Weekly Interest Rate Roundup: Sep 27 - Oct 4

Over the last few months there hasn't been much to talk about in the DeFi space on Ethereum, and so people have been talking about Layer 2s instead. From all the noise that their respective boosters make on Twitter, you would think that there are big things happening. But in reality, ETH L1 is still very much the king both in terms of raw TVL as well as new products and innovation.

Ethereum DeFi TVL is still ~10X the TVL of Optimism, Arbitrum, and Polygon combined. The majority of innovation is happening on L1 as well - in fact many of the largest DeFi protocols that are continuing to build and improve their products aren't currently active on L2 at all.

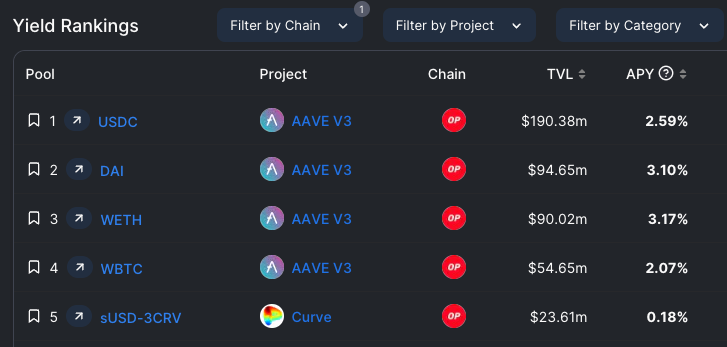

L2s have the promise of delivering protocols that take advantage of ultra-cheap blockspace to enable products and experiences that would be prohibitively expensive on L1. But so far, with one or two notable exceptions, it hasn't happened. Instead, L2s look relatively homogenous. They have a handful of the largest DeFi protocols copy-pasted over from L1. Consider the top 5 yields on Optimism for example:

This isn't totally surprising. Developing new blockchain applications takes a very long time. But it is interesting, and it calls into question the idea that L2s would unleash an explosion of both user demand and developer creativity.

This isn't to say that I'm bearish on L2s. There are two protocols which, in my mind, prove out the thesis that cheap blockspace will enable new and valuable DeFi protocols that would be unviable on L1. Those are GMX, a perpetuals trading protocol and Lyra, an options trading protocol. Both of these protocols are complex and built for users who you would expect to be very active - thus cheap blockspace is key.

As the co-founder of a lending protocol, I think about potentially deploying on an L2 through the lens of "who would borrow on L2 instead of L1, and for what reason?" You would expect that L2s would have the same kind of borrowers as L1 (in proportionally smaller size), who would be borrowing on L2 because their capital is on L2 instead of L1. But to me, the more interesting question is what are the new kinds of activities that you could finance which are unique to L2? So far we've got two new things. Hopefully we'll have more soon.

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.