Weekly Interest Rate Roundup: Mar 8 - 15

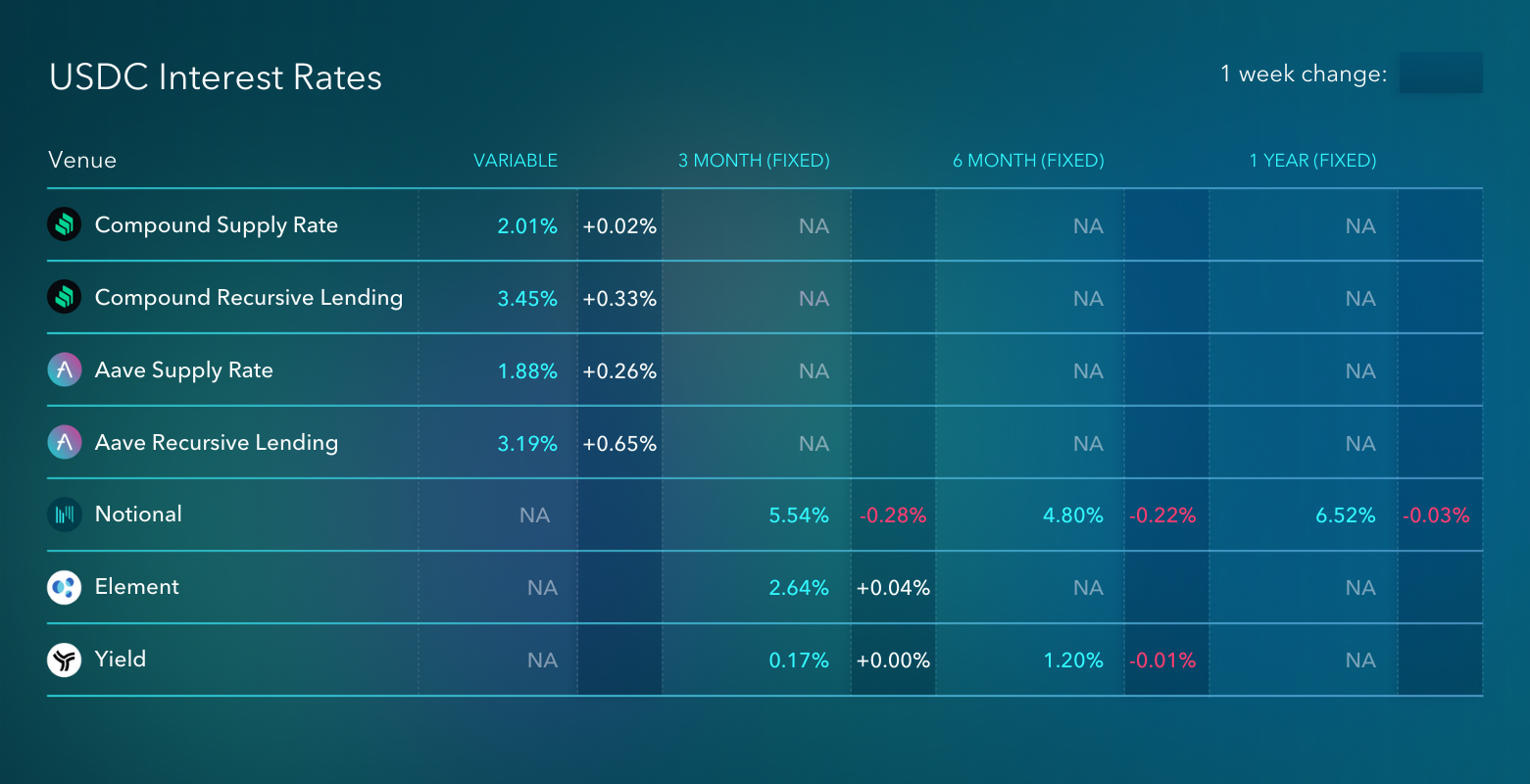

Rates haven't moved much this week. The recursive lending rates have risen off of recent lows and Notional's fixed rates continue to decrease and converge toward the variable rates.

Rates haven't moved much this week. The recursive lending rates have risen off of recent lows and Notional's fixed rates continue to decrease and converge toward the variable rates. The 6M USDC rate on Notional is now just 2.8% greater than the supply rate on Compound. This doesn't sound like a lot, but yields in DeFi have compressed a lot. Overall, there is still just very little borrowing demand and a lot of capital looking to earn yield.

The alt-stablecoin yield spreads are tightening as well. Convex offers 5.6% on FRAX and 9.5% on MIM. Those yields are substantially higher than the ~2% baseline on USDC and DAI, but holding those stablecoins is undeniably risky. It's hard to say whether that risk is appropriately priced, but I don't think these levels are crazy.

FRAX in particular looks attractive on a relative basis. FRAX is 85% backed by USDC so it doesn't have nearly the same vulnerability to a liquidation-induced insolvency as something like MIM. Additionally, the FRAX pool is one of the largest on Curve with over 3B in TVL, and the majority of that TVL is provided by FRAX itself which should make holders comfortable that the liquidity will be there when it is really needed. As alt-stablecoins go, I think I could get comfortable holding FRAX to earn additional yield on top of what is offered on USDC or DAI.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.