Notional Monthly Update 🗓️ November 2021

Welcome to the latest edition of the Notional Monthly Update! You can also follow the latest news on Twitter or join the Notional community on Discord.

🗒 Summary Notes

-900M total liquidity provided milestone reached 🌟

-Grant applications/technical bounties now live

-Nexus Mutual cover now available! 🤓

-Liquidity incentive migration issue

-Balancer 50/50 WETH/NOTE trading pool now active

-Community call #2 set + call #1 recap

-Layer 3 bounties for earning NOTE

📊 Monthly Protocol Stats

-Total Value Locked: $931,032,274.80

-Total Loan Volume: $170,886,992

-Current Lend (USDC 6m) APY: 9.26%

-Current LP (USDC) APY: 17.49% (3.71% variable + 13.78% NOTE)

-Protocol Revenue: $535,000 ($235,000 fees generated + $300,000 COMP accrued)

What a Launch!

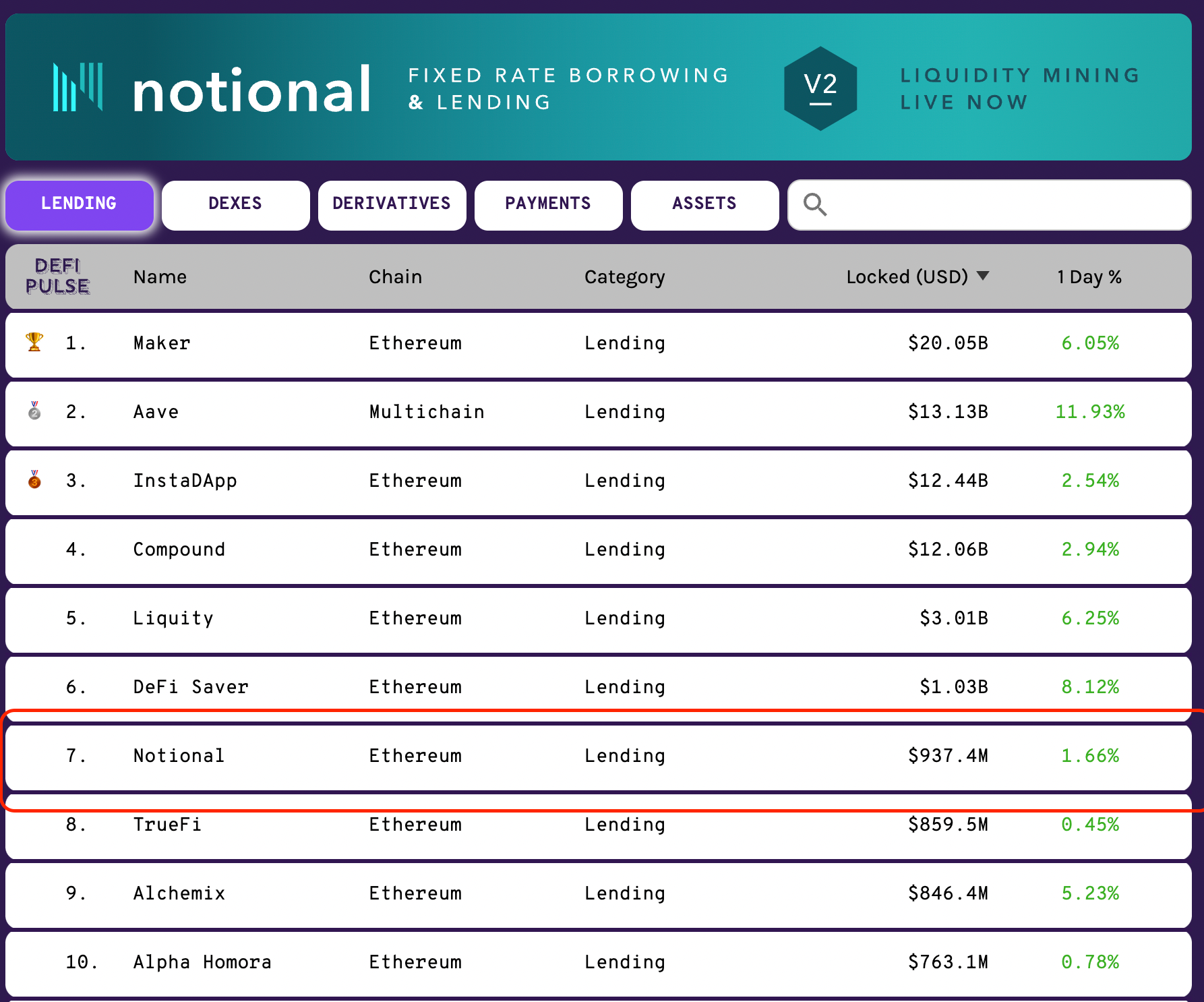

We can't thank our supporters and early users enough for believing in Notional. We are well on our way to the goal of expanding the DeFi ecosystem and use cases via a secure fixed rate protocol with deep liquidity. With more than $930M in TVL locked, Notional just catapulted into the top 10 for DeFi lending protocols in our first month post V2 launch.

The future is looking increasingly fixed as we've also started to see some HUGE transactions come through.

🚨Whale alert🚨

— Teddy Woodward (@teddywoodward) November 30, 2021

Somebody just lent 6,885,823 USDC and locked in a fixed rate of 10.55% on @NotionalFinance

🐳🐋🐳

While we are ecstatic that TVL has mooned, we are even more excited that the total loan volume is picking up pace. In fact, in the last week of November, the fixed rate lending volume ALONE was on a $1.5B pace for the year.

