Notional Fixed Rate Update: Feb 2023🗓️

Welcome to the latest edition of the Notional Monthly Update! Follow the latest news on Twitter or join the Notional community on Discord.

🗒 Summary Notes

-Community growth via Layer3 / Crew3

-Audit/V3 updates

-Index $MMI Index Coop integrations proposal

📊 Monthly Protocol Stats

-TVL: $54,527,249

-Feb. Loan Volume: $8,105,671

-Protocol Revenue: $3,776 in trading fees and $13,800 in COMP incentives. Total: $17,576

-Current Lend (ETH 3m) APY: 6.24%

-Current LP (ETH) APY: 8.23% (3.15% variable +5.08% $NOTE rewards)

Sherlock Audit Contest Updates🕵️

-The latest leveraged vault strategy framework for deploying Convex strategies underwent an audit contest from Mar 1-8 with Sherlock. Deploying leveraged vault strategies on Curve/Convex will allow for a wider range of vault strategies (beyond Aura) that will potentially incentivize further $ETH borrowing activity on Notional. More activity = More organic returns for LP = Reduced token incentive emissions.

-Notional V3 (!!!) is scheduled for an audit contest starting March 27. We'll have much more to say about what is coming with V3 in the coming month, but...

Do you like L2 deployments? Do you like earning the highest possible variable money market yield in DeFi with the ease of entering and exiting positions knowing exactly what you're getting? Do you like more collateral types and more strategies for leveraged vaults? How about LSD strategies? If so, we think you'll LOVE V3. 🔜🔜🔜

Big couple months ahead for @NotionalFinance

— Teddy Woodward (@teddywoodward) March 8, 2023

✅Launching a stablecoin leveraged vault

✅Listing LSDs

✅Launching more ETH/LSD leveraged vaults

✅New UI design

✅Notional V3👀

And more

-Our stablecoin leveraged vault strategy also completed an audit contest and pending a few UI updates should be launched over the next month.

