Notional Fixed Rate Update: Jan 2023 🗓️

*Leveraged Vault now driving 55% of loan volume* Welcome to the latest edition of the Notional Monthly Update! Follow the latest news on Twitter or join the Notional community on Discord.

🗒 Summary Notes

-Leveraged Vault stats

-Crew3 Community Questboard w/ $NOTE prizes

-New Notional Explainer: Where does the Yield Come From?

-Read: Q4 Report // Watch: Year in Review

-Patchfix to Leveraged Vaults Report

📊 Monthly Protocol Stats

-TVL: $55,310,000

-Jan. Loan Volume: $7,965,406 ($4,432,775 of that volume coming directly from leveraged vaults)

-Protocol Revenue: $5,606 in trading fees and $31,205 in COMP incentives

-Current Lend (ETH 3m) APY: 6.17%

-Current LP (DAI) APY: 6.25% (1.14% variable +5.11% $NOTE rewards)

Leveraged Vaults Driving Loan Volume

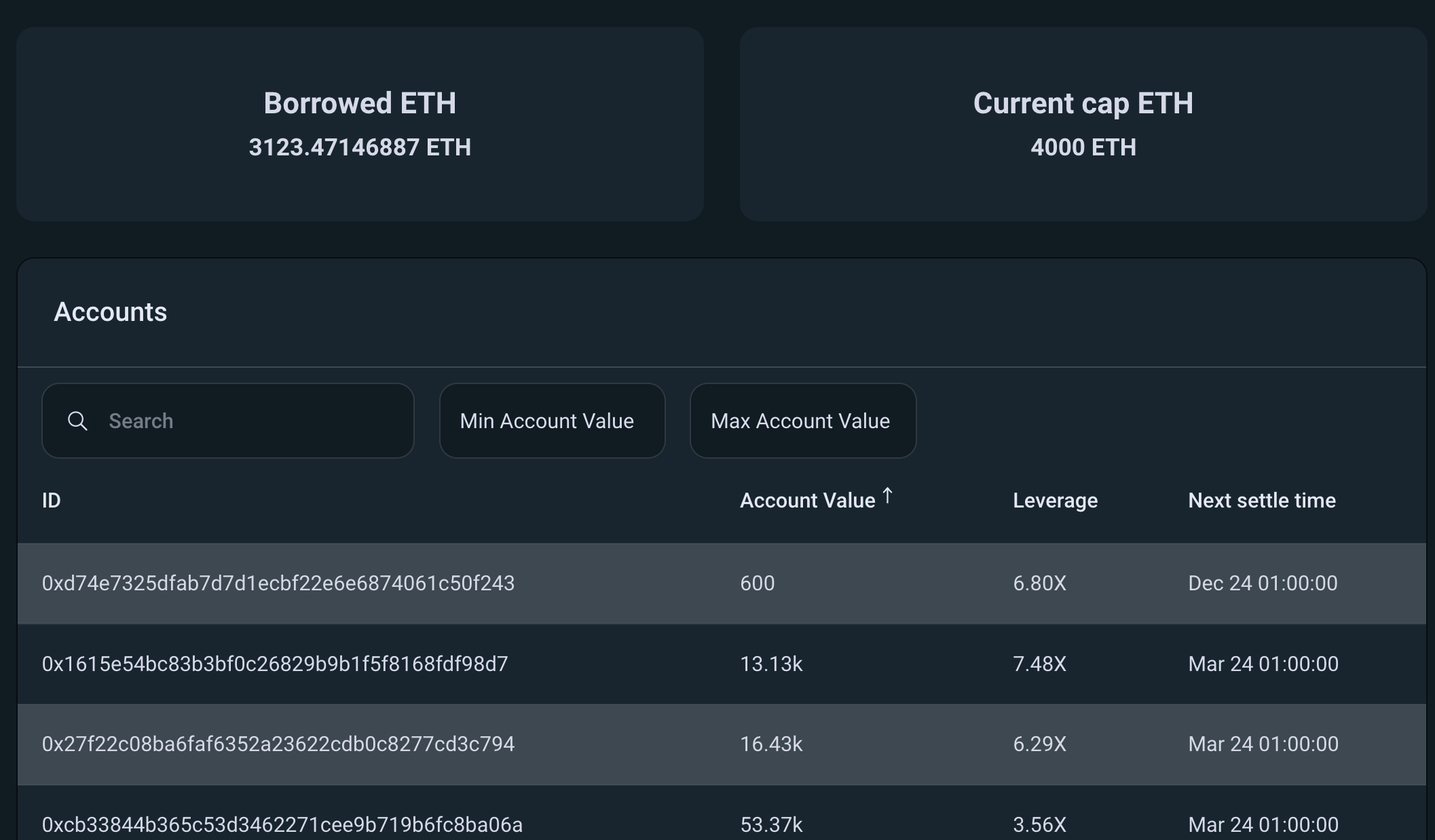

There aren't many metrics in crypto right now that are "up and to the right," but leveraged vaults usage is currently one of them. With one user recently borrowing over 600 $ETH at a fixed rate to initiate a position into the wstETH/ETH Balancer vault, usage is at an all-time high.

In fact, volume from the leveraged vaults accounted for more than 55% of the total loan volume on Notional last month. While we expected this outcome, it's great to see it happening so quickly. DeFi needs to give users good reasons to borrow fixed, and leveraged vaults do just that.

As Teddy wrote in his 2022 year in review post,

Leveraged vaults and new currency listings will be key drivers of growth in Notional’s outstanding debt. We expect growth in outstanding debt to primarily come from two buckets - ETH and ETH staking derivatives, and stablecoins. We plan to expand our currency listings significantly in the first half of next year to include all major ETH staking derivatives and leading stablecoins.

New asset listings and new leveraged vaults will generate borrowing demand for new currencies as well as create opportunities for interest rate arbitrage between similar assets on Notional.

Want to check out this particular user's transactions? Head over to the super slick analytics dashboard to see all the details.

