Notional Finance Full Q4 2022 Report

Q4 was a challenging quarter for all of crypto with the recent collapse of FTX and the bankruptcy of multiple centralized lenders. Amidst this pessimistic backdrop, Notional continued to move forward by launching leveraged vaults in Q4.

Leveraged vaults allow users to borrow at a fixed rate from Notional and deposit the borrowed assets in whitelisted yield strategies. The release of only one leveraged vault strategy pushed ETH rates from 1-1.5% to 4-5.5% in only a few weeks. This marks a turning point in making yields more attractive for lenders while also increasing LP returns organically. Leveraged vaults put Notional on a path of being able to offer sustainable unsubsidized yields to LPs in the coming quarters.

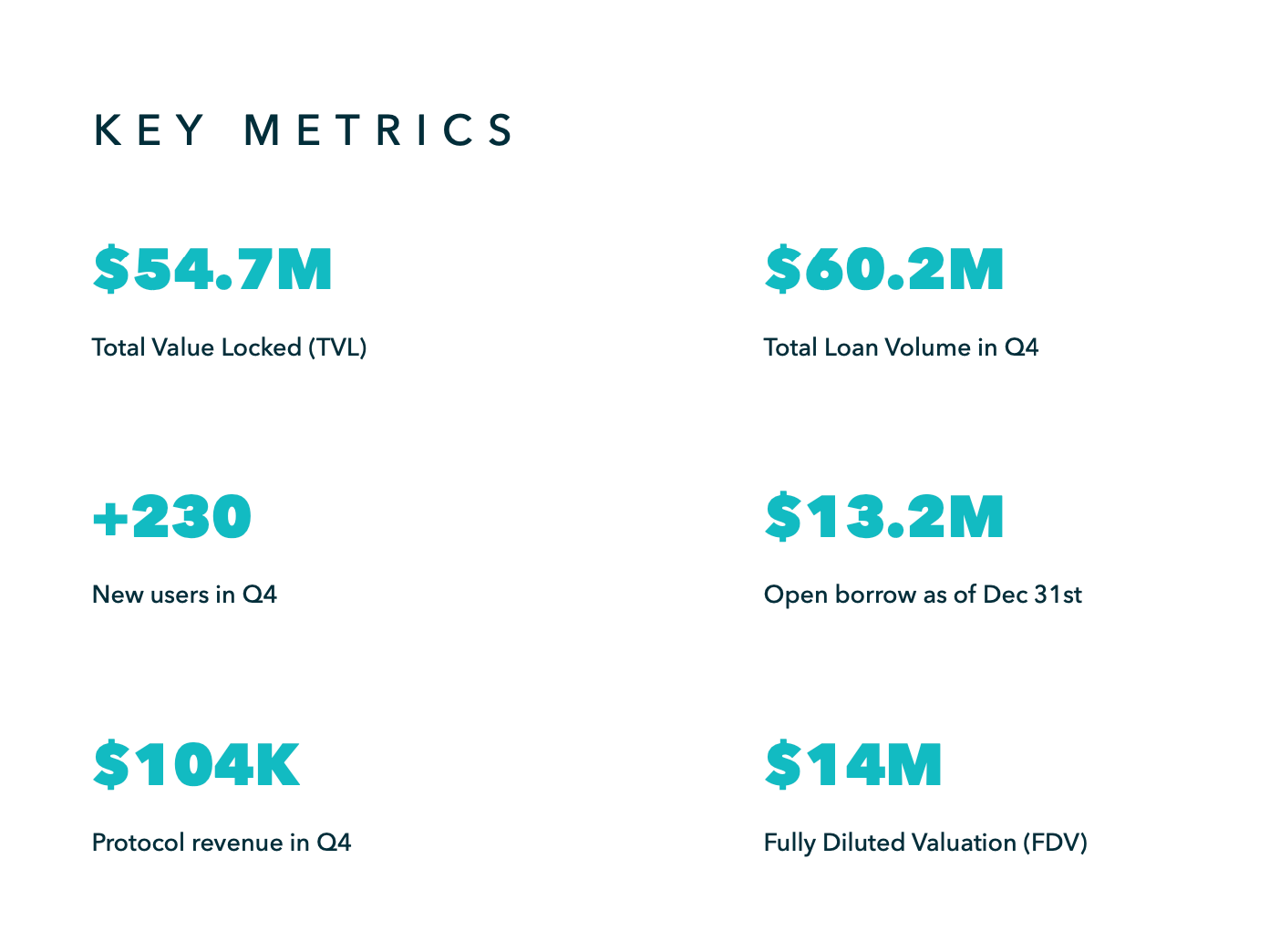

During the quarter, Notional saw its TVL decrease from $85M to $55M nevertheless the protocol still managed to process $60M in transaction volume and generated $104K in revenue. While these figures are down from Q3, Notional is still reinforcing its lead in the fixed rates market with our two biggest competitors having $8M and $4M of TVL.