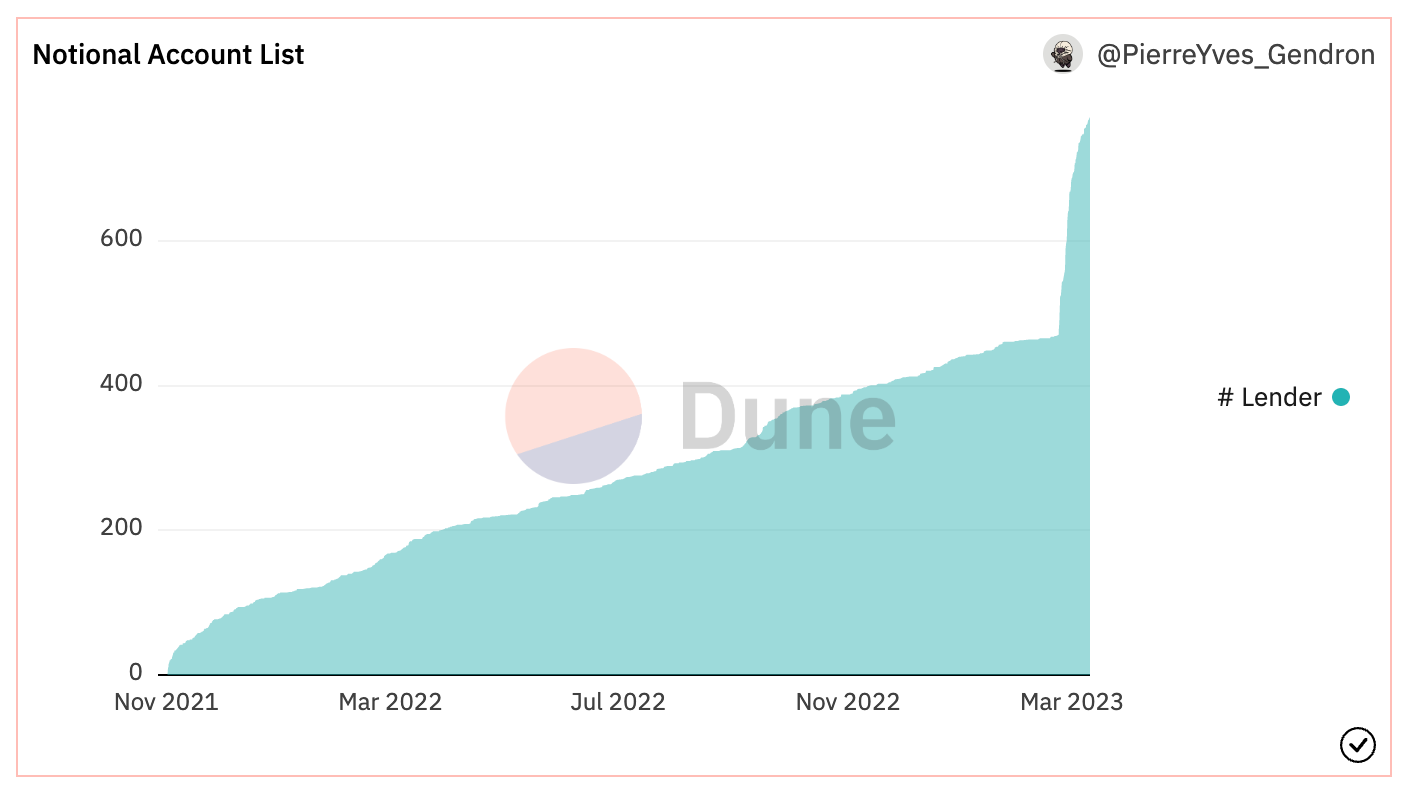

Community Outreach: Layer3 + Crew3 (winners announced!

Want a chance to win 1000 $NOTE each month? Check out the Crew3 community page full of tasks that reward you with the chance to win!

🎉🪂Each month we reward two community members from our @crew3 leaderboard with 1000 $NOTE each.

— Notional (@NotionalFinance) March 10, 2023

Congrats to Feb. winners @jarrrax19 & @Jack15016574!

Want a chance to win next month? Join in the fun with quizzes, videos & other social quests 🔗👇👇