ICYMI: Intro to leveraged vaults

CREW3 Community Quest

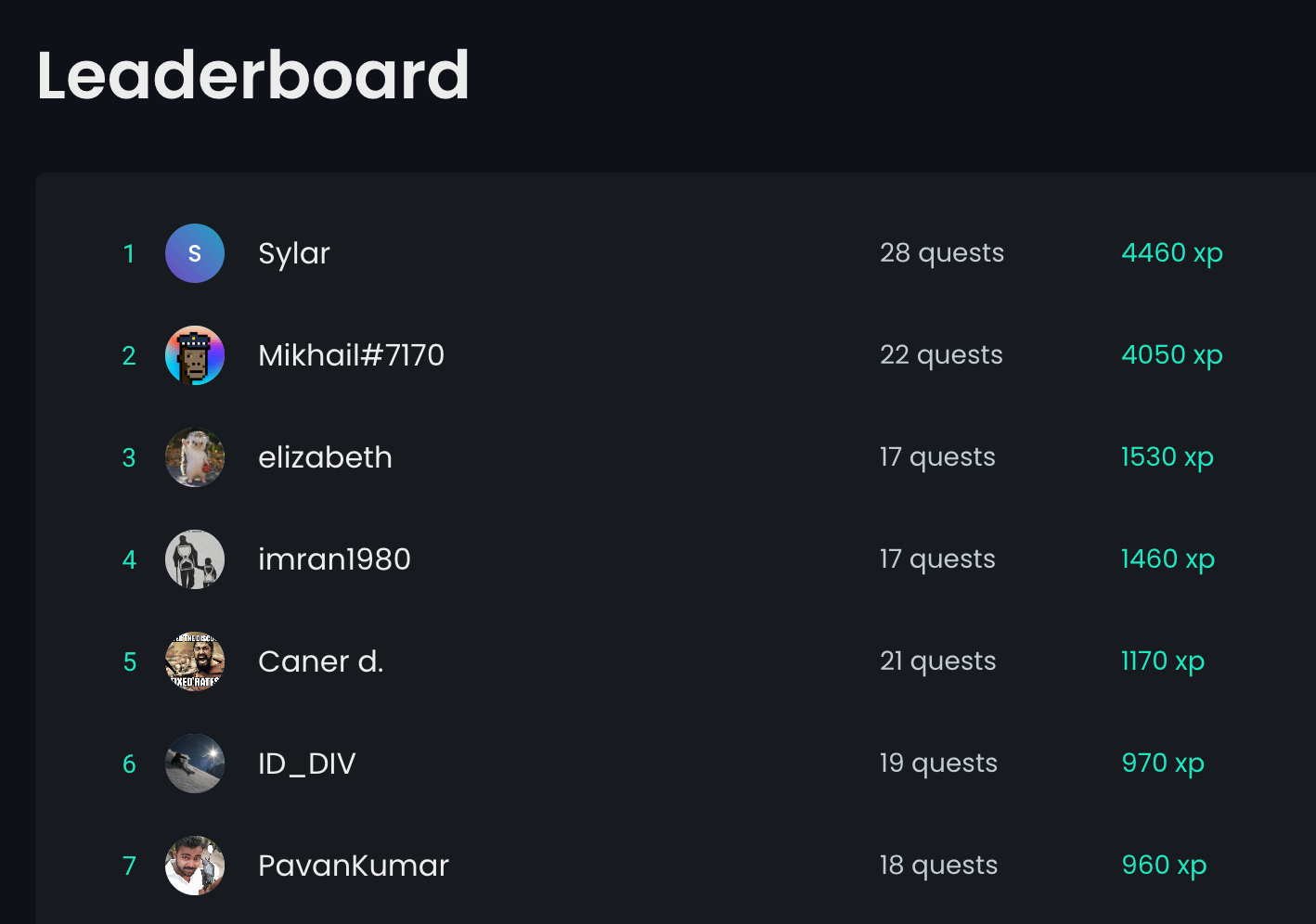

Each month, we’ll award 1000 $NOTE to two users who have racked up points on our Crew3 questboard. Crew3 is a gamified tool that makes engaging with the community fun and rewarding. Take simple quizzes to learn about and interact with Notional content and earn even higher XP rewards for completing on-chain tasks, such as lending and providing liquidity.

The more XP you’ve earned on Crew3, the better your chances are to win the drawing: 1 XP = 1 entry into the drawing. We'll announce winners in the #Crew3 Discord channel, Twitter, and monthly newsletter recap. Read more.

Notional Explainer: Where does the Yield Come From?

Take 90 seconds to understand one of our most frequently asked questions. Hint: it's the borrowers.

Full Transparency: Leveraged Vault Patchfix Notice

On Thursday Jan 19th, the Notional Team discovered a low severity issue on the wstETH/ETH leveraged vault during the course of routine testing. The team verified that the issue was not exploitable, that no funds were at risk, and that the leveraged vault could continue to operate normally while we worked on a fix. We implemented that patchfix on Sunday Jan 22nd and everything on Notional is operating normally with no negative impact to users.

All leveraged vault users with funds on Notional should see a minor increase in their net worths today following the upwardly revised value of their vault shares.

