Weekly Rates Market Overview: Feb 8 - 15

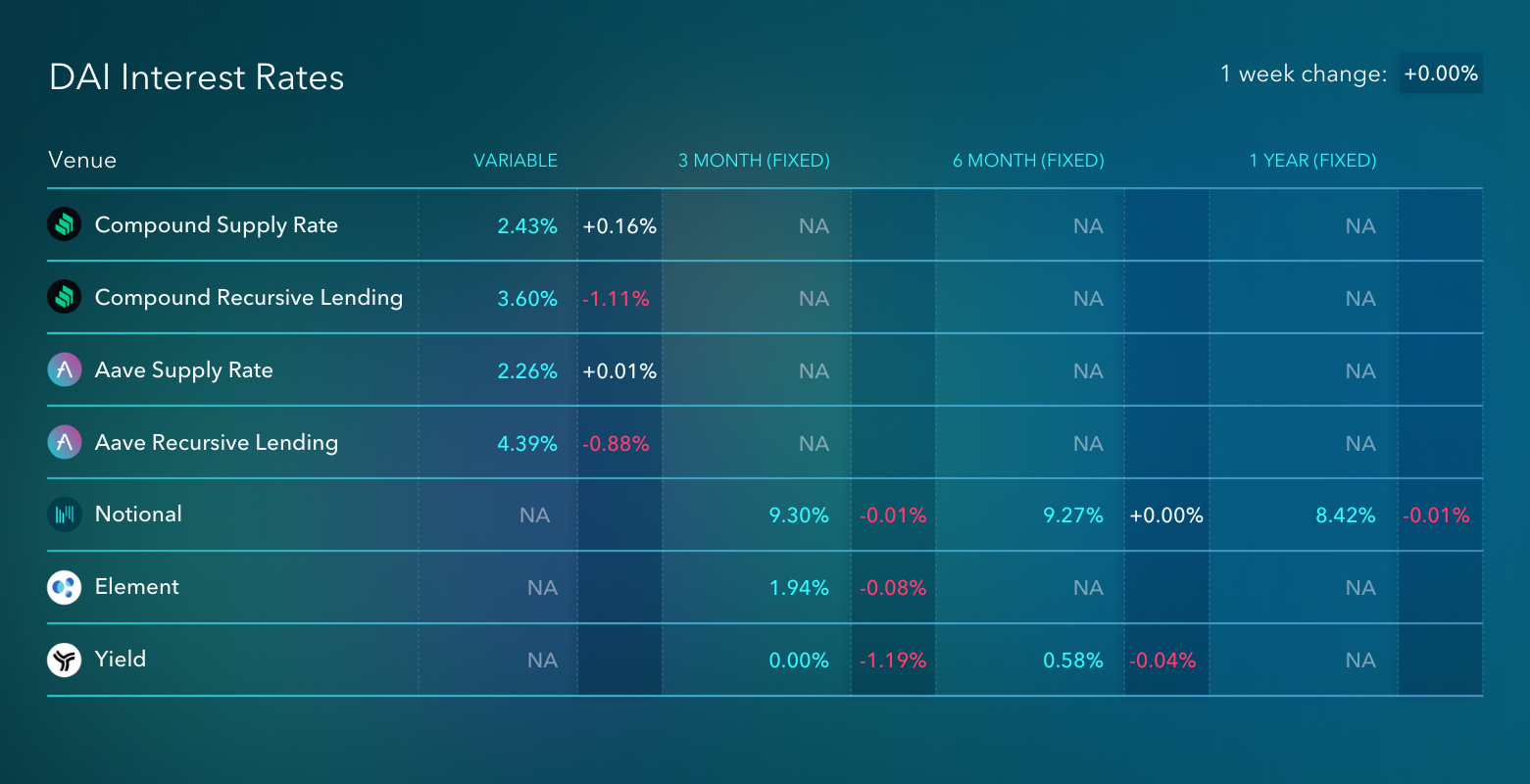

It's tough out there for stablecoin farmers. DeFi yields continued their march lower over the past week. Compound and Aave supply rates held steady, but the recursive lending strategies got hit hard - this DAI strategy on Compound currently yields a measly 3.6%. Down bad.

It's tough out there for stablecoin farmers. DeFi yields continued their march lower over the past week. Compound and Aave supply rates held steady, but the recursive lending strategies got hit hard - this DAI strategy on Compound currently yields a measly 3.6%. Down bad.

As you may know, the recursive lending rates on Compound and Aave are highly sensitive to the price of their incentive tokens. As those token prices go down, so do those yields. And this week those yields went down.

This brings us to an interesting juncture. The DAI recursive yield on Compound is only ~1.17% higher than the regular supply rate. How much further could that spread compress? At some point, that spread doesn't justify the operational risk and gas expense required to maintain the strategy.

We're not there yet - but if token prices go much lower I would expect to see some significant unwinds of recursive lending positions. This would be bad for all the yield-seekers out there, but it would be interesting to see how much of Compound and Aave's borrowing demand is organic and not purely linked to farming their token incentives.

Further out the curve, rates are down on fixed rate protocols across the board. Rates on Notional continue to decline amid heavy lending and light borrowing. I expect the spread between Notional's rates and the recursive lending rates to compress - although I'm not certain if Notional's rates will eventually be higher or lower than the recursive lending rates.

On the one hand, Notional has more smart contract risk than those platforms because it's a newer protocol. But on the other hand, Notional's yield is clean and easily accessible - it doesn't require a complex farming strategy to capture. And that means something.

The big story elsewhere in the fixed rate ecosystem is Yield Protocol. They're currently sporting 0% 3-month yields. If you thought DeFi yields couldn't go lower than your tradfi savings account, I guess you were wrong. Let's just hope they don't go negative ;)

Teddy

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.