It’s been a good week for lending @NotionalFinance

— Teddy Woodward (@teddywoodward) November 29, 2021

$29M in total lending volume in the last 7 days!🥳🥳

That's a pace of $1.5B per year, less than a month out from our initial launch.

I'm bullish.📈

This is a testament to the fundamentals of the protocol, with fixed rate crypto borrowers willing to pay more to lock in those rates for long periods, pushing up the lending rates to some of the highest in DeFi, and certainly the highest in the fixed rate space.

Today is a great day to lend USDC at a fixed rate on @NotionalFinance pic.twitter.com/UysbubNQB7

— Notional (@NotionalFinance) November 22, 2021

Now Accepting: Grant Applications + Technical Bounties

We’re excited to announce that application are now open for technical development and community building grants! Several grants have already been awarded to community contributors that approached us with their ideas - and the gates are now fully open for anyone who wants to apply to contribute via a unique proposal or to answer one of our open bounties. More than 6M NOTE is allocated from the DAO towards community initiatives like these.

Applying for Grants

There are a few ways to participate in the grants program, which is open to everyone.

Open bounties: These targeted grants have been identified as needed by the Notional team and range from from US$5k-100k. This list will be updated periodically, so be sure to check back often. Please copy and paste the bounty title from the notion board as the project name when submitting an application for that bounty.

There are countless other useful grants that we’d love to see developed on Notional but that are not explicitly included in the bounty list. Funding for these grants is available and we encourage you to pursue those proposals by filling out the application form directly.

Non-technical builders are also encouraged to apply for community building grants - this could include, but are not limited to engaging the community with content, eg. videos, blog posts, podcast sponsorships, etc.

Check out the full announcement to see the first round of approved proposals!

🐛Nexus Mutual Cover Now Available

We’re pleased to announce that Notional Finance is the latest DeFi protocol to be covered by Nexus Mutual, a premium insurance provider in the DeFi ecosystem. This decision reaffirms our confidence in the safety and reliability of V2 and gives our borrowers, lenders and liquidity providers an option to manage the smart contract risk of Notional V2.

🛡️ Protected Yield Opportunities 🛡️

— BraveNewDeFi 🐢🛡️ nexusmutant.eth (@BraveDeFi) November 30, 2021

So many opportunities with Notional Finance V2!

Buy Protocol Cover from Nexus Mutual to protect your crypto deposits, which enable you to:

✅ Provide liquidity

✅ Lend crypto

✅ Use as collateral to borrow against

🧵👇 For PYOs pic.twitter.com/IfC7i4iqVl

Notional users who have DAI/ETH/WBTC/USDC deployed in a liquidity pool or used in an active fixed rate lend or borrow position can purchase Nexus Mutual coverage to get reimbursed for smart contract issues resulting in loss of funds. Note that coverage is specific to smart contract risk only, and does not extend to credit or liquidation risk. More information can be found via Nexus Mutual’s Notional program page.

If you'd also like to read the results of our other V2 audit processes, you can check them out here:

ABDK Consulting | Nov 01, 2021

Certora Formal Verification | Nov 1, 2021

Open Zeppelin, Governance Contracts | Jun 10, 2021

Incentive Reward Issue Fix

ICYMI: There was an issue with our TVL increasing so rapidly that some liquidity providers temporarily experienced decreasing NOTE incentives.

We will change the calculation to be exact going forward, and we will compensate LPs for any NOTE incentives they have lost out on due to this approximation.

LPs will be compensated for any losses occurring between the inception of the protocol and the time that the incentive calculation is upgraded. Full compensation for any lost NOTE will require no action from LPs other than to claim NOTE from a future airdrop contract. This means that LPs will be made whole for any past NOTE losses as well as any potential future NOTE losses as a result of this issue.

For more info on the situation and planned fix, check out the full post.

📞 Community Calls

We've got our next community call coming up on Tuesday, Dec 6 at 1PM EST directly in our discord server. If you missed our last call, you can find the notes and youtube recording links here.

Layer 3 Bounties

We've partnered with Layer3 to help reward community members interested in earning $NOTE by doing interesting missions IRL. Check out all the possibilities at the link below!

We’re back with more @NotionalFinance bounties! https://t.co/sVbbc6VVYX

— Layer3 (@layer3xyz) November 30, 2021

🗞️Notional in the News

A roundup of Notional media mentions and appearances by the core team.

Weekly gainers #Cryptos 🔥

— Coins Meter (@CoinsMeter) November 30, 2021

Follow us, RT & Like Comments your favorite coin #TRIBE #note #LRC #YAK #BOO

1. Fei Protocol ( $TRIBE ) +677.54%

2. Notional Finance ( $NOTE ) +94.98%

3. Loopring ( $LRC ) +21.76%

4. Yield Yak ( $YAK ) +19.72%

5. SpookySwap ( $BOO ) +19.65%

About Notional Finance📈

Notional is the first decentralized, Ethereum-based protocol for borrowing and lending at fixed rates and fixed terms. With variable rate lending, DeFi can only serve a small segment of the crypto lending market because variable interest rates don’t provide the certainty that lenders and borrowers require. Notional fixes this by creating a true market for lenders and borrowers that empowers individual investors, business owners and institutional investors.

After raising a $10 million Series A in May 2021 from some of the top VC firms, including Coinbase Ventures, Notional’s protocol was relaunched on 11/1 with a host of new features as well as the NOTE governance token. Notional is now a top 10 DeFi lending protocol, with more than $900M in TVL.

To find out more, follow Notional on Twitter @NotionalFinance, subscribe to the newsletter, join the Discord, or check out the website to learn more.

Notional Finance Newsletter

Join the newsletter to receive the latest updates in your inbox.