All leveraged vault users who exited the vault after December 23rd redeemed their vault shares for slightly less than their true value. The Notional team has transferred ETH to recoup this difference in value to each one of these users from address 0x9299B176bFd1CaBB967ac2A027814FAad8782BA7. The total amount transferred was 1.328 ETH across 4 users.

Check out the full post here.

Q4 2022 Report & Notional's Year in Review

Check out the full PDF report below or the blog post for more details.

🗞️Notional in the News

A roundup of Notional media and appearances by the core team.

Teddy on a panel with Angle Labs:

📐Yesterday we had fun discussing leveraged yield and composability in DeFi with @Benjamin918_ (@QiDaoProtocol), @bneiluj and @HatashiYamatomo (@StakeDAOHQ), as well as @teddywoodward (@NotionalFinance).

— Angle Labs 📐 (@AngleDevs) January 31, 2023

📼Here is the recording if you couldn't make it!https://t.co/vCqyhh3ZoV

About Notional Finance📈

Notional is the #1 Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With more than $700M in total fixed rate lending volume, Notional is now a top 10 lending protocol providing core DeFi infrastructure.

Notional’s latest product launch, leveraged vaults launched in late 2022. A new DeFi primitive built on fixed rate borrowing, leveraged vaults execute specific yield strategies while collateralizing the vault assets, allowing users to maximize capital efficiency by taking up to 10x leverage.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the $NOTE governance token.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.