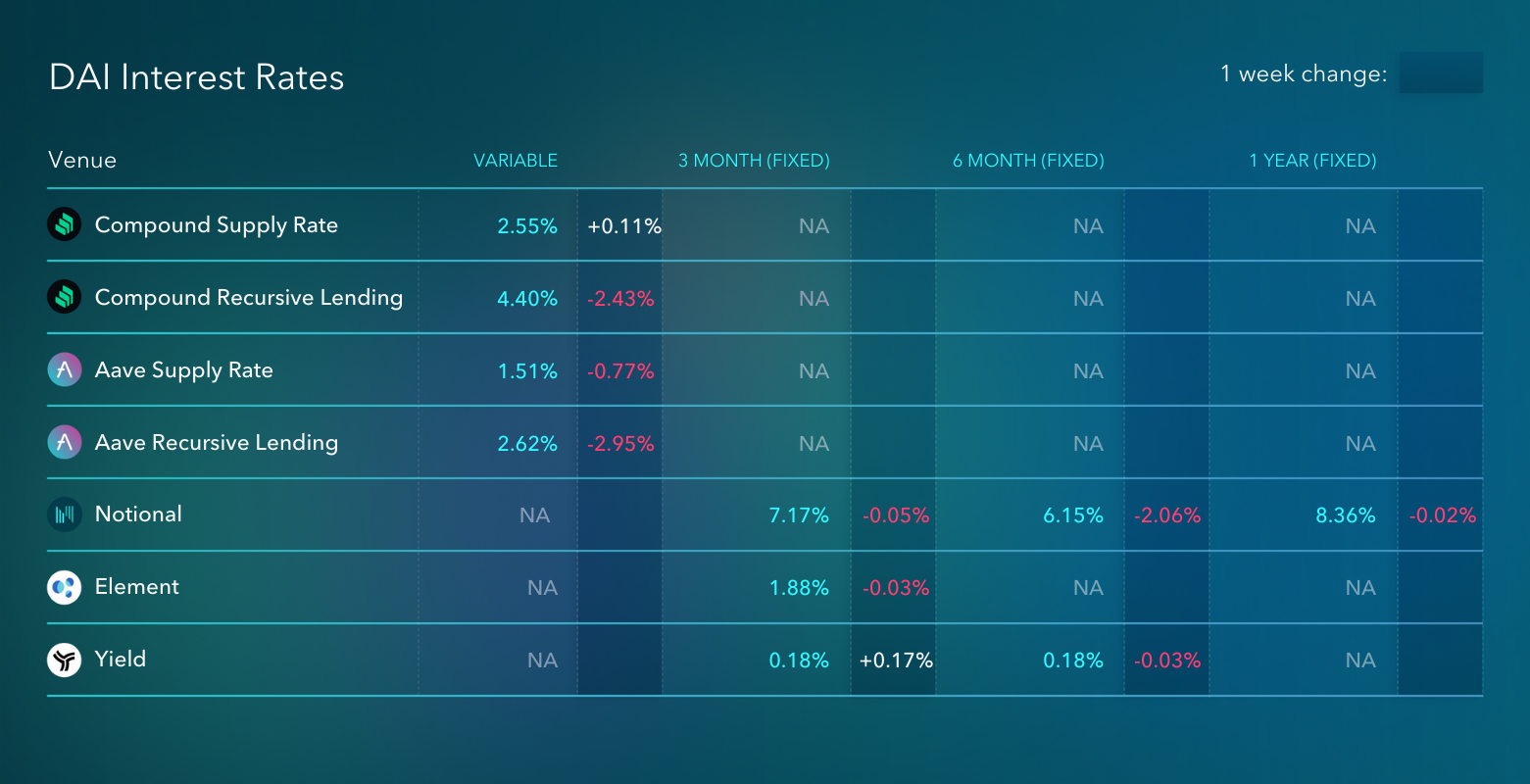

Rates are back down again. The recent adverse market conditions have resulted in declining token prices and minimal demand for leverage. As a result, rates have fallen to their current levels and, in my opinion, they are unlikely to rise until the market turns around.

Rates are back down again. The recent adverse market conditions have resulted in declining token prices and minimal demand for leverage. As a result, rates have fallen to their current levels and, in my opinion, they are unlikely to rise until the market turns around.

Crypto is a highly cyclical market, and so is the DeFi interest rate market. The reality is that there is very little lending/borrowing activity in DeFi that isn't directly related to trading/yield strategies. As prices go down and trading activity falls, yield opportunities dissipate and the demand for borrowing falls as well. So DeFi interest rates are hit from both angles in a bear market - lower token incentive prices + lower demand for leveraged yield opportunities leads to very low interest rates.

