Weekly Interest Rate Roundup: Apr 19 - Apr 26

Despite the volatile macro environment, DeFi stablecoin yields (namely USDC and DAI), did not experience much week-on-week volatility. Variable supply rates are trending at the 2%-3% level, consistent with the long term average rates for the major lending platforms.

Special guest edition - This week's edition of the DeFi interest rate roundup was written by Evgeny Gokhberg, Managing Partner of Re7 Capital, a DeFi-focused investment fund (re7.capital)

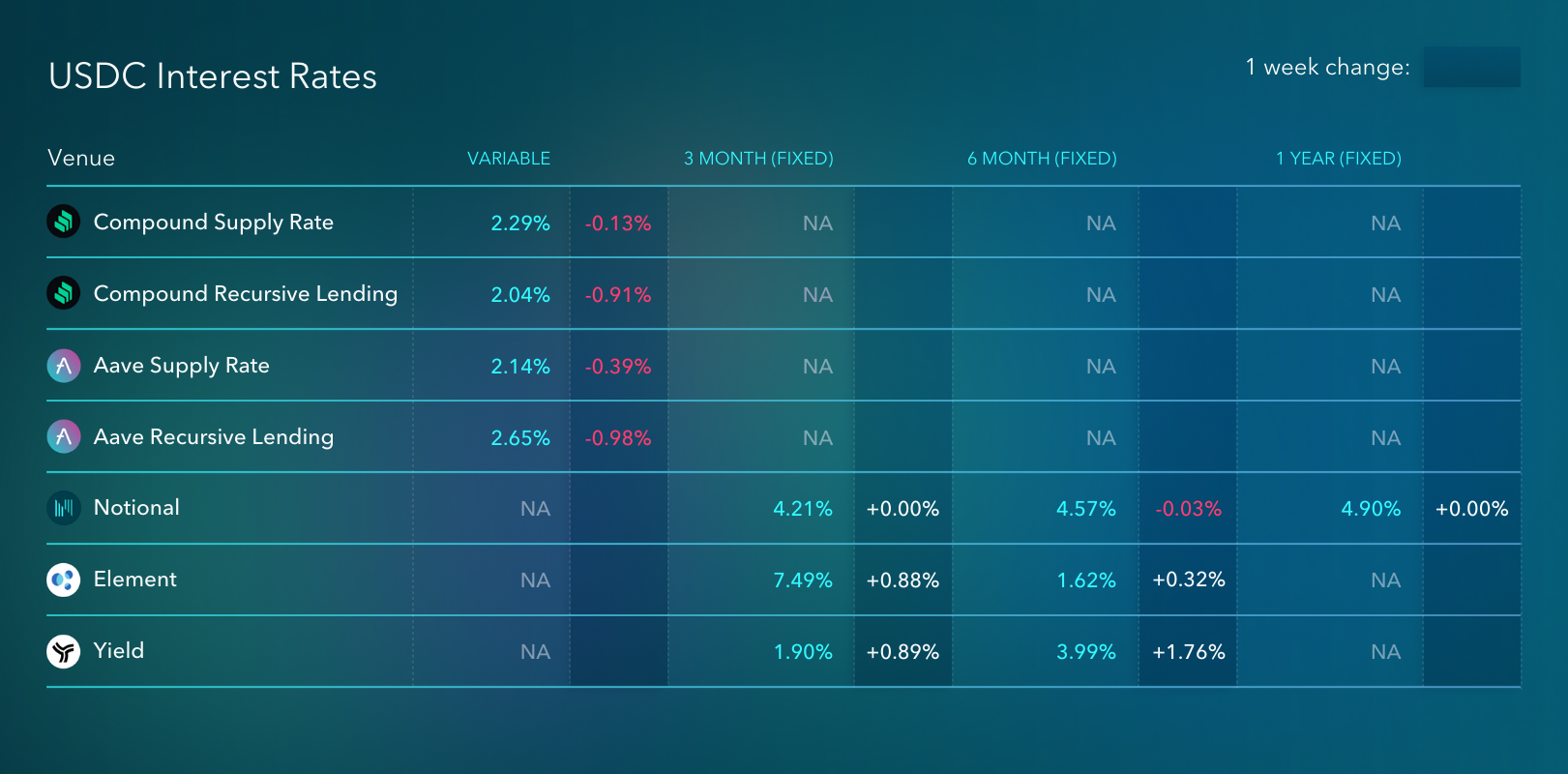

Despite the volatile macro environment, DeFi stablecoin yields (namely USDC and DAI), did not experience much week-on-week volatility. Variable supply rates are trending at the 2%-3% level, consistent with the long term average rates for the major lending platforms. When looking at USDC on Compound, it is interesting to observe a slightly lower recursive lending rate (2.04%) compared to the base supply rate (2.29%). This can be explained by the substantial decrease in the price of COMP over the past week (-6.5%).

Moreover, Compound Proposal 100 has now failed, and COMP rewards will continue to be distributed as per usual. As mentioned in the previous article, COMP rewards play a big role in the borrowing demand of USDC and DAI pools, and the end of their distribution could have result in a huge hit to the protocol. Even with rewards intact (for now), Compound TVL has already dropped below $6B, down from $7.2B one month ago.

Euler Finance, a younger lending protocol on Ethereum, has now entered Epoch 3 of its reward distribution, which will last until 5/5/2022. Their mechanism incentivizes active borrowing, leading to high utilization rates and higher-then-average supply rates (5.98% for USDC).

Notional Finance is demonstrating consistently high DAI APY (7.28% vs 7.49% last week). Same applies to USDC, which did not see any change on 3 months and 6 months fixed rates. The presence of stability of those rates is consistent with the persistent activity of borrowing/lending activity, and DeFi users seeking fixed-long term high yield rates in the space.

Other protocols like Benqi (Avalanche-based lending protocol) and Geist (Fantom-based lending protocol) offer highly profitable recursive lending strategies on stablecoins due to heavy borrow-side token incentives. At present time, borrowing of DAI on Geist is highly rewarded, and users can borrow at negative rates. This results in a significantly profitable recursive lending rate (12.95%).

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $395M in total value locked and nearly $500M in lending volume.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.