Weekly Interest Rate Roundup: Mar 29 - Apr 5

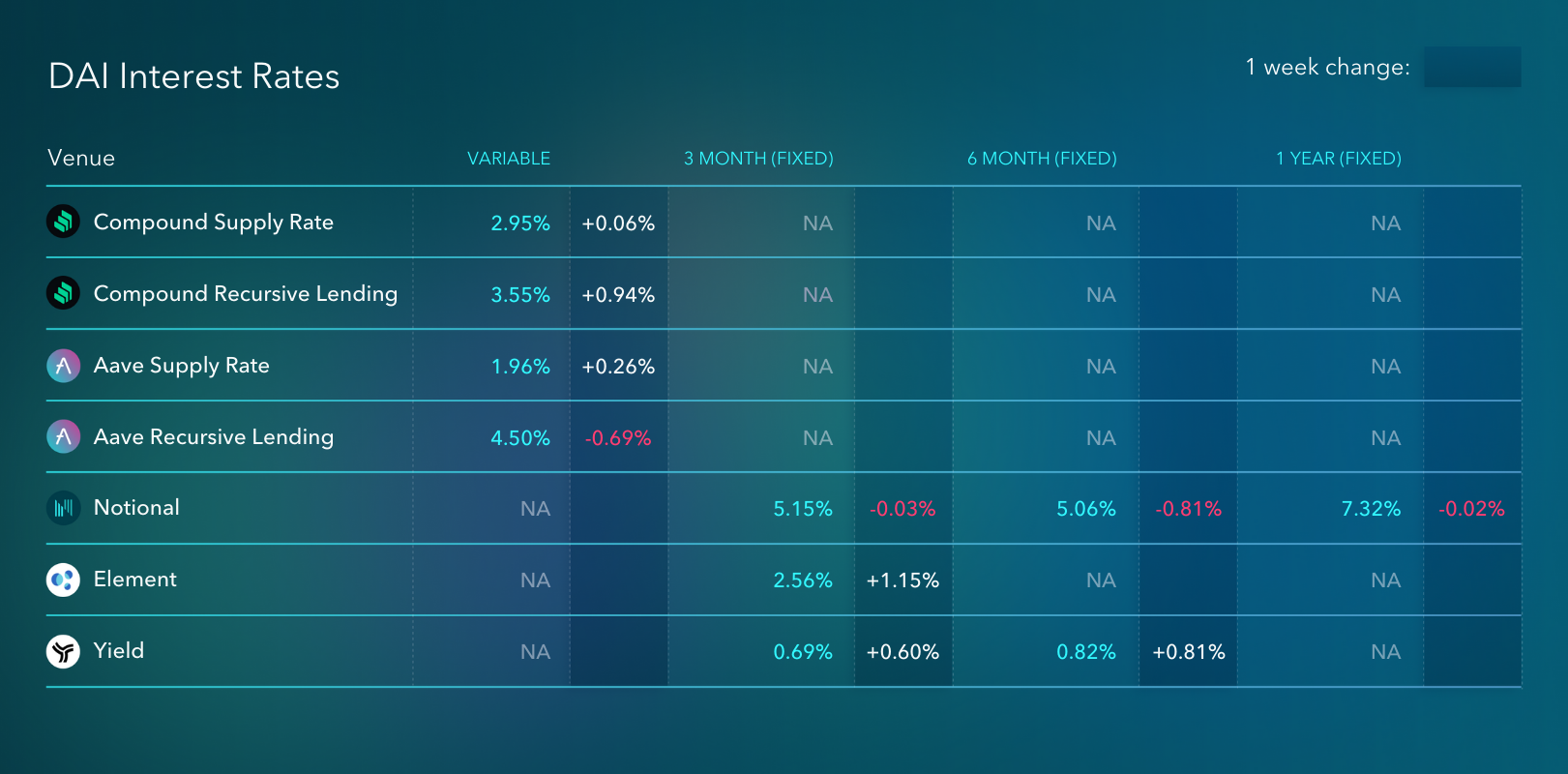

Last week we talked about Compound cutting its incentives by 50%. This week we start to see the effect. The COMP price is roughly flat over the week, but the USDC and DAI recursive lending rates are both up significantly and yield more than the base supply rate again.

Last week we talked about Compound cutting its incentives by 50%. This week we start to see the effect. The COMP price is roughly flat over the week, but the USDC and DAI recursive lending rates are both up significantly and yield more than the base supply rate again.

So what happened?

Compound lost a lot of DAI and USDC liquidity. A smaller amount of total stablecoin liquidity -> more incentives for remaining stablecoin liquidity -> higher recursive lending rates. If I had to guess, I would say that a lot of the recursive lending positions on Compound were unwound over the past week. Looking at Aave and Compound's comparative TVL over the past week supports this theory. Compound shed about $300M in total TVL while Aave's TVL expanded by roughly $1B.

Consequently, Compound's base lending rates are now higher than Aave's. That means Compound's borrowing rates are now higher than Aave's as well. You wouldn't expect a significant difference in borrow rates to stay there for a long - and if it's not corrected by extra supply coming in to Compound, it will be that borrower begin to leave for Aave.

It's going to be really interesting to see how this plays out, particularly if Compound proceeds to cut incentives all the way down to zero. If Compound takes this action, borrowing on Aave will go from moderately more attractive than Compound to starkly more attractive. And borrowers are stickier than lenders - if Compound starts to lose its borrowers, it will be hard to get them back.

In fixed rates, the big story was that Yield Protocol listed Notional's fCash token as collateral. Now DeFi users can lend on Notional at 3%-6% and then borrow against that position at <2% on Yield to re-lend on Notional. It looks like we saw some of this activity over the last week which caused Yield's DAI rates to increase moderately. But liquidity on Yield is limited so it's difficult to put this position on in any material size at the moment.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.