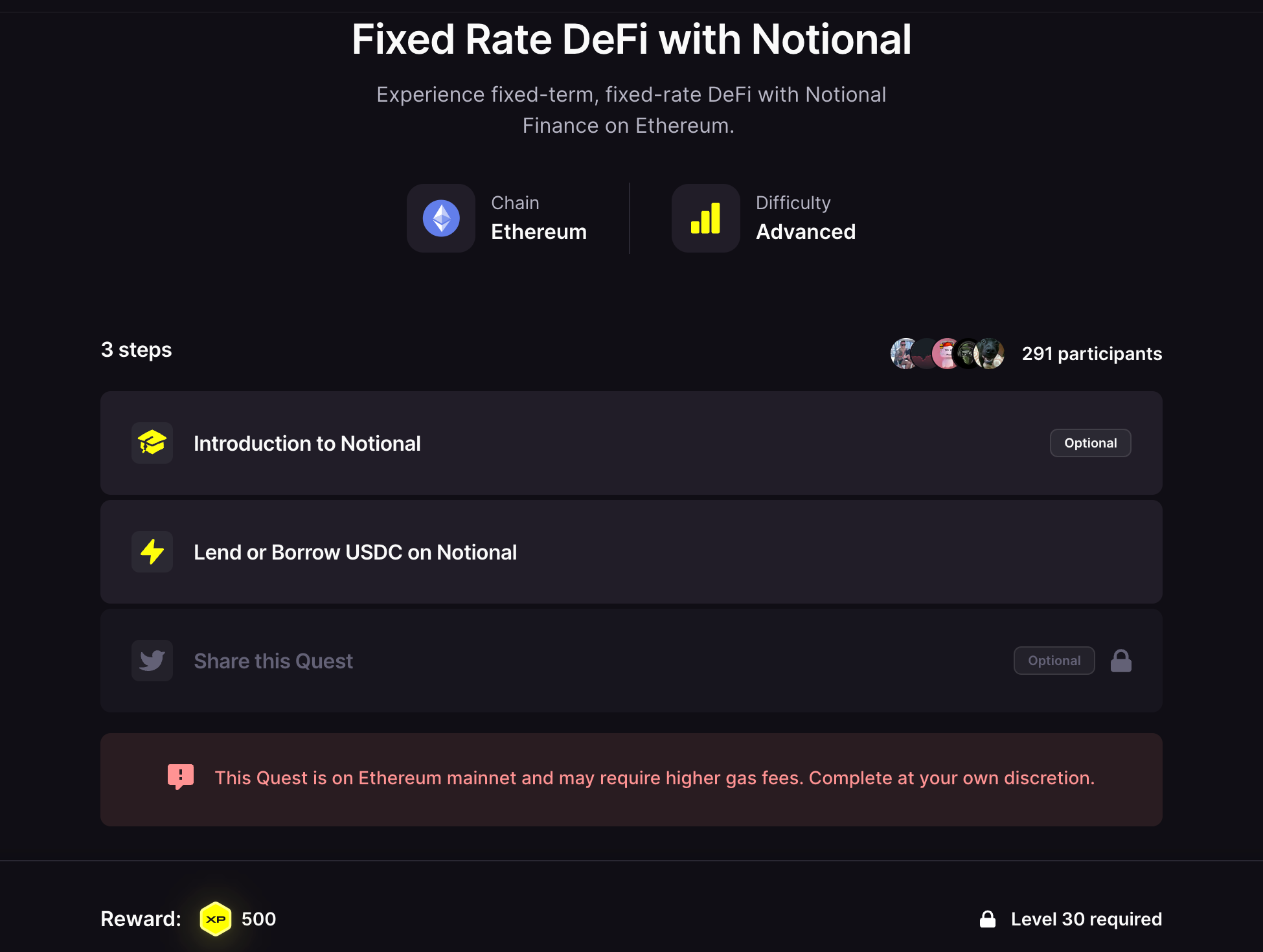

More advanced questers may want to check out the tasks currently live on Notional's Layer3 page. You'll need to be level 30 on their platform in order to participate and get the 500XP reward for borrowing or lending on Notional via mainnet.

