Weekly Interest Rate Roundup: Oct 11 - Oct 18

We’re making some changes this week! Going forward I’m going to drop DAI interest rates and include ETH interest rates instead. Additionally, I’m dropping a few of the rate venues that we used to track due to low liquidity and adding rates on Optimism and Arbitrum via Aave. ETH rates and the L2 landscape are getting more and more interesting so I thought these changes would keep the rates we track on this newsletter more relevant and informative. We’ll have week on week percentage changes here next week. Hope you all like the new setup.

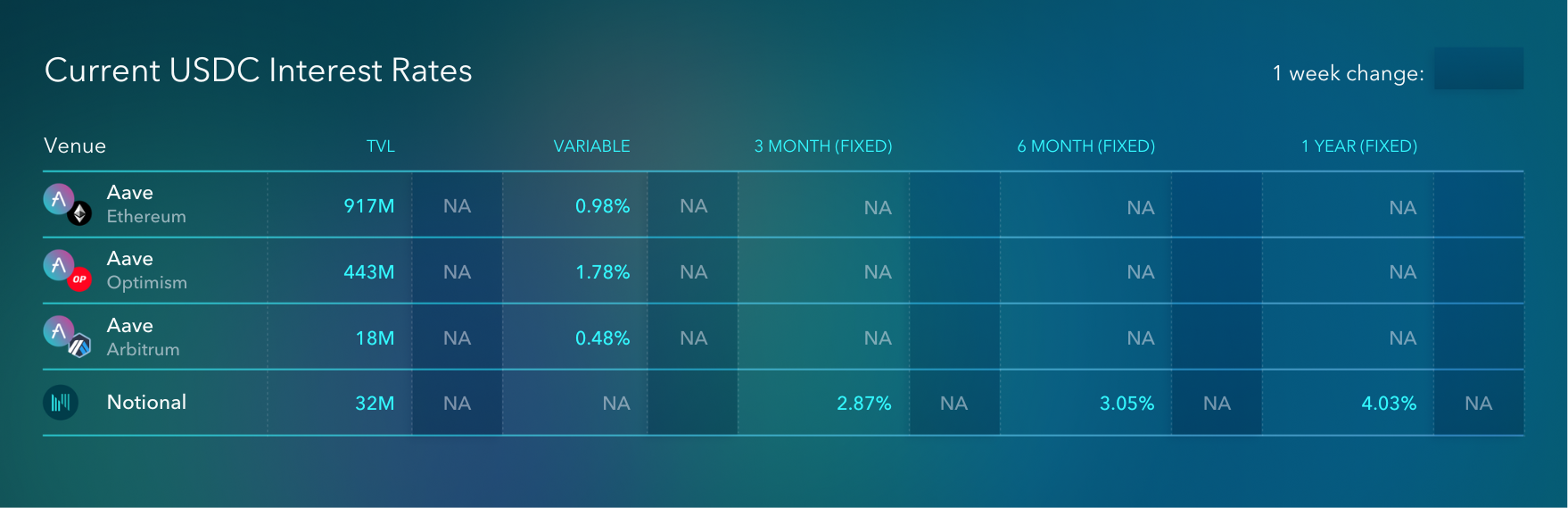

When looking at these new rates, one thing stands out to me in particular. Aave has done an exceptionally good job at retaining deposits despite cutting incentives to zero and paying out below-market interest rates. Some of this can be attributed to user apathy - people put their money in Aave over the years and then basically can’t be bothered to move it elsewhere for whatever reason. But that’s not the only explanation.

For example, there’s 18M USDC sitting in Aave on Arbitrum earning <0.5% with zero incentives. That’s USDC which was purposefully bridged over to Arbitrum and then purposefully placed onto Aave. Nothing apathetic about that. And it’s also probably not being used as collateral given how uncommon it is to borrow anything that isn’t a stablecoin. Maybe these are Arbitrum airdrop hunters, but still, it’s impressive.