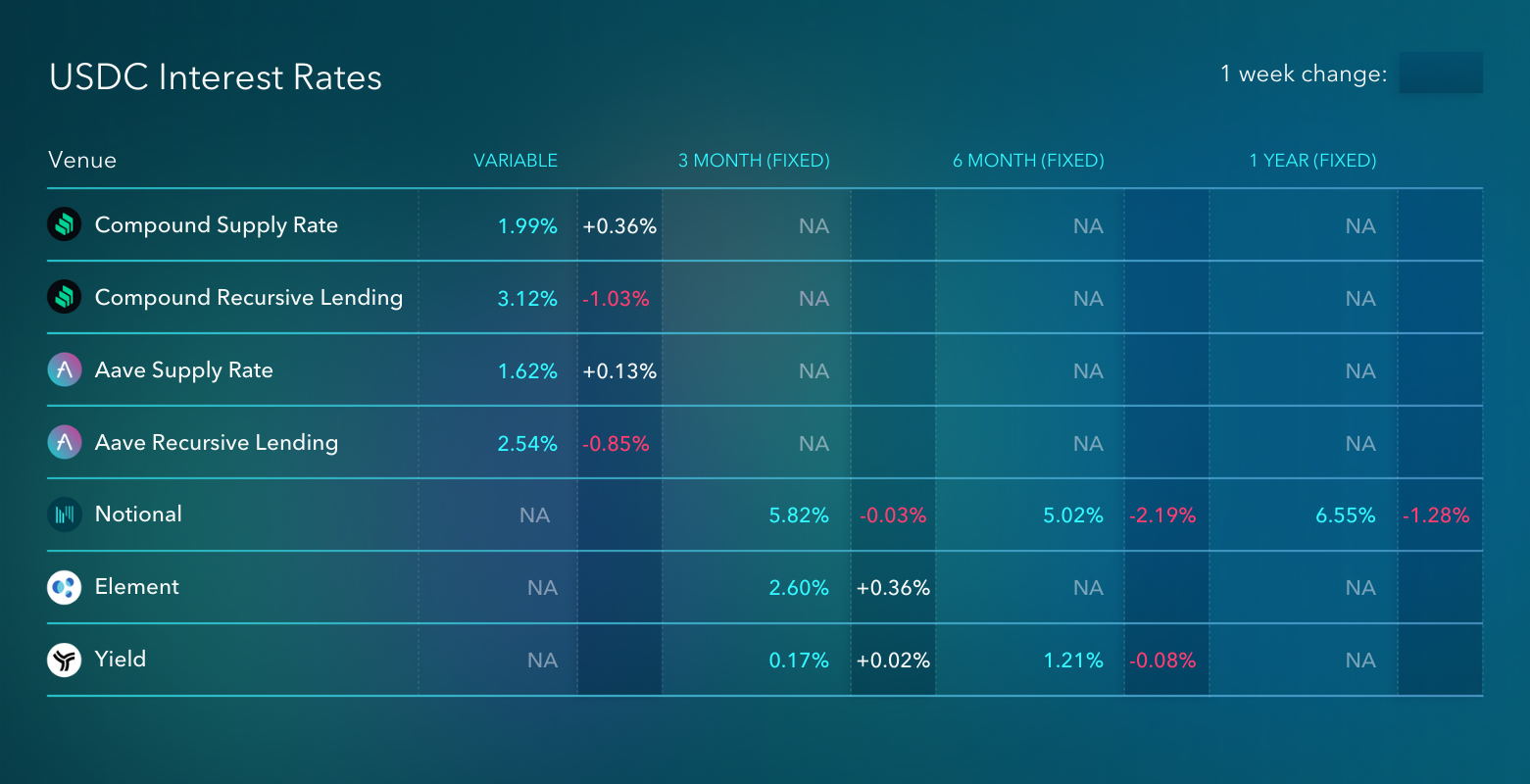

Rock bottom interest rates on DeFi blue chips has pushed DeFi users to take more risk and put capital into newer/riskier protocols. Notional continues to be a the beneficiary of these capital flows. This week, Notional attracted another $36M in net lending volume which caused the spread between Notional's rates and Compound/Aave lending rates to compress further. Just 30 days ago, the spread between the 3M USDC rate on Notional and the Compound USDC lending rate was ~6.5%. Today it's just 3.8%. I expect this spread to tighten even more in the coming weeks.

Notional hasn't been the only place where DeFi users have driven down yields. DeFi users have pushed capital into alternative L1s, ETH L2s, and alternative stablecoins as well. For example, the mimCRV staking pool on Convex now yields less than 9%. This is down from close to 20% earlier this year.

Finally, Element and Yield remain quiet. USDC yields on Element ticked up slightly but activity has generally been pretty muted on these platforms.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.