New Integration Proposal Alert: $MMI on Index Coop

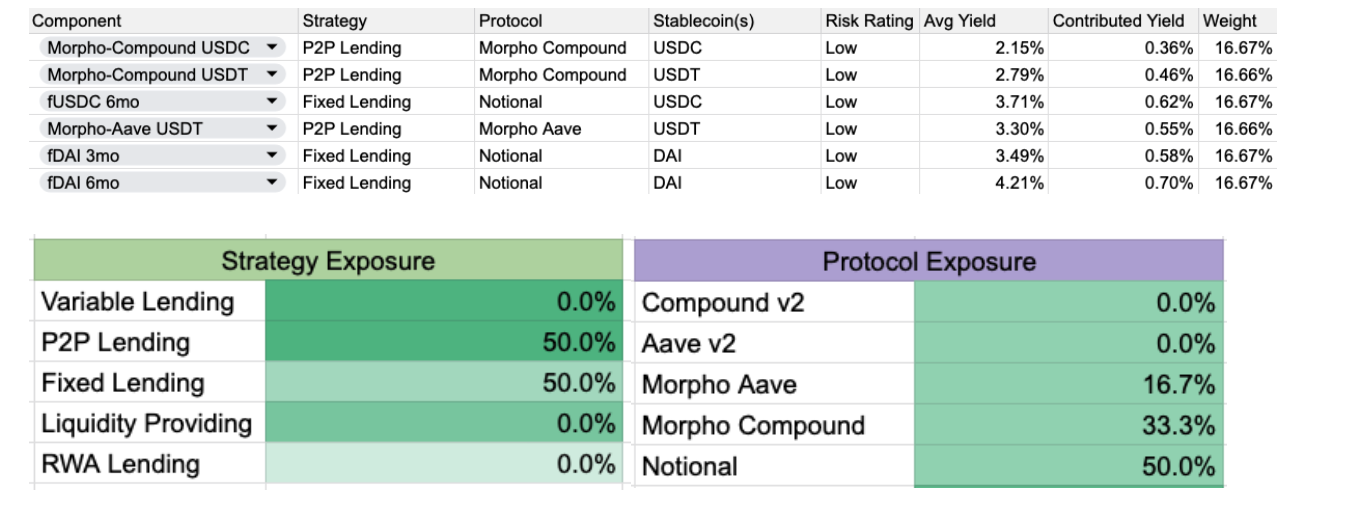

The Product team at Index Coop has an active proposal up for a new product that sources a portion of the yield from Notional - the Money Market Index ($MMI).

What is it? "A stablecoin-denominated yield product with the objective of providing diversified exposure to the top money market yields in DeFi."

Where does the yield come from?: "Underlying stablecoins will be distributed across variable-rate, peer-to-peer, and fixed-rate lending positions on Ethereum main net. $MMI will be built on Index Protocol with initial integrations to Morpho-Aave, Morpho-Compound, and Notional."

Based on 180 days of historical interest rate data, $MMI would have a Gross APY of 3.28% and a Net APY of 3.13%, but due to volatility and slippage Index is advising to expect a 2-4% Net APY range.

Check out the full proposal and weigh in!

IIP: Launch the Money Market Index is now live on the @IndexCoop governance forum 🦉🗳️$MMI will be a stablecoin yield product providing diversified exposure to the top money market yields in DeFi pic.twitter.com/fomjwSZ6Gm

— Index Coop 🦉 (@indexcoop) March 9, 2023

Relevant Tweet of the Month

Quick reminder - @NotionalFinance can never have an asset/liability mismatch.

— Teddy Woodward (@teddywoodward) March 10, 2023

For every borrower at a given maturity, there is a lender, and vice versa.

Notional is not a bank. It's financial infrastructure. Feels nice on days like today 🙂

🗳️Governance

$NOTE holders can make a Notional Improvement Proposal (NIP) via the forum. Voting is gas-free and happens on Snapshot.

[NIP-18] Update governance parameters Q2 2023

In preparation for Notional’s upcoming quarterly roll occurring Thursday, March 23rd at 8:00 PM EST, we propose to update some of the protocol’s governance parameters to increase capital efficiency across Notional’s markets. These changes will facilitate borrowing at higher rates making it more capital efficient for leveraged vault users based on the current rate environment.

Check out the full proposal and details.

🗞️Notional in the News

A roundup of Notional threads, media, and appearances by the core team.

CEO and Co-Founder Teddy Woodward on a recent Swivel Finance Twitter Space: Defi: Fixed - What are Fixed Rates in Defi?

— Swivel Finance ⏩️ ETHDenver 🏔️ (@SwivelFinance) February 1, 2023

USV-FraxBP Pool on Curve got the gauge allocation for $CRV rewards.

— LlamaRisk (@LlamaRisk) March 1, 2023

Soon the APY will 🚀@LlamaRisk is here to help you DYOR:https://t.co/CKhLGIfe1K

A 🧵 on Risks associated with providing liquidity and holding USV in general.

1/8

About Notional Finance📈

Notional is the #1 Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With more than $700M in total fixed rate lending volume, Notional is now a top 10 lending protocol providing core DeFi infrastructure.

Notional’s latest product launch, leveraged vaults launched in late 2022. A new DeFi primitive built on fixed rate borrowing, leveraged vaults execute specific yield strategies while collateralizing the vault assets, allowing users to maximize capital efficiency by taking up to 10x leverage.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1/21 with a host of new features as well as the $NOTE governance token.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.