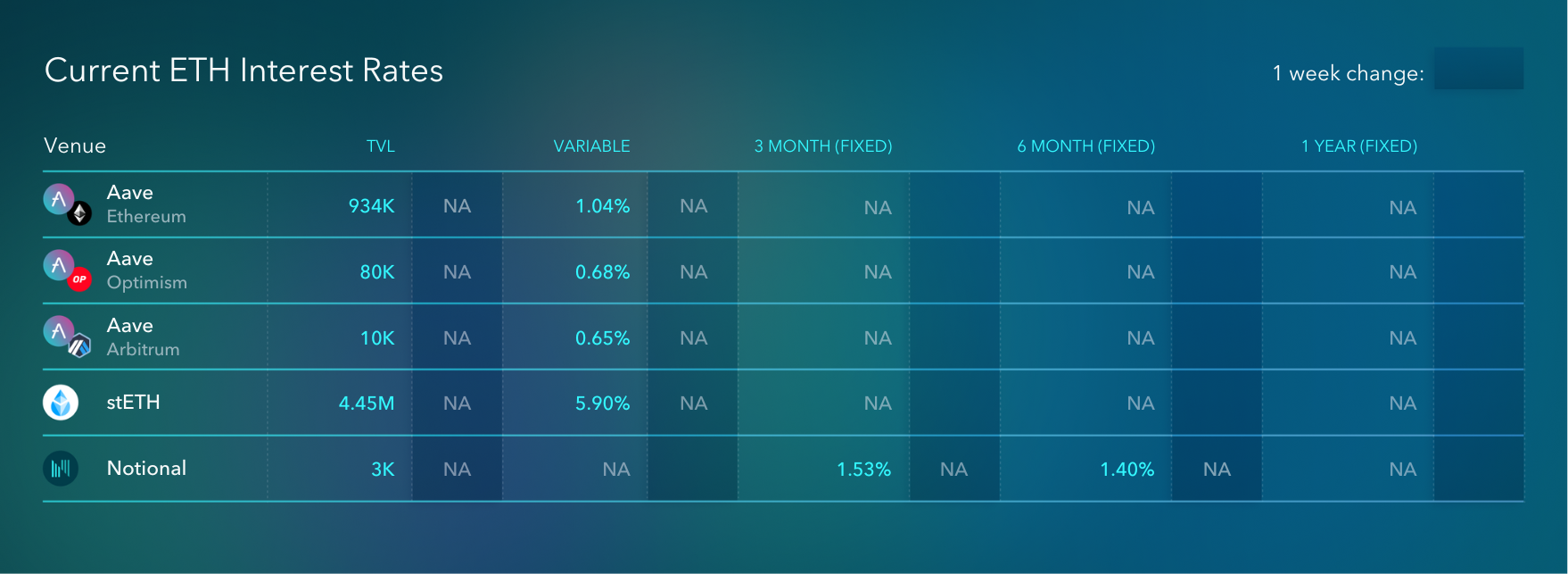

Aave’s ETH liquidity retention is even more impressive if you ask me. Setting aside Aave’s ETH deposits on L1 - Aave has 90k ETH between Arbitrum and Optimism that’s earning less than 1%. I think it is fair to say that putting your ETH on an L2 and taking bridge risk is as risky, if not riskier, than staking it with Lido. And Aave users are doing it for less than 1% interest vs. 5.9% interest on stETH! Well done Aave.

People have long since prophesied that the ETH stake rate will give rise to the risk-free rate for DeFi. I think in some sense that’s definitely true - Lido has absolutely dominated in terms of attracting ETH supply. But I think what we see with ETH liquidity on Aave demonstrates the limits of the idea that everyone acts in their optimal economic interest. In reality, it’s just not true. Maybe there’s more to life than efficiency.

(To be clear, I’m talking about for other people. I will always be a slave to my rational economic self-interest. I do not endorse inefficient capital allocation.)

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.