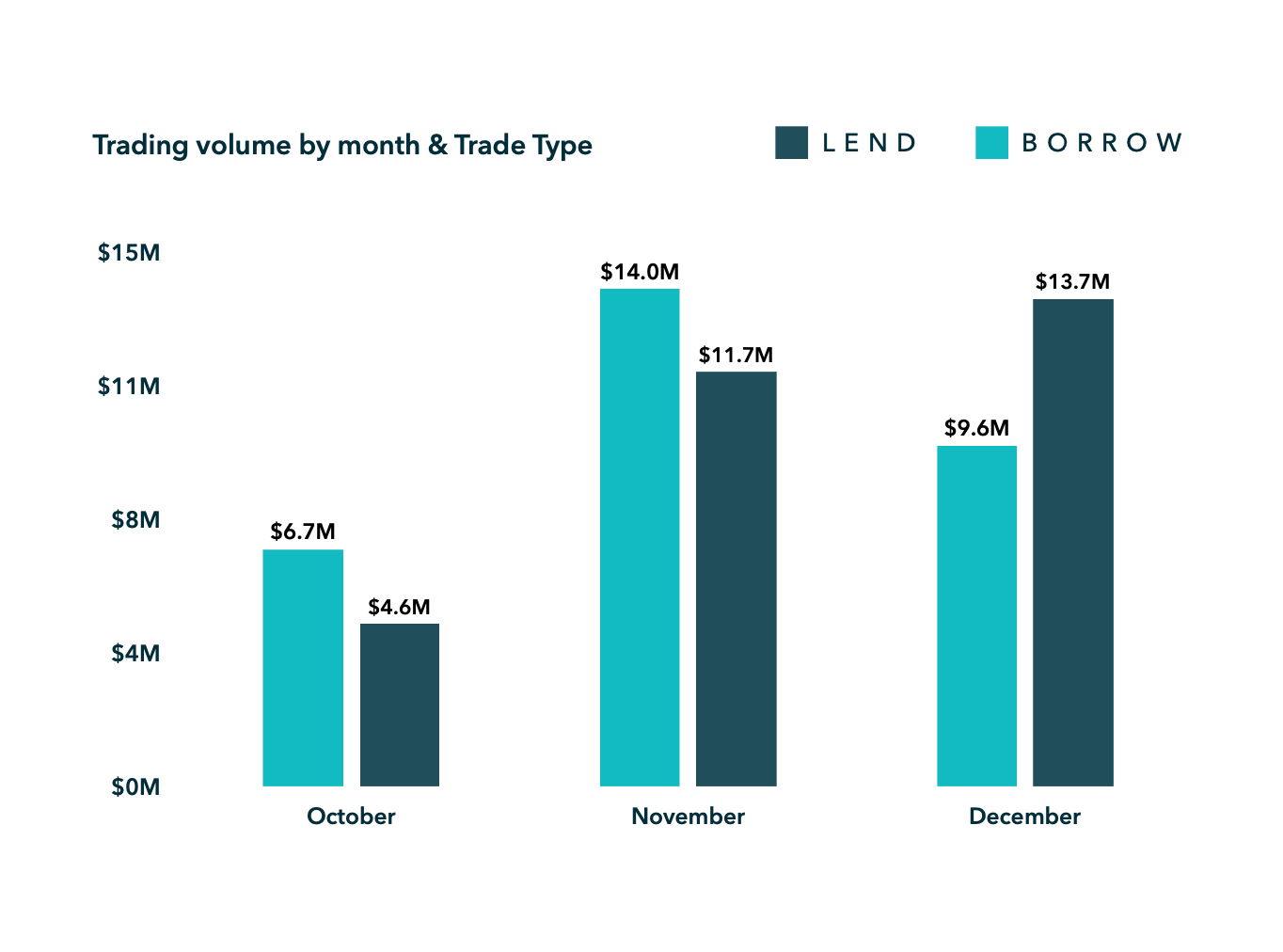

In Q4, Notional facilitated $60M in trading volume and generated $104K in protocol revenue. As of December 31st, Notional also managed to attract and retain more than $55M in capital from its LPs.

70% of trading activity was executed in 3 Month pools, 27% in 6 Month pools, and 3% in 1 Year pools. This clearly denotes that users have a preference for shorter term maturities when markets become more volatile.

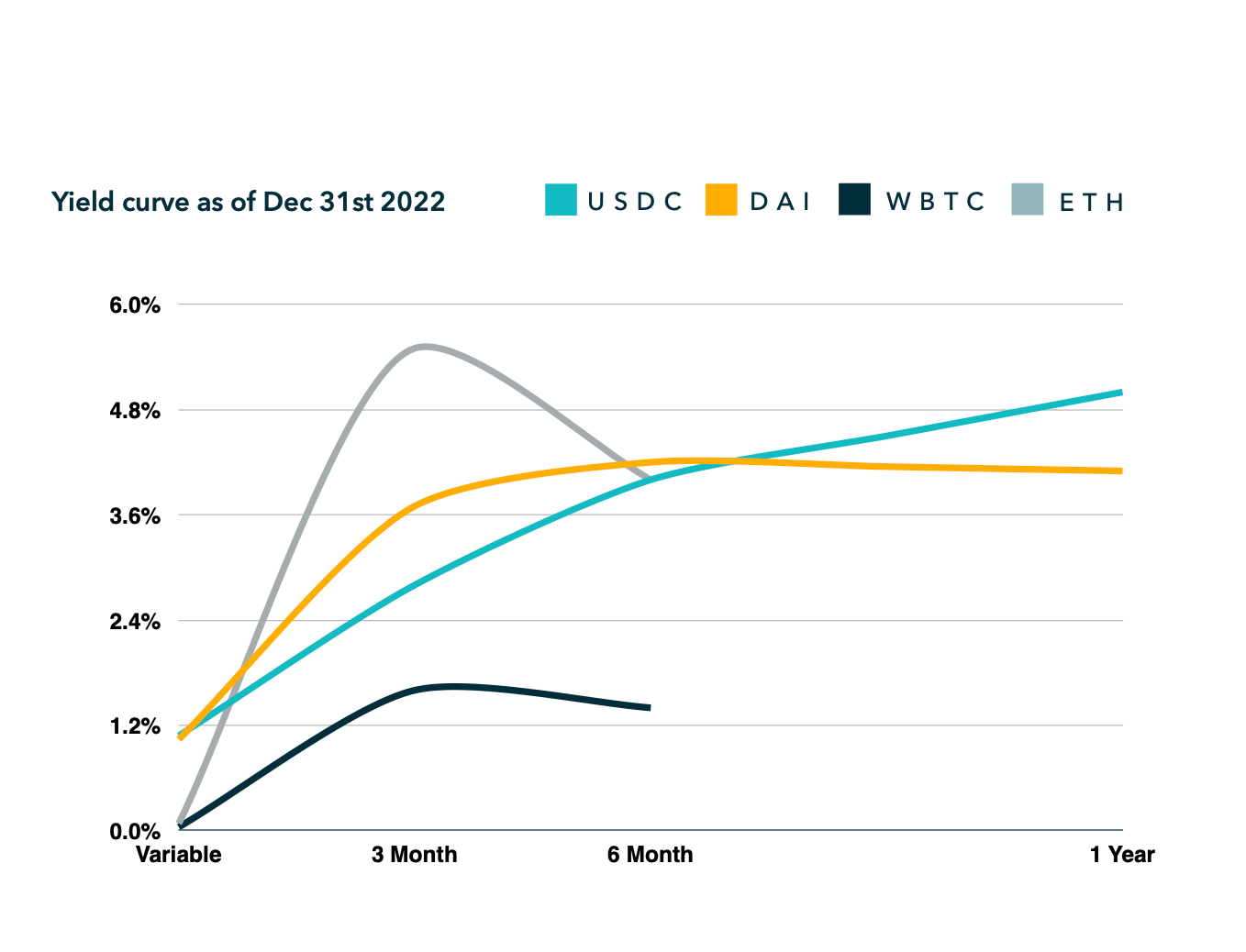

The launch of the Balancer-Aura wstETH/ WETH leveraged vault had a significant impact on ETH rates. The 3 month ETH rate increased from 1.6% to 5.5% and the 6 month rate increased from 1% to 4%. The impact leveraged vaults had on rates clearly shows that borrowers are willing to borrow at higher rates if they can enter a yield strategy with the assets they borrow.

Notional rates have remained consistently higher than Compound lending rates in Q4.

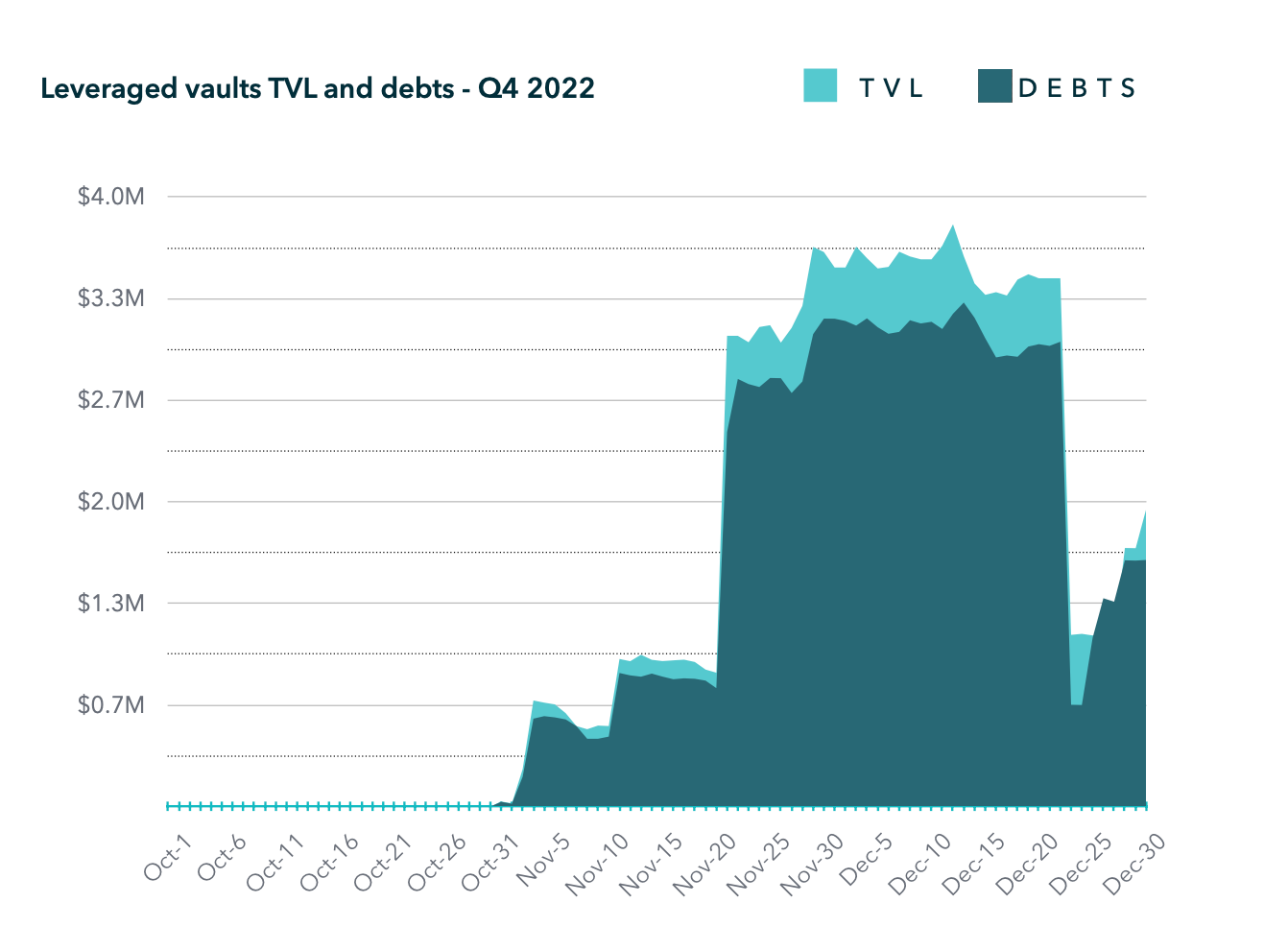

Notional’s first leveraged vault strategy - the Balancer-Aura wstETH/WETH leveraged vault launched in early November in Beta.

At its peak in mid November, 14 leveraged vault users borrowed 2,500 fETH from Notional to deposit in the strategy.

We plan to deploy additional leveraged vault strategies in Q1 2023 as well as decreasing the minimum borrow requirements for the Balancer-Aura wstETH/WETH vault.

About Notional Finance📈

Notional is the #1 Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With more than $675M in total fixed rate lending volume, Notional is now a top 10 lending protocol providing core DeFi infrastructure.

Notional’s latest product launch, leveraged vaults, launched in beta in Q4 2022. A new DeFi primitive built on fixed rate borrowing, leveraged vaults execute specific yield strategies while collateralizing the vault assets, allowing users to maximize capital efficiency by taking up to 10x leverage.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched in November '21 with a host of new features as well as the $NOTE